Tim Duy: Stocks Won't Crash; Look For These Indicators

Tim Duy says stocks won't likely crash. He has a chart showing the behavior of our current stock cycle. And he has a set of leading indicators to look for down the road. Tim is very consistent in his pronouncements. He does not see stocks taking the economy down:

But if not market valuations, what should be the focus on investors? My view is that they should be watching for signs that, at a minimum, earnings growth will falter or, probably more importantly, that the economy is set to tip into recession. I tend to think it is more likely that the economy takes the equity market down with it than the opposite.

There is a rule by which stocks operate, according to Professor Duy:

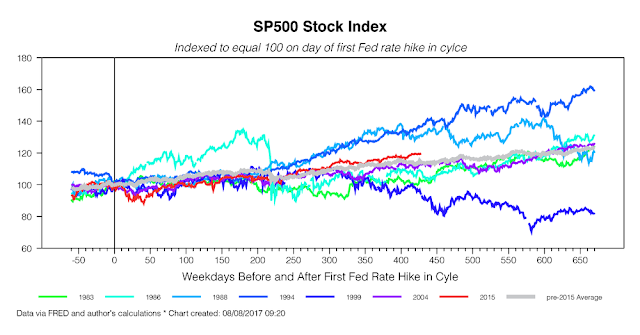

The general rule is that if the economy continues to grow, then it is more likely than not that stock prices rise, even if the Fed tightens monetary policy. Many analysts, however, continue to resist this historical lesson, largely on the basis of traditional valuation metrics. These metrics, such as PE ratios, have been long elevated, leading to the difficulty explaining market behavior that my Bloomberg View colleague Barry Ritholtz has observed.

The stock market is not currently behaving unusually. The following Duy chart shows this clearly:

|

| By Permission |

The 2015 red line looks like a very well behaved market. There is certainly less volatility. Some say it is manipulated and the lack of volatility is just plain creepy. That would not be a surprise.

Ultimately, Duy, who believes that the Fed is still in charge, believes that an over tightening will cause recession and recession will cause stock decline. The insiders, in my opinion, will always be the first to know.

And we cannot leave out housing. A strong slowdown in the housing market could portend serious economic troubles at home. Housing is in the process of slowing.

We have to add Professor Edward Lambert's views into the mix. He believes that labor has very little power right now. Since labor has very little power, it shows up two ways:

1. Prices are high. There is no reason that firms need to raise prices. Prices are in a sweet spot. Raising them could lower profits. Therefore, the lack of power of labor brings with it the problem of low effective demand.

2. Wage earners don't have the power, so inflation will not be created as wage earners do not have the power to raise wages.

Dr. Lambert said it this way:

Yes... the Fed has believed for a long time in the Phillips curve that wage inflation would accelerate with unemployment low.

Yet that is not how inflation works. For me, high profit rates (which means low labor share), along with low interest rate costs produces an environment with little pressure to raise prices... and when profit rates are maximized in the macroeconomy, this implies that any raise in prices would actually lower profits, holding all else relatively equal like labor wages. The Fed has given to much power to labor thinking that they can get higher wages... but the Fed will realize that labor's lack of power is causing a

problem of low effective demand.

So, under this current economic regime, it is clear that there will not be price volatility or a wage price spiral. Labor is too weak. Yet the Fed believes labor is strong. That borders on delusion, if we are to correctly understand both Lambert and Duy.

Earnings growth could slide if labor gets any weaker. Duy says watch for this leading indicator. And surely the Fed understands this. Or maybe not. Or maybe they don't want to.

Disclaimer: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice. The ...

more