Where Has All This Printed Money Gone To?

As central banks pour liquidity into their respective economies, many are warning of the heavy price to be paid down the road. Relying on the famous dictum of the great economist, Milton Friedman, that “inflation is always and everywhere a monetary phenomenon” conservative economists continue to sound the alarm bells with each new Federal Reserve program to inject funds into the financial system. We have entered virtually unchartered waters in which central banks have signed on to fund the unprecedented fiscal response from governments to combat depression-like drops in income and increases in unemployment. Just how worried should we be regarding future inflation emanating from the surge in the money supply?

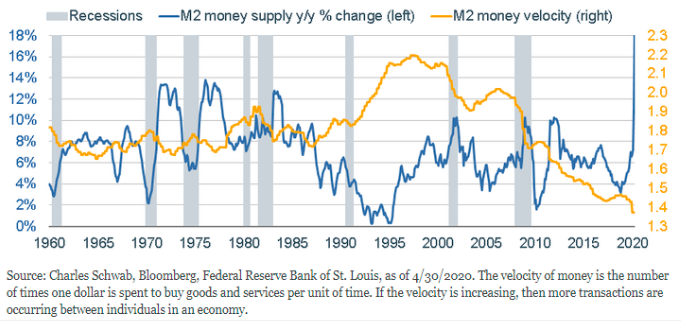

Let’s start with a basic formula which ties money supply growth to inflation ---- MV=PY. Where M is the money supply; V is the velocity of money or the turnover of money supply; PY is nominal GDP. This formula is the bedrock of the monetarist argument that increasing the money supply ultimately results in rising prices. The key to the analysis is V, the turnover of money, which needs to be relatively constant to allow for steady nominal income expansion. As the accompanying chart demonstrates V is anything but constant, and in particular, it has been falling rapidly since the 2008-9 financial crisis. While the debates are going on as to why velocity is tumbling, the fact remains that any increase in the money supply is being offset, in varying degrees, by the fall in velocity. Simply put, increases in the money supply is not leading to any inflation and certainly not to any excessive increase in nominal growth (PY).

Money Supply Growth and Money Velocity, U.S 1960 -2020

Courtesy of W. Chin, Caldwell Securities

Economists freely admit that they do not have a good understanding to explain the rapid fall in velocity. Under current economic conditions, the lockdown in the economy can explain a great deal. Consumers have chosen to spend only on essentials; at the same time, there has been a huge upswing in savings. However, the downward trend in velocity is unmistakable.

Lacy Hunt, in his latest quarterly report, argues that banks continue to operate with excess reserves, even though the reserve ratio remains zero. He goes on to make the point that the lack of productive investment opportunities makes it more difficult for a bank and its customers to reach an agreement on a loan. Hunt maintains that:

Even more importantly, the banks must manage their portfolio with regard to the risk and potential default of loans. Equally critical, the potential borrowers from the banks must have a need for loans and the ability to take on that loan and repay principle and interest. The Fed has no direct role in this process.

So, we come full circle. The Fed is pumping money into the system, but the lender and borrower remain far apart, making it more difficult for the injection of funds to bring about the desired growth.

NIce column

Your point on MV=PY is instructive. Could it be the defn of money has changed. Really all you can say is that the velocity of money, conventionally defined, has fallen.

But what about money substitutes, which move far beyond the conventional defn.?

A related point. It is often not realized that when the demand for money falls, Ceteris Paribus, the money supply shrinks. (the money stock is determined at the intersection of the supply and the demand curves)

That is, the money supply is a function of both the demand and the supply of money.

Your conclusion on the macro effects are right on.

I agree that the definition of money is changed considerably in this digital age. But I think there still is a liquidity trap in that liquidity is held closely by the banks

It could get worse as the bank's contend with loan losses and the fear of a worsening credit environment.

Your point about the intersection of demand and supply is right on. There is a weakening supply supply and also a diminished demand as the economy slows down. A rather dismal Outlook.

Hi Norman, thank you for this article. As part of understanding V, it makes sense as to the slower turnover right now due to this pandemic, but why do you personally think we have seen such "a rapid fall in velocity" pre-COVID 19?

Salient piece, Norm. Significantly reduced productivity will certainly further suppress the turnover of money for a while. Signs of such had already been evident prior to Covid-19, as you outlined.

Everything just goes at a slower speed--- hence the term velocity.