Why Did US Economic Policy Uncertainty Rise So Much During The Pandemic?

I was doing a review of measured economic policy uncertainty, and found an interesting divergence between the US and Europe:

(Click on image to enlarge)

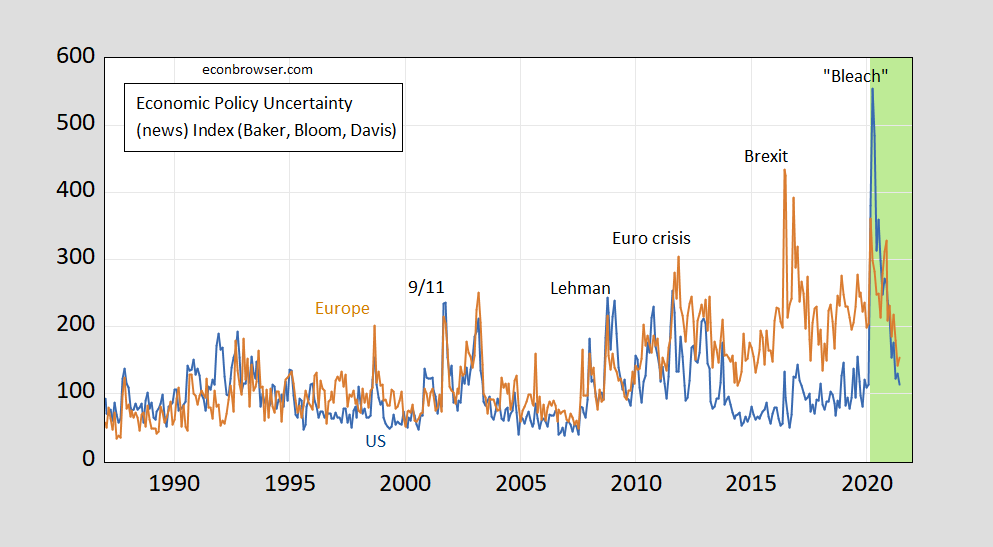

Figure 1: Economic Policy Uncertainty index (news only) for US (blue), and for Europe (brown). Light green shading denotes pandemic in US. Source: policyuncertainty.com.

Most of the peaks are interpretable as being driven by clearly defined events. The 2020M04 spike in the US is notable as (1) it comes not during the beginning of lockdowns (in March), but in April, and (2) the corresponding peak in Europe is much lower relative to average (the level of the indices are not comparable across series).

This is not a finding specific to Europe. Consider a broader look:

(Click on image to enlarge)

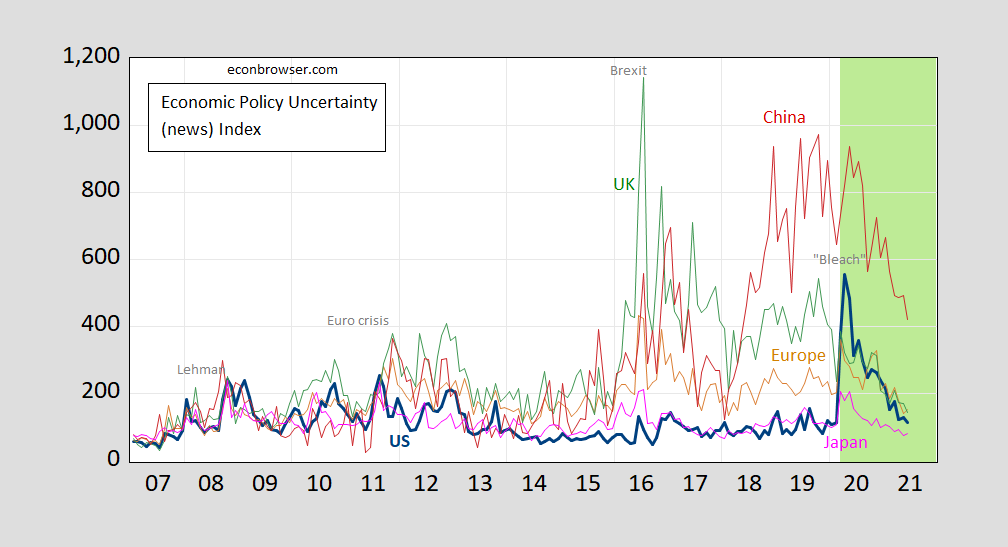

Figure 2: Economic Policy Uncertainty index (news only) for US (blue), Europe (brown), UK (green), China, Baker-Bloom-Davis-Wang version (red) and Japan, RIETI version (pink). Light green shading denotes pandemic in US. Source: policyuncertainty.com.

One can’t see a dynamic similar to that for the US series in any other. The US index jumps up from a relatively low level and decays slowly. The April spike is a 38% jump (log terms); the next highest jump is in China, at 10.8%. This leads me to believe that perceived policy uncertainty was driven particularly high during the Covid-19 pandemic by Mr. Trump’s erratic statements and actions.

Disclosure: None.