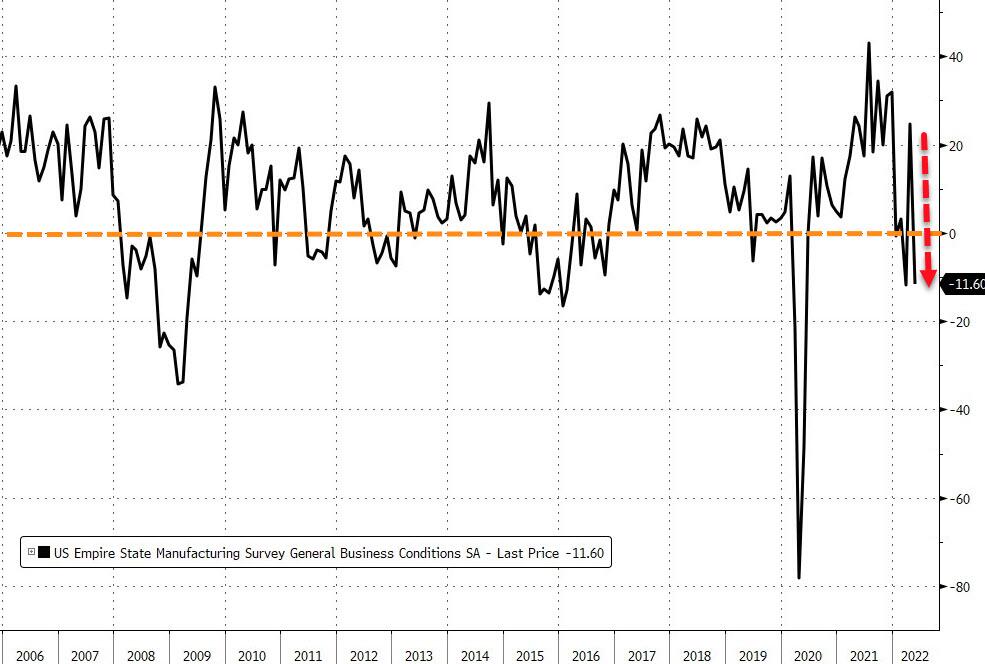

Empire Fed Manufacturing Survey Unexpectedly Crashes To Post-COVID Lows

As Goldman lowers its US growth forecasts for 2022 and 2023, the NY Fed's survey of manufacturers surprised with a drastic plunge into contraction in May, for the second time in 3 months. The general business conditions index dropped over 36 points to -11.6 (against the expectation of a +15 print)...

Source: Bloomberg

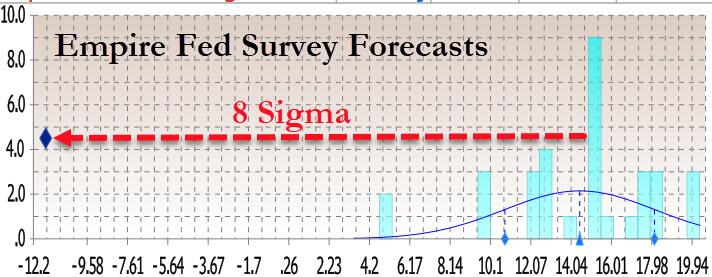

That -11.6 print is lower than the lowest forecast from analysts (-10) - an 8 sigma miss from expectations...

