What's Holding This Market Up? The Real Question: Why Isn't It Much Higher?

Picture above: Alice asked Ralph where the market was going. Ralph answered, "To the moon Alice, did you see Elazar Advisor's Fed liquidity spree chart with the yellow line? To the moon Alice!"

You can see on his face the disappointment that it hasn't happened yet. Alice, though is quite content either way, she's in cash, as you can also see. Disclosure, we think Ralph misinterpreted our chart. We know from his show, The Honeymooners, his trades didn't always work out. We really meant to infer the chart looked peaky and risky but I guess he, like many bulls, were looking at it saying, "to the moon."

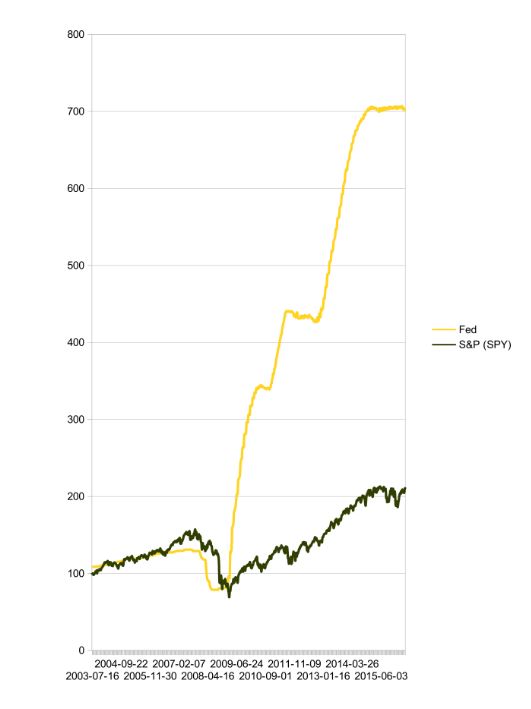

Here's the famous chart the star of The Honeymooners was referring to.

Our report (In Fed We Trust) showed how the 08 crash could have been spurred on by the Fed and the next crash may also. One key was the above chart. The green line is the market (NYSEARCA:SPY) and the yellow line is the Fed's "liquidity spree" designed to drive funds to banks, the consumer and the market. (See Is The Fed Buying Stocks for the data).

Based on the above chart, you would think that the market would follow it all the way to the moon. But it's still sitting near last year's highs, down here on earth.

We heard from many followers and commenters that it's at "ATH" (All Time Highs) and for that reason it has to go higher. It may.

We want to show what, we feel, has it artificially inseminated and what can cause it to break.

Four Reasons Why The Market's Still Up

1) Elazar's yellow line in the chart above

2) Overstated Fed Model

3) Low rates driving banks and all to chase lower quality returns

4) Because it's up

One, Elazar's Yellow Line

The unbelievable amount of liquidity (first chart above: yellow line) that the Fed has pumped into the economy should be holding up the economy. That said it's slowing.

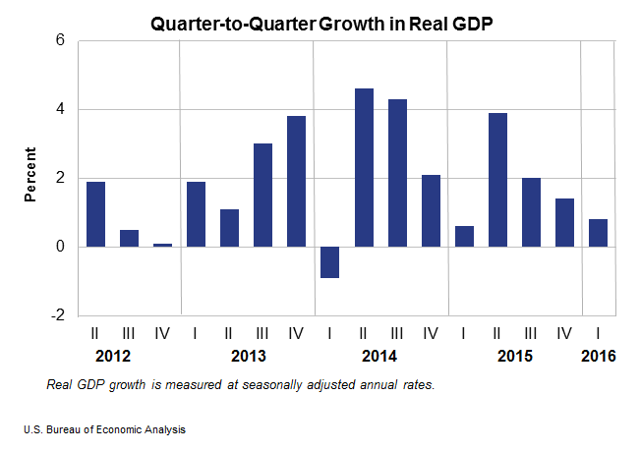

GDP slowing...

Jobs slowing...

An economy awash in liquidity should have been driving results for quite some time. The economy is gasping, at best, and if any of these above two charts go any lower, we are in a recession, despite the mounds of Fed liquidity.

That is a fair first reason why we haven't dropped fast, yet. The underlying liquidity is holding up levels despite grinding fundamentals.

Why we don't buy it?

We think the yellow line may be coming down. We see, not expect, the economic numbers slowing. We see, not expect, earnings and other important fundamental measures slowing. We do think, in the end, fundamentals, not pure liquidity, will reign. And that liquidity may come down too.

Continue reading on Seeking Alpha.

I think there is still a lot of uncertainty in the market. and this is what might be putting the stopper on the markets in general. Major unresolved themes include: Brexit in the UK, the Fed interest rate decision uncertainty, and what Trump will do when he takes power in January. For example will he take aim at companies like Apple and if so what effect will this have on the Nasdaq. If the US dollar continues to strengthen as it has, what effect will this have on US companies export prices? Lastly the elephant in the room is that we are very overdue for a market crash. We are in a bubble, and many believe it's just a matter of time in the cyclical economy in which we find ourselves.

With the SPY very close to breaching its all time high,it seems there's no stopping the US stock market. The SPY has had its ups and downs, but over the past 10 years the index is up over 60%. We are very overdue for a correction no matter what the Fed says.

Joe, we were down big in January, it is still near its highs for the year so it really hasnt net gone anywhere but it is brittle. agree w/ u

Good article though it's annoying to have to click through to another site. And your own site seems to be broken (BestIdeