Energy Prices Will Not Be Growing Faster Than Other Goods And Services In The Next Ten Years

Economic variables measured by economic agencies and institutions present a unique source of valuable information for a scientist with a background in physics. Instead of building thought experiments based on assumptions, as economists usually do, physicists first look into the data and try to find regular behavior, which can be described by simple functions/equations.

Such regular behavior allows predicting the future behavior of economic (and physical) variables. The evolution of the consumer price index (CPI) in the USA is one of such variables we have studied since the mid-2000's. In 2008, we published a paper on the presence of long-term sustainable trends in the differences between various components of the CPI in the USA.

We started with the difference between the core CPI (i.e. CPI less food and energy) and the overall CPI. In this post, we revise the previous observations and add data for the last four years (our previous post on this issue was published on December 25, 2016). First, we repeat two Figures (1 and 2) from the previous post, which are borrowed from the aforementioned paper:

Figure 1. This presents the linear regression of the difference between the core CPI and CPI for the period from 1981 to 1999. The goodness-of-fit is 0.96, and the slope is 0.67.

Figure 2. This presents the linear regression of the difference between the core CPI and CPI after 2002. The goodness-of-fit is 0.86, and the tangent is -1.57. Elevated volatility has been observed since 2005.

In this twelve-year-old paper, as well as in later papers on the sustainable trends in the CPI and PPI (see here), we suggested that the negative trend shown in Figure 2 should reach some bottom point and then turn into a positive trend. It was also mentioned that such processes in the past had been accompanied by an elevated volatility in the difference, i.e. high amplitude fluctuations.

Eight years after the 2008 prediction, we confirmed and reported that the initial predictions were accurate - after reaching the bottom in 2010, the trend turned to a positive one and was likely approaching (in 2016) the mid-point of the contemporary linear segment. It is important to stress, that from the very beginning, we have been reporting on the evolution of the difference between the headline CPI and core CPI (cCPI, i.e. CPI less food and energy) many times.

The four-year-long gap in reporting is due to lack of time - analysis of the DPRK nuclear tests and their aftershocks were of the highest priority. At the same time, the four-year-gap makes it possible to assess the accuracy of the previous predictions without short-term prejudice.

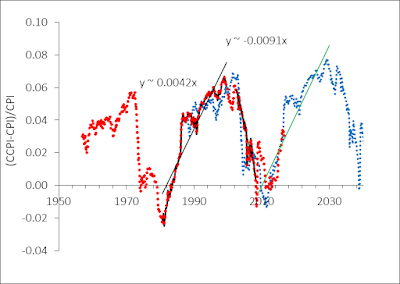

Our concept of cyclic evolution was formulated in 2007. Essentially, this concept says that the future trajectory has to repeat the path observed thirty years ago, i.e. the cycle has a 30 years period. Figure 3 (repeated from the previous post) presents the state of the CPI difference normalized to the headline CPI ( [cCPI-CPI]/CPI ) observed since the late 1950's (dotted red line) and the predicted trajectory (blue dotted line), which is the current curve shifted by 30 years ahead.

Figure 4 (also from the previous post) presents corresponding linear trends with all volatile periods removed. The current period between 2010 and 2025-2030 is characterized by faster growth in the prices of all goods and services (cCPI) than the growth of food and energy prices included in the CPI.

Figure 3. This presents the difference between core (cCPI) and headline (CPI) CPI normalized to CPI. The period of the cycle is 30 years and the dotted blue line presents the future of the normalized difference before 2044.

Figure 4. This illustrates the current state of our prediction. Red line follows up the blue line.

Twelve years after the first prediction, we have to conclude that it was extraordinary by its accuracy - we predicted the era of low energy plus food prices since 2014 (the end of the transition to the new positive trend) and for the following ~20 years. For energy companies, Figure 4 implied that oil/energy prices are on a negative trend until at least 2030.

Figure 5 presents the current state of the cCPI and CPI difference, as reported by the Bureau of Labor Statistics. The positive trend formed between 2014 and 2016 is still observed and will likely continue in the 2020's.

This observation indicates that there is no reason to expect that food and energy will gain some economic power to push their prices above the overall price of other goods and services. A figure in the Appendix repeats the old versions of Figure 3 with new data added.

Figure 5. Same as in Figure 4 with data between 2016 and 2020. The positive trend formed between 2014 and 2016 is still observed and will likely continue in the 2020's.

Appendix

Disclosure: None.