Which Nations' Governments Are Taking The COVID Virus Seriously?

Image Source: Pixabay

Summary

- This chart dump is a quick review of the relative fiscal response of major national governments around the world.

- The USA, Brazil, Canada and Australia seem to be taking the crisis most seriously and most are likely to bounce back and be a good place to invest.

- Countries to keep away from are the UK, Spain, Japan and the Euro area.

- The budgetary fiscal response of each national government is listed below in order of GDP size from largest to smallest with commentary where relevant.

The purpose of this article is to show where the fiscal response to the pandemic has been the most pronounced and therefore highlight investment destinations most likely to bounce back and perform the best.

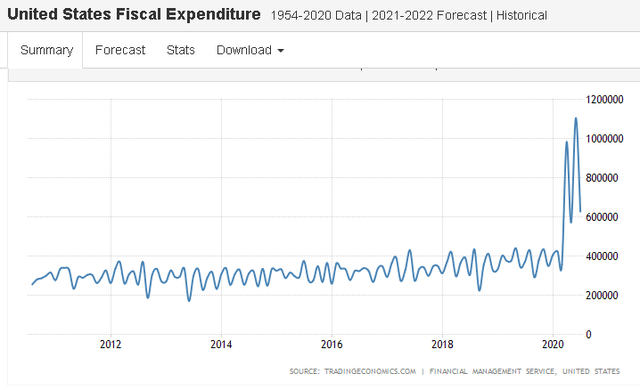

The USA is clearly making an effort that is in fact larger that anything since the second world war. This is very significant given that US GDP is about one quarter of world GDP.

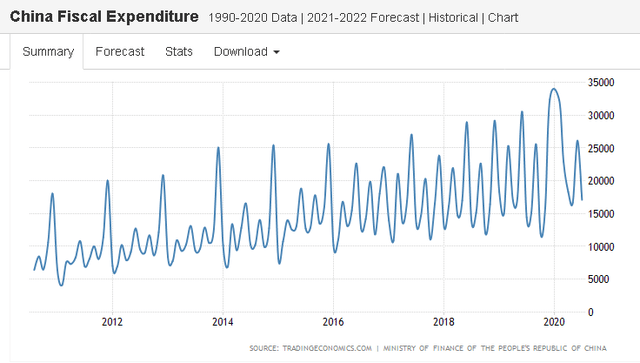

A response noticeable along a growing upwards trend line but nothing special. Perhaps if this had been greater the epidemic would not now be a world epidemic.

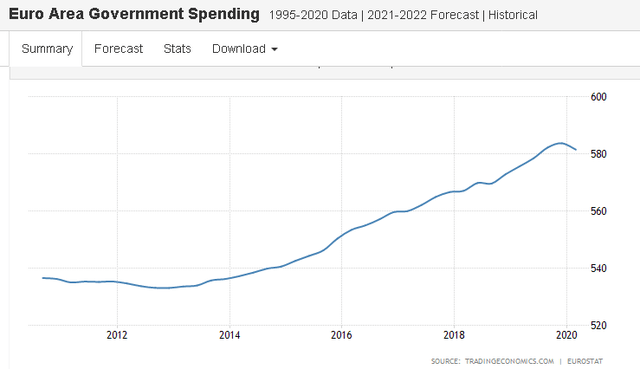

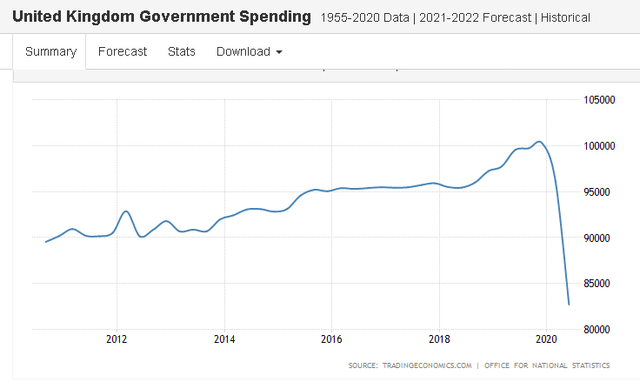

Government spending is not quite the same as fiscal expenditure however the latter is not available. The poor response trend is obvious. Neoliberal austerity was maintained and enhanced even through a pandemic crisis.

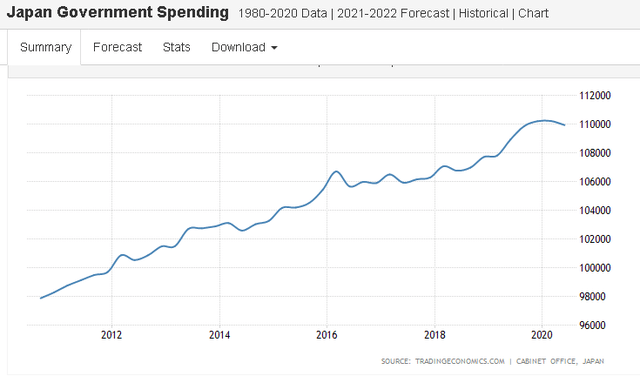

Similar to the Euro area one can see that the Government response has been negative. Again this is Government spending rather than fiscal spending however the trend is still clear. At a time when aggregate demand is falling in the private domestic sector the federal government has stepped back as well making the spending gap even larger than it would otherwise have been.

