When You Can’t Hear Yourself: The Other Reverse Repo

A lot of times, what becomes most frustrating about all of this eurodollar business is trying to get other people out of the conventional mindset to open up to the idea that there is something more going on. It’s the myth of the “maestro”, how there is just no way these Ivy League Economists could be missing something so big. After all, you’d figure even if they screwed up once (2008) it was absolutely assured they were going figure out how to fix (QE) what was wrong.

At other times, what’s most maddening is how officials say the very thing that’s wrong (chronic and global dollar shortage) and then don’t realize the magnitude or the implications of what they’ve just said.

Before getting to that, we have to back up and start with the Fed’s other reverse repo. Yes, there’s actually two of them. The first, the RRP, is really the second. This is the reverse repo rate the central bank pays domestic institutions so as to act as a floor underneath the federal funds rate. It’s not as big a joke as IOER, but T-bill yields are certainly laughing at it at the moment.

The original, this other one, goes back much further. New York City has been a global money center since before there was ever a Federal Reserve System to hang a branch from. Global trade demands global payment, and New York reserve city banks functioned as the transit point between US dollars and foreign currencies. Both were exchanged and netted as necessary.

As with any payment system, it required(s) correspondent balances to be kept up and maintained; a liquidity buffer, so to speak. A foreign central bank may wish to hold more dollars in New York if its own domestic agents (businesses and banks) are expecting more robust trade heading in their direction in the near future. This would necessitate the need for more dollars to pay for it.

They might also do so if they get the sense dollars are becoming scarce. Whether in anecdotes or in the prices of foreign exchange or foreign markets, if an overseas central bank worries dollars are going to be harder to come by then it would naturally, prudently build up that correspondent buffer. Make sure there are more than enough dollars on hand to keep the goods flowing with a lot to spare.

Once the Federal Reserve came along, more and more it took over the basis for a lot of global payments. As time went on, the system’s New York branch began to offer more services attached to this crucial function. There was custody and clearing products. And it would allow overseas entities maintaining these correspondent balances to invest the proceeds in risk-free ways.

Enter the first reverse repo.

In FRBNY’s parlance, it is called the foreign repo pool. Any cash balance left in this program by a foreign official entity (central banks, governments, and international institutions like the BIS) is swept into what is just a regular repo. Since the transaction is recorded from the viewpoint of the “cash borrower”, in this case, FRBNY, it is called a reverse repo.

As part of its normal operations and now after four QE’s, there are UST and MBS securities sitting in the Fed’s SOMA portfolios. These are used as the collateral backing the reverse repo.

Beginning in December 2014, the outstanding balance began to surge. Before 2015, the FOMC had imposed limitations on this correspondent investment service. Remember, prior to 2008 there were practically no (bank) reserves in the system. FRBNY, therefore, had to more carefully manage any cash balances showing up here because they are a drain on domestic reserve balances (an autonomous factor absorbing them).

So, foreign officials could place dollars with FRBNY to be swept into the foreign repo pool, but they weren’t allowed to change that amount very much (without notice and permission) over the short run. They could add or subtract as needed, only in predictable increments through time.

Beginning in 2015, these constraints were removed and suddenly the size of the foreign repo pool skyrocketed.

Why? More to the point, why then?

A few explanations were put forward, the usual benign-sounding technical mumbo jumbo. One which became widely accepted (among the few who follow these arcane processes) was some tortured repo rate arbitrage (foreign commercial banks would park dollars with their central banks who would then “invest them” on their behalf in FRBNY’s foreign repo pool paying what must’ve been more, but we don’t know since the Fed doesn’t publish the rate it pays).

It was, as usual, nonsense; anything to avoid the truth of QE and bank reserves, a malfunctioning global eurodollar system instead behind everything.

It was Simon Potter, of all people, who in February 2016 let slip the dirty secret. At the time, he was Executive Vice President of FRBNY’s Markets Group (and would go on to become the Open Market Manager, remaining in that position until last month). In a speech at Columbia University, the topic which was the Fed’s anticipated policy liftoff and normalization (at that moment in hibernation for reasons officials couldn’t fathom), Dr. Potter said of the foreign repo pool:

This growth isn’t associated with liftoff, and it isn’t because we have changed the way in which the interest rate is calculated. Instead, use of the pool has increased because over time the constraints imposed on customers’ ability to vary the size of their investments have been removed, the supply of balance sheet offered by the private sector to foreign central banks appears to have declined, and some central banks desire to maintain robust dollar liquidity buffers.

