Crude Crashes, Gold Gains As Defensives Dominate Stocks

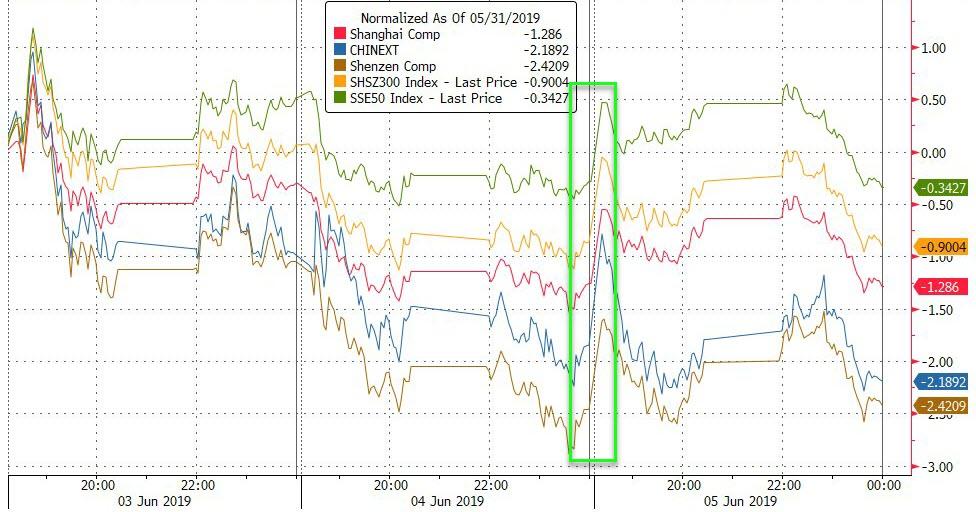

Weak China PMI was greeted with a buying panic early on but by the close, Chinese stocks were lower on the day (with the tech-heavy indices leading the drop)...

(Click on image to enlarge)

European stocks finally slowed their manic buying spree (but ended higher)...

(Click on image to enlarge)

US equity markets extended yesterday's gains...Trannies - green - continue to lead the week (Nasdaq - blue - flatlined from the gap open today)...

(Click on image to enlarge)

But Small Caps closed red...

(Click on image to enlarge)

As the short-squeeze seems to be running out of juice...

(Click on image to enlarge)

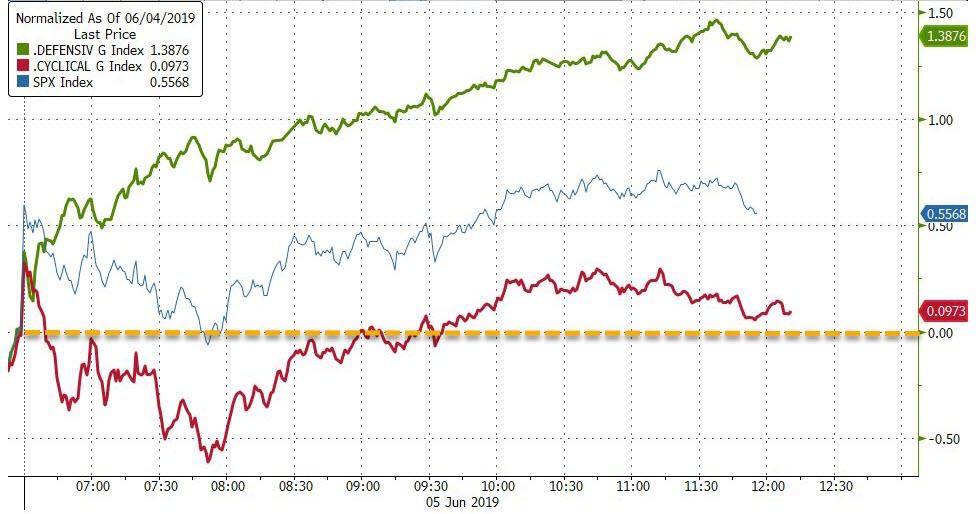

Today's gains were dominated by Defensive stocks, with Cyclicals notably underperforming...

