Wiping Out $1 Trillion In Student Debt Could Soon Be Government Policy

Biden is still under immense pressure within his own Democratic Party to cancel a much bigger portion of student debt via executive order "from day one" than he's already promised to forgive, namely $10,000 per borrower according to his prior campaign statements.

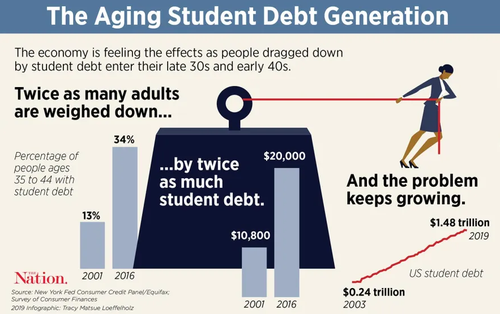

A new deep dive reviewing the main arguments and counterarguments in Bloomberg Businessweek underscores that "Just a few years ago, writing off large chunks of the U.S.’s $1.7 trillion in student debt seemed like a fringe idea. In a few weeks' time, it could be government policy."

Biden's current plan would cancel about $370 billion in loans, but the much more ambitious Schumer-Warren plan would wipe $1 trillion off the books. Pretty much all agree that the cost of higher education is becoming astronomical, to the point of becoming a crushing burden to middle class families. But the progressives' plan will likely only exacerbate the crisis while rewarding upper income families.

Biden is also seeking to attach to his plan a mandate making public universities free for all families that earn under $125,000 a year. Below are some of the pros and cons to the competing proposals being battled over internally within the Democratic camp ahead of Biden's taking office.

Largest Debt Type for Most Families

Since 2008 student debt has been the largest type of debt to strap families.

Explains Bloomberg: "Borrowing has risen in tandem with college costs, which have outpaced incomes for a generation, and accelerated after the 2008 crash—partly because state governments cut funding for higher education and public colleges covered the shortfall by charging their students more. There’s also been a decades-long expansion of higher education that has drawn in students from lower-income families more likely to depend on loans. And unpaid debts can snowball, because even in an era of ultralow interest rates, student loans are pretty expensive. Interest rates have ranged from 4.5% to 8% in recent years, with graduate students and parents who borrowed on their kids’ behalf generally paying more."

In recent years there have remained fewer of the well-paying jobs new graduates could in better times more easily find.

Long gone is the boomer generation trend of get a degree = secure a good job right out of college. Bloomberg reviews: "For years now, delinquencies and defaults on student debt have been running much higher than for those on other types of loans. That’s in large part because, even amid the longest expansion in U.S. history, the economy hasn’t been creating enough of the well-paid jobs that all these graduates had counted on. High dropout rates, especially at for-profit colleges, are also a factor. In 2019 only about 40% of borrowers were current on their payments."

Likely Options & Non-solutions

Bloomberg continues: "Biden could just renew the payment freeze. President Trump did that by executive order in August, so it won’t trigger a dispute over presidential powers. But if Biden tries to use the same instrument to cancel student debt, bypassing a Congress where he may not have a Senate majority, some analysts foresee legal challenges." Of course, progressives are pushing for much more, including the at least $50,000 of individual forgiveness pushed in the Schumer-Warren plan.

It still won't help those hit hardest by the pandemic, for example in the service industry, but is likely to instead do the opposite: "Critics say debt forgiveness helps college graduates at a time when low-paid service workers, mostly without degrees, have been hit hardest by the pandemic," Bloomberg notes.

"It would sow more division in a country where education levels are one of the clearest fault lines. And they say it’s unfair to student borrowers who paid what they owed."

Asked about his plan for student loan debt, Biden promises:

— The Recount (@therecount) November 16, 2020

• Immediate $10,000 forgiveness on federal loans

• Public colleges tuition-free for students whose family income is less than $125,000

• Lessen Public Service Loan Forgiveness requirement pic.twitter.com/7e94mJrpxh

Wealthier Households will Actually Benefit

As we and others have detailed elsewhere: "Also, some argue that debt forgiveness won’t do much for the economy right now because the extra cash it frees up will be spread over years, will flow disproportionately to wealthier households less likely to spend it, and may incur tax liabilities that cancel out the stimulus effect," Bloomberg writes.

And further: "Advocates agree that wealthier families tend to have larger student debt totals, so they might get a greater break in simple dollar terms from forgiveness," and yet they still argue, "But, they say, student debt is even more of a burden for lower-income families, so relief would benefit them more even if the value of loans forgiven is less."

Read the full Bloomberg analysis here.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more