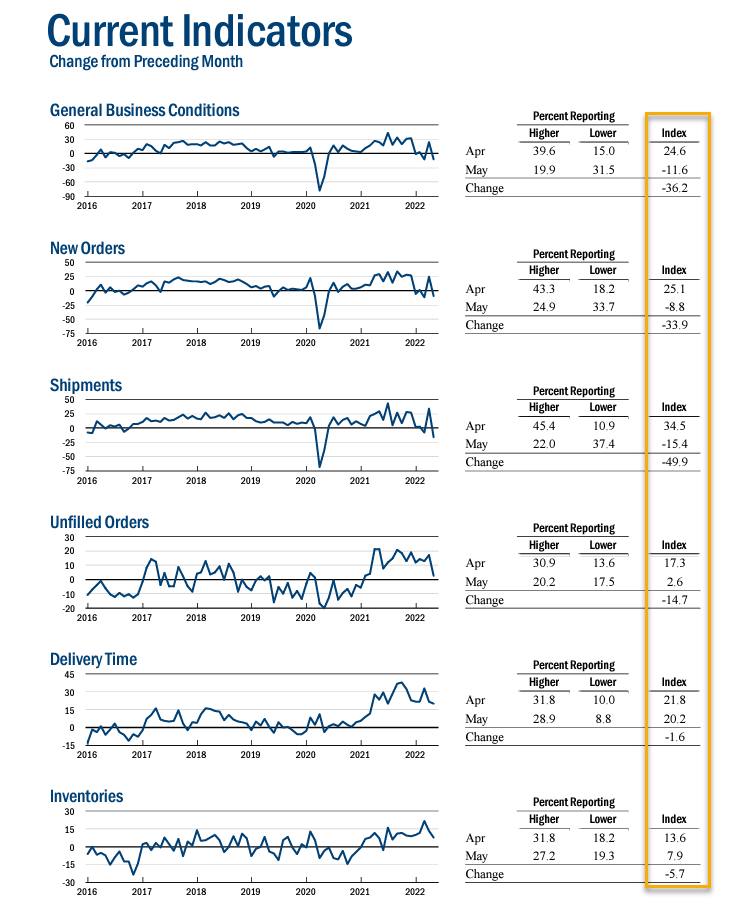

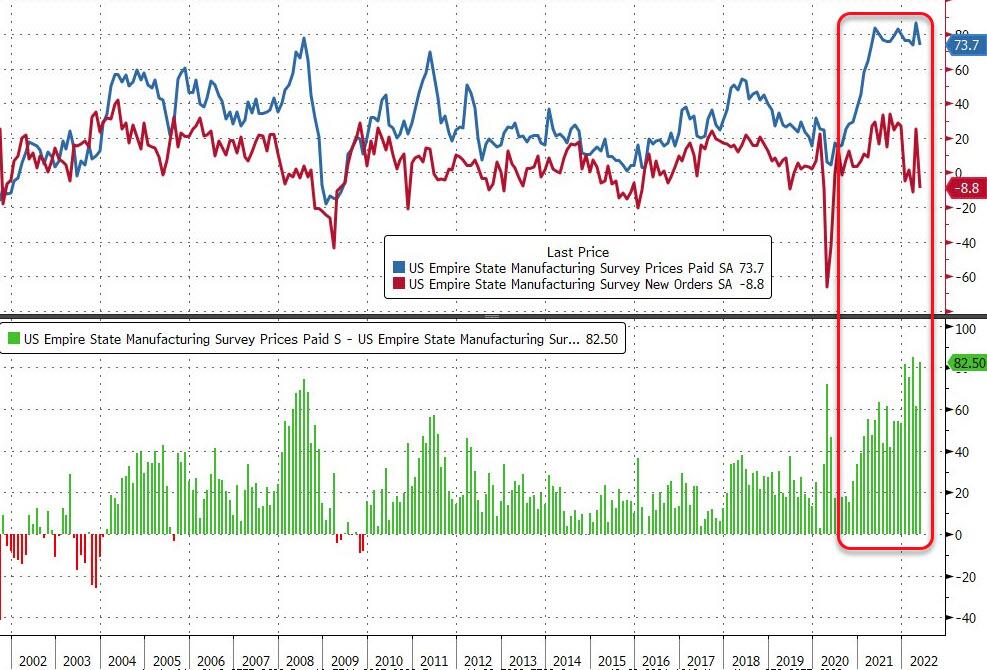

Under the hood, new orders dropped nearly 34 points in May to -8.8, and the shipments measure fell at the fastest pace since early in the pandemic, sinking about 50 points.

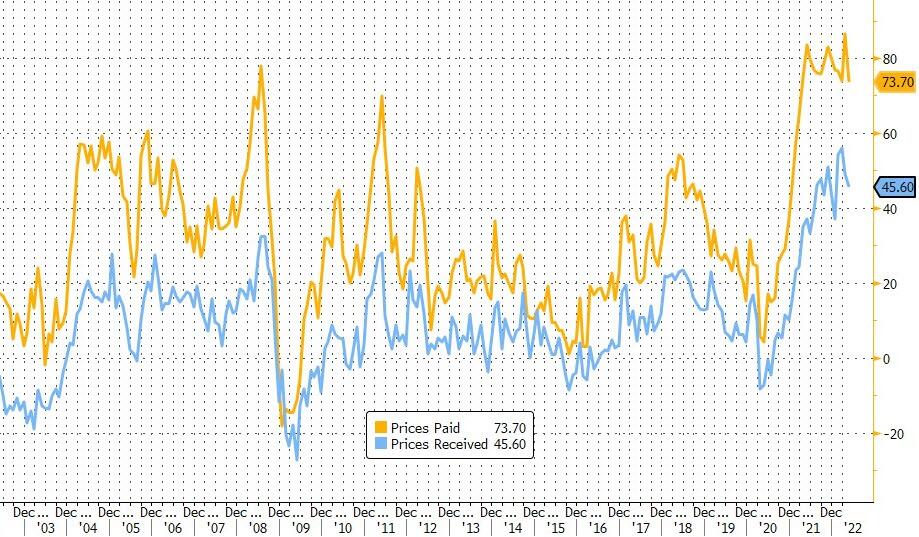

The prices paid index fell from a record high last month to a still-elevated 73.7.

As in April, firms expressed less optimism about the six-month outlook than they did earlier this year. The index for future business conditions was little changed at 18.0. Increases in prices and employment are expected to continue in the months ahead. The capital expenditures index fell to its lowest level in several months

This is the first of several regional Fed manufacturing numbers set for release over the coming weeks. Is this the start of 'weakness' that offers Powell his 'out' from uber-hawkishness?

Or is this yet more signals that stagflation is becoming embedded... the central bankers' nemesis.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more