(Click on image to enlarge)

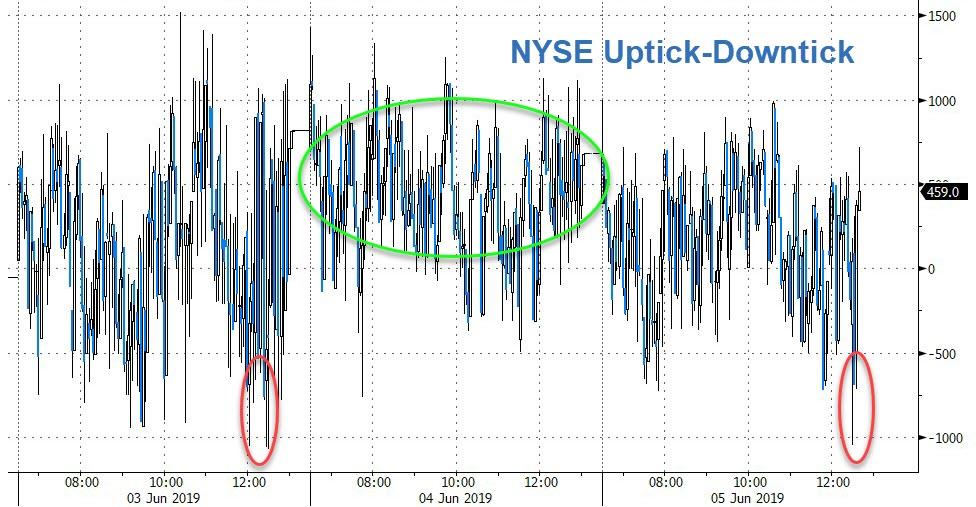

Stocks saw a notable sell program hit around 3pmET (same as we saw Monday)...

(Click on image to enlarge)

BUT as one comic noted, for the third day in a row, stocks are suddenly cheaper in the last 10 minutes of trading as stocks went vertical once again. Dow futures are up almost 900 points from Sunday night lows...

(Click on image to enlarge)

Stocks extended their decoupling from bond yields today...

(Click on image to enlarge)

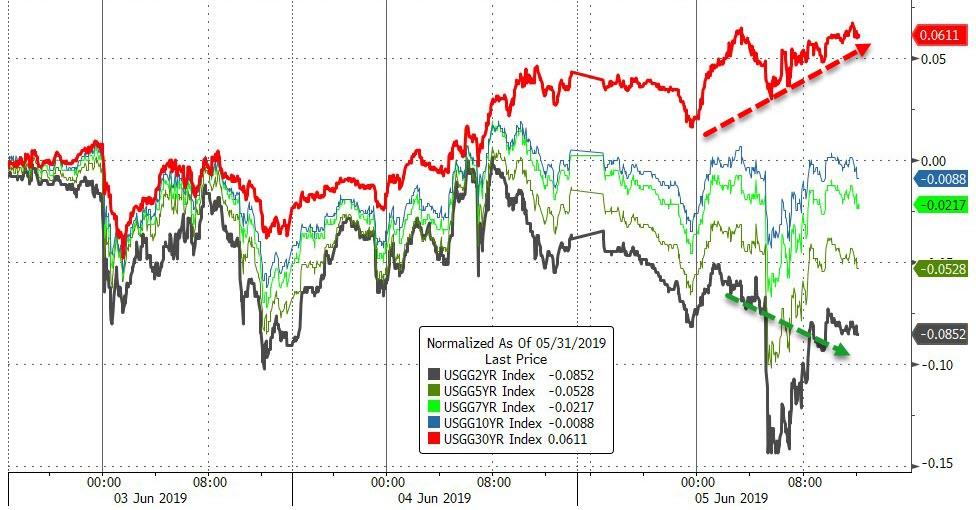

Very mixed day in bond-land today with the entire curve lower aside from the long-end (30Y +2bps, 2Y -4.5bps)

(Click on image to enlarge)

Which has sparked a massive steepening in 2s30s...

(Click on image to enlarge)

But the short-end remains dramatically inverted...

(Click on image to enlarge)