In other words, the Fed removed restrictions on the size of investments in it, foreign central banks couldn’t find similar dollar buffers in the private sector, and for some reason decided they needed an increasingly robust dollar liquidity buffer. There are many different ways to say dollar shortage, and Potter manages to get almost all of them into this one sentence.

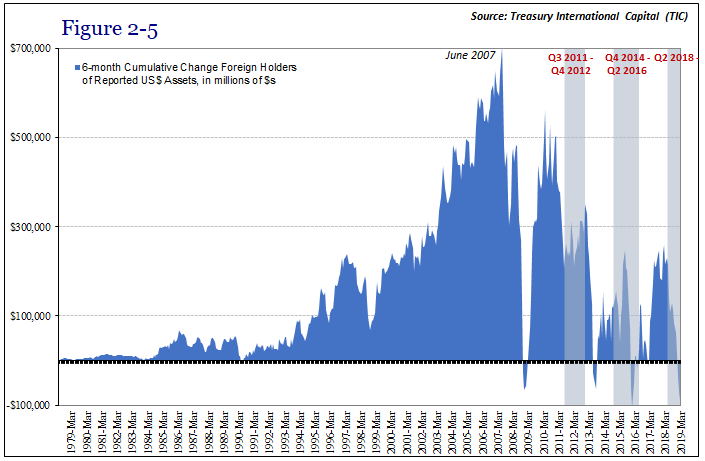

Go back to the chart above and look at the times when the foreign repo pool really expands: September/October 2008; August 2011; December 2014; January 2018. When foreign governments and central banks are suddenly interested in raising their liquidity buffers, it doesn’t seem to have anything to do with repo rate arb. It does correspond (pun intended) perfectly with identified dollar shortages or eurodollar squeezes.

In other words, Dr. Potter can almost perfectly describe one without ever giving it a second thought. This is Economics. When drug addicts, baby boomers, and people living longer are argued and studied endlessly but the meaning and condition of dollars and money provoke very little response.

There’s an added bonus to it, if you will. Because it is a repo transaction whichever way you want to describe it, there’s collateral involved. From the other perspective, the repo perspective of the foreign institution, they receive UST’s (or MBS) as collateral out of SOMA. Once they are out of SOMA, these securities can then be used if it might so happen that foreign commercial firms in any foreign central bank’s jurisdiction should also experience the same dollar shortage in terms of repo collateral (the bottleneck).

The foreign repo pool allows an overseas central bank to increase its dollar payment buffer at the same time gaining further access to badly needed collateral securities. The program sells itself – in times of a dollar shortage.

And there is another wrinkle to consider, ironically what may be a policy problem. With the FOMC in balance sheet runoff, the level of bank reserves has declined. Thinking these are money, officials are trying to be careful about how much reserves they believe need to be kept around; what’s the minimum required. There are now autonomous demands for them, the very subject of Potter’s 2016 speech, including the large balances in the foreign repo pool.

As the level of bank reserves decline under QT, it is possible the Fed is reintroducing constraints on it, size limitations in order to better manage the smaller level of reserves; as Potter said in February 2016, “the current operating framework is not based on reserves scarcity.”

With QT in mind, if the Fed has switched back to a reserves scarcity doctrine (applying to all the autonomous factors, not just these reverse repos) then it would stand to reason it would also again seek to limit big changes in the foreign repo pool – including a sudden and sharp rise in demand.

In another dollar shortage, which is already indicated (Euro$ #4), this would mean constraining foreign central bank’s dollar buffer at the same time as limiting access to SOMA collateral. And doing so at maybe some very inopportune moments, perhaps making a bad situation even worse. Overseas entities would have to manage their dollar problems in other likely more intrusive ways (again, the specific problem isn’t QT but how officials see QT).

This last part I’m inferring and speculating. I don’t know that FRBNY has as yet reapplied constraints on the foreign repo pool. Reading between the lines it is at least a possibility.

The bigger issue stands regardless; the Fed has the data and the details on these global dollar shortages in its own dealings with the offshore world. They even talk about and describe them – before dismissing their significance in the face of QE and bank reserves, thinking of them as nothing more than curious anomalies.

It’s beyond frustrating, what Economics has done to technical proficiency inside and out.

I didn’t include this piece of evidence in my recent paper (for reasons of space, already doing a lot of heavy lifting just describing the basics of all the other evidence), but like the other indications the Fed’s original reverse repo falls right in line – dollar shortages. This one also includes the collateral implications, too.

The answers are all right there.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more