When Will The Fed Begin Tapering: Here's What 10 Wall Street Strategists Think

When it comes to the Fed's Wednesday FOMC statement, economists agree that this meeting should largely serve as a status check of the economic recovery relative to the substantial forecast upgrades that the FOMC unveiled at their March meeting, but things will then heat up in the summer and certainly the fall, when Powell may have no choice but to address the roaring inflation and - gasp - even hint at a taper, risking another bond (and stock) market tantrum.

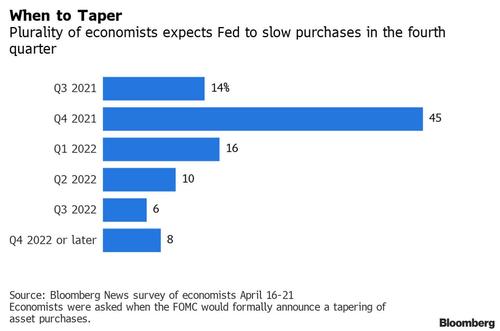

In any event, after the Bank of Canada became the "taper trial balloon" when it said last week it would scale back its purchases of government debt and accelerate the timetable for a possible rate increase, the Fed is expected to begin trimming its $120 billion in monthly asset purchases before the end of the year as the USbeconomy recovers strongly from Covid-19, according to economists surveyed by Bloomberg. That’s a bit earlier than forecast in the March survey but leaves Fed asset purchases untouched for several more months, with the first interest-rate increase still not expected until 2023.

Ok, but when exactly?

To answer this question, Bloomberg has sifted through and compiled the thoughts of ten of Wall Street's top rates strategists and economists for their outlooks when the Fed will broach the subject of tapering. Here are the results:

Bloomberg (Carl Riccadonna)

- Our view is that the tapering happens in the first quarter of next year.

- This will give plenty of opportunity to pre-announce/forewarn/hint/etc. starting from the July semi-annual testimony, through Jackson Hole and over the course of the second half.”

Bank of America (Bruno Braizinha and Mark Cabana, April 23 report)

- “Recent rate decline does not change our view for higher yields this year”

- For 10-year, current range of 1.4%-1.7% should move to 1.75%-2.10% as economy improves and Fed signals on taper during second half of year

- Recommends “to use dips in the newly established trading range to position for higher rates”

Barclays (Anshul Pradhan, others, April 22 report)

- Recommends trades “for a rangebound environment”

- Front end is “still being too aggressive in pricing in inflation and hikes,” while long end has “room to push real yields higher” based on “scope for the growth outlook to be revised higher”

- Recommends 2yr forward 10s30s swap curve steepeners, which “look too flat even assuming that the hiking cycle starts in two years”

Citi (Jason Williams, April 23 report)

- Treasury to “take precautionary measures and reduce the size of the 20y auction,” which has experienced “a clear and consistent concession” in contrast to the 30- year

- “There is a clear demand for long-duration bonds, but the 20y does not appear to be fulfilling that role for investors”

- Treasury may “foreshadow a reduction in 20s for the August refunding, with a risk that it does a marginal cut this quarter”

Goldman Sachs (Praveen Korapaty, others, April 23 report)

- “There appears to be a good case for some asymmetry on the outlook for real rates vis-à-vis inflation,” in which further inflation upside doesn’t move liftoff pricing forward very much “but a softer outlook could see the timeline shift further out”

- More bullishness on inflation “would likely have a greater impact on the pace of hiking beyond liftoff rather than pulling forward the liftoff date by much”

JPMorgan (Jay Barry, Phoebe White, Natalie Matejkova, April 23 report)

- Treasury yields “need a new catalyst” to move higher from current levels, and “tightening labor markets and a Fed tapering could spark such a move, but we do not see this driving Treasuries until the summer”

- Meanwhile, “investor position technicals are short and could bias yields lower over the near term”

- Favors lower-beta carry-efficient ways to position for higher yields and recommends holding 3s7s steepeners

- 20-year bond introduced last year has been successful and its liquidity “should continue to improve”; any changes to issuance pattern should be modest and no earlier than August

Morgan Stanley (Guneet Dhingra, April 23 report)

- “The complete lack of reaction to the recent upside surprises in economic data shows the high degree of optimism embedded in Treasury yields”

- Risks of prolonged virus challenges “will be enough to keep the Fed a lot more patient than the optimistic path priced by the Treasury market”

- Rate-hike expectations are likely to move “deeper into 2023,” and 5- and 10-year yields “could be around 65bp and 140bp if the market prices the first hike in June 2023”

- Continues to favor 5s30s steepeners and EDM2/EDM3 flatteners

NatWest (John Briggs, April 24 report)

- Recommends short positions in Treasuries, especially intermediates, based on rising expectations that Fed will begin to discuss tapering asset purchases in September, following similar moves by Canada and possibly U.K. in the meantime

- Tapering “will lead to the market pricing in more hikes down the road,” beginning in 2023, “and then as in 2013, just roll that rate hike pricing over time until we actually get there”

Soc Gen (Subadra Rajappa, others, April 22 report)

- “With the U.S. economy at an ‘inflection point’ and bond yields at the lower end of the recent range, we see room for yields to rise on strong data”

- Fed “is set to take baby steps towards preparing the markets for a taper announcement, while the ECB retains a more cautious stance,” which should lead to U.S.-German 10-year spread widening

TD Securities (Priya Misra, Gennadiy Goldberg, Penglu Zhao, April 23 report)

- It’s too soon to expect any sign on tapering asset purchases from the FOMC meeting

- Recent price action “is just a temporary breather in the longer-term trend towards higher rates” driven by economic improvement, increased supply of duration and higher inflation risk premium

- Expects 10- year yield to reach 2% by year end, 5s30s curve to steepen

Meanwhile, Bloomberg summarizes the result of its survey noting that more than two-thirds of the economists surveyed expect the FOMC will give an early-warning signal of tapering this year, with the largest number - 45% - looking for a nod during the July-September quarter.

That could come from either the July or September FOMC meetings, or Powell’s semi-annual testimony to Congress. Another option is the Kansas City Fed’s annual late-August Jackson Hole Economic Symposium, which has been used as a venue to deliver signals in the past. The Fed chair typically gives the keynote speech and Powell has so far continued that tradition.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more