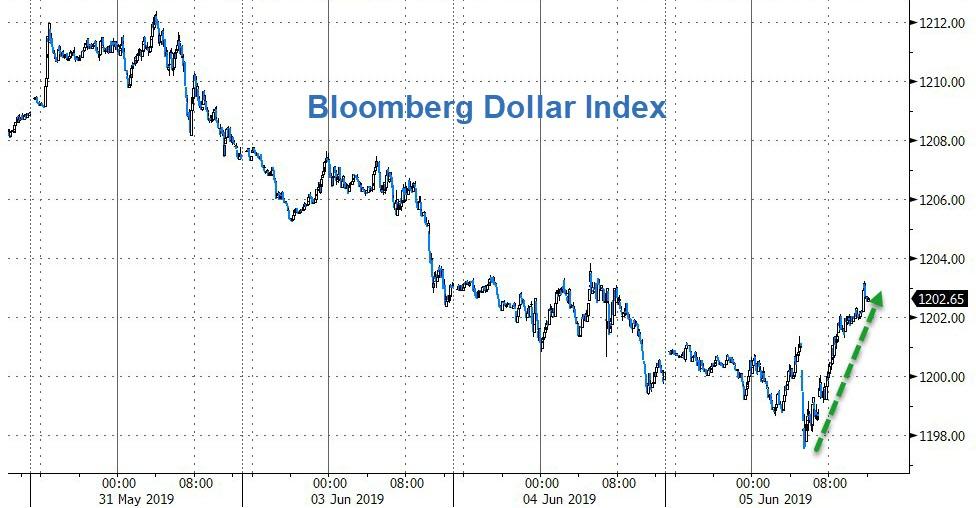

After 4 straight days down, the dollar index spiked today - best day in 6 weeks (back to yesterday highs only though)...

(Click on image to enlarge)

Yuan was weaker today...

(Click on image to enlarge)

NOTE how far from offshore yuan (market levels), the yuan fix has been held.

Cryptos managed modest (2-5%) gains today but remain lower on the week...

(Click on image to enlarge)

Copper and Crude were ugly today as PMs early gains leaked away as the day wore on...

(Click on image to enlarge)

Gold is up 6 days in a row...

(Click on image to enlarge)

Testing (and fading) at Feb highs...

(Click on image to enlarge)