GDP = Federal Government Spending + Private Spending + Net Exports.

This is an accounting identity correct by definition.

Private spending is clearly going to be less in a pandemic given the deaths, sickness and lockdowns. The only other agent in the economy that can step in to maintain GDP is the national government.

Gross Domestic Product = Gross Domestic Income.

This is another important accounting identity correct by definition. The only way that GDP could have been maintained was if national income had been maintained. The only agent able to maintain national income in the event of a pandemic is the currency issuing national government. This was not done.

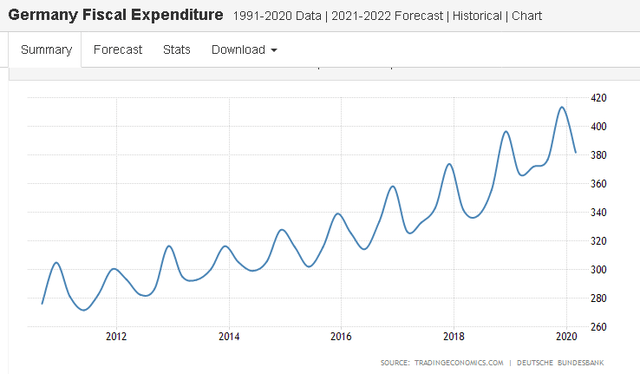

The trend in Germany is a steady extension of the rising trend but nothing out of the ordinary.

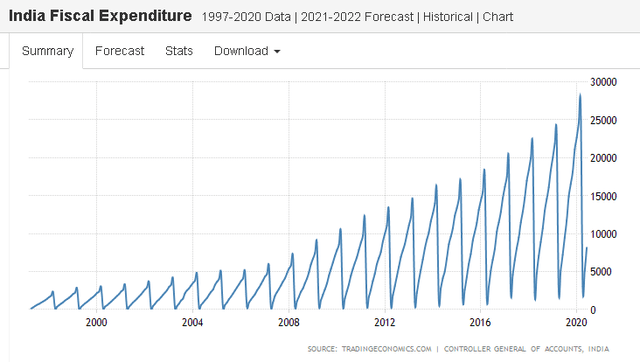

Similar to Germany, the response from India is nothing out of the ordinary. One would not think that the economy were in shutdown and a large and yawning private domestic spending gap needed filling by the currency issuing national government.

Most shameful of all is the response from the UK government. Though not fiscal expenditure data the trend is clear enough.

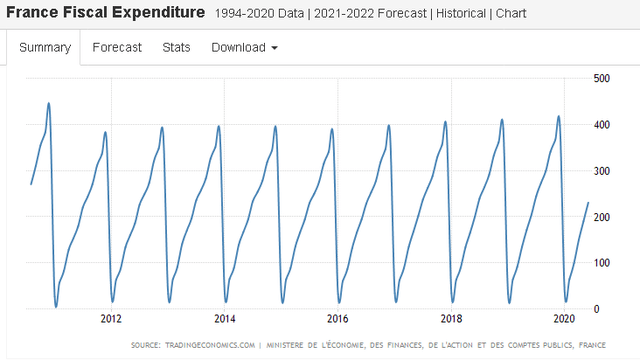

In France one would not know that a major epidemic were happening.

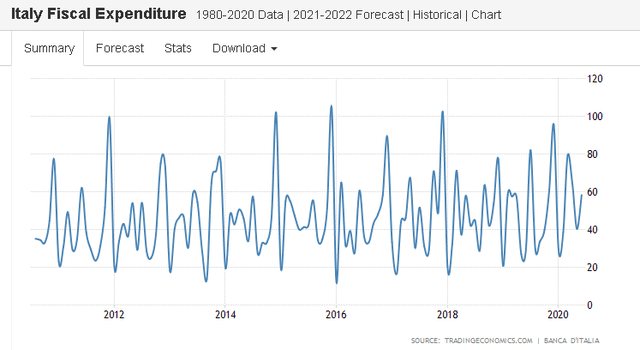

Italy also shows no sign of a commensurate government response to the epidemic.

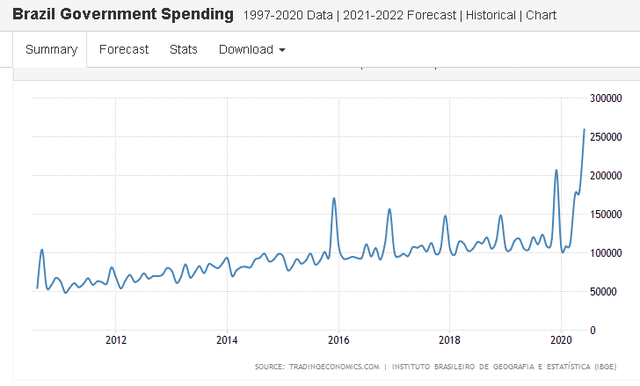

The Brazilian government clearly making an effort despite the known neoliberal parsimony of President Bolsonaro. This is spending data rather than fiscal data however the trend is clear and commendable.

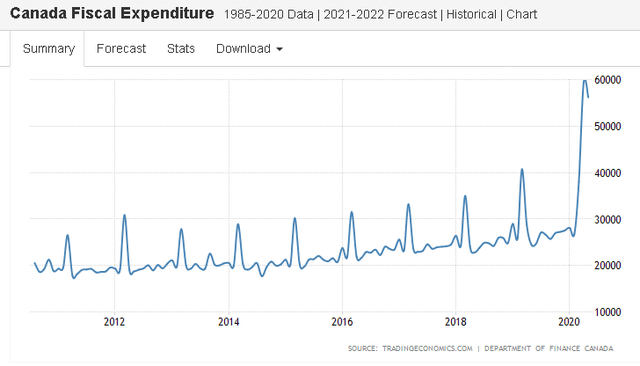

The Canadians clearly doing the right thing and taking matters seriously.

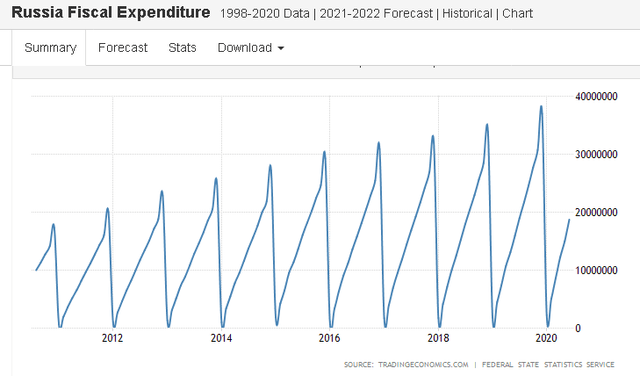

Nothing special from the Russian government as the ongoing upwards trend merely continues.

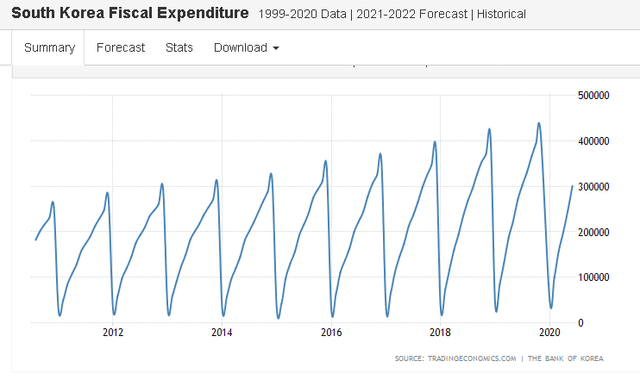

The South Koreans appear to be making no special effort as the ongoing trend marches on. Perhaps it will show in the next quarter of data.

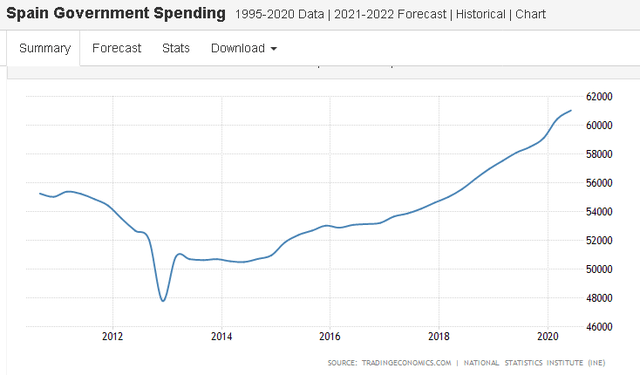

Spain making no special effort either. This is spending data rather than fiscal however it is clear that there has been no acceleration in spending during the crisis. The trend in the EU countries is very similar and mirrors the net result shown above for the Euro area as a whole.

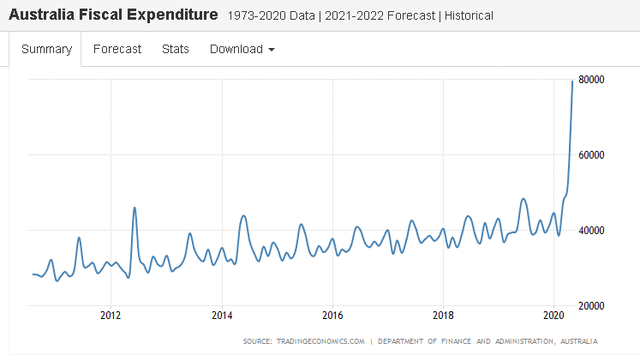

The Australians clearly doing the right thing in true blue Aussie style. This is despite one of the strongest neoliberal austerity biases in the world.

So after reviewing the fiscal responses across the major economies of the world where would one wish to seek investment opportunities in an economy most likely to bounce back? The answer is clearly the USA, Brazil, Canada and Australia.

Countries to keep away from are the UK, Spain, Japan and the Euro area.