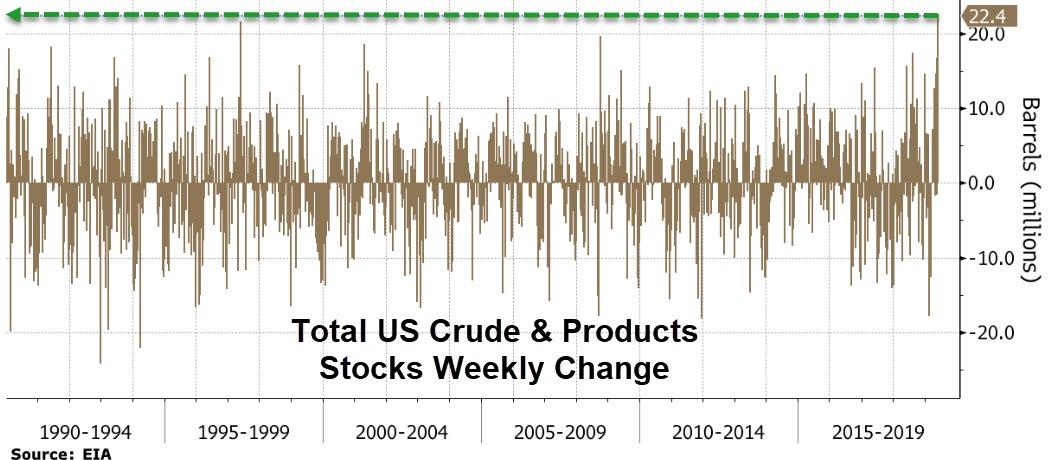

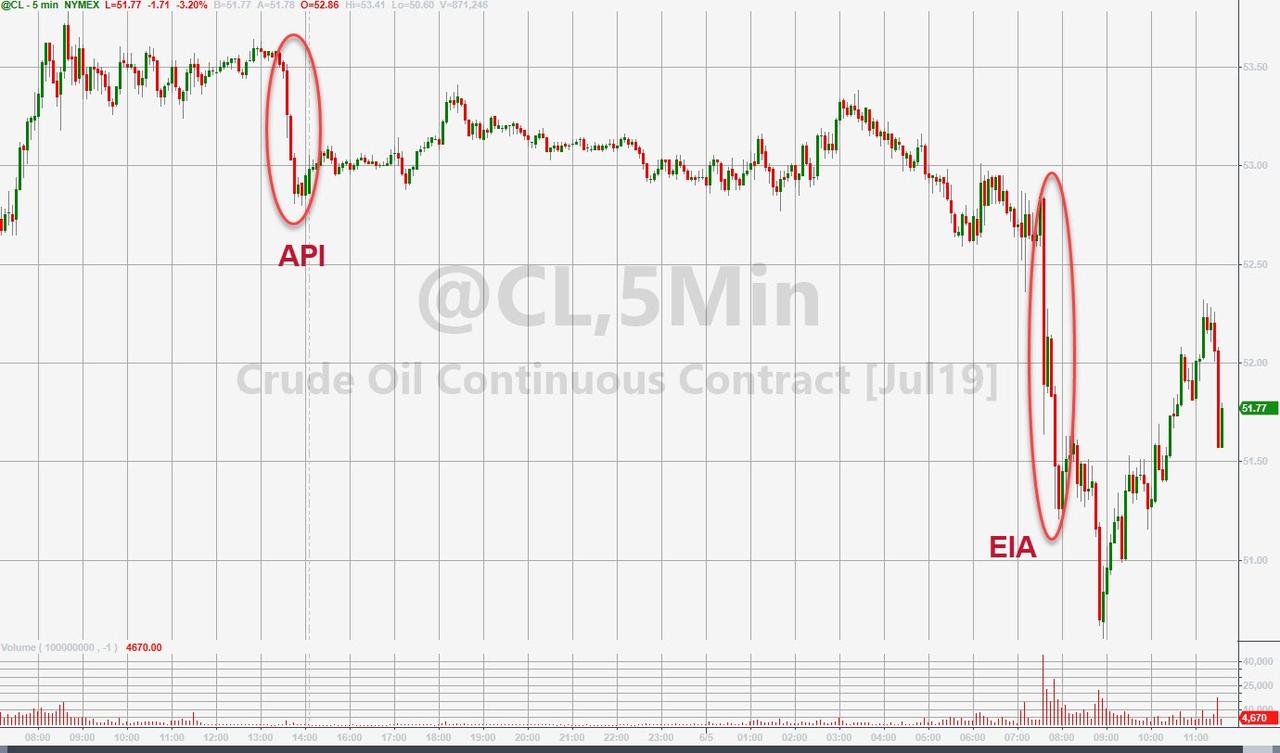

Oil prices collapsed into a bear market today (down 22% from highs) after a surprise build across all products produced the biggest aggregate inventory build since 1990...

(Click on image to enlarge)

“It’s the perfect storm, in a way, of increased supply coupled with perceptions of slowing demand growth,"said Marshall Steeves, energy markets analyst at Informa Economics in New York.

WTI tested down to a $50 handle (before ramping into the close) - the lowest since January 9th...

(Click on image to enlarge)

Brent fell back below $60 for the first time since Jan...

(Click on image to enlarge)

Both down around 22% from recent highs, which stocks are summarily ignoring for now...

(Click on image to enlarge)

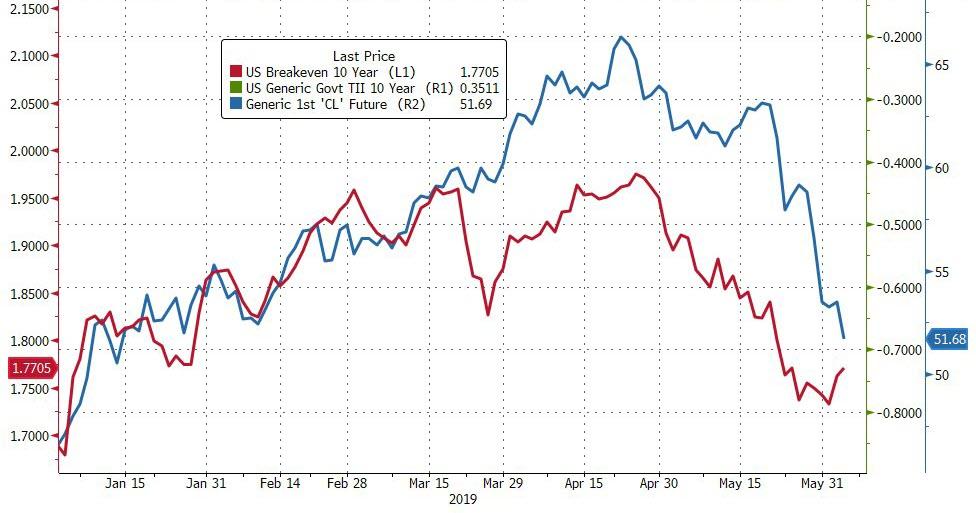

Is oil catching down to inflation breakevens?

(Click on image to enlarge)

Judging by HY Energy credit markets, WTI has further to fall...

(Click on image to enlarge)

The recent outperformance of gold (safe haven) vs oil (growth scare) is impressive (an ounce of gold now buys almost 26 barrels of WTI - up from just 20 barrels two weeks ago)...

(Click on image to enlarge)

Finally, we give Rosie the last word:

Does this chart look bullish? 16 months of nothing except the dividend, volatility, and acute anxiety. The S&P 500 has crossed above and below the 2,800 threshold no fewer than 19x since first testing the milestone in Jan/18. Looks like an elongated topping formation to me. pic.twitter.com/3YaRu7YLuH

— David Rosenberg (@EconguyRosie) June 5, 2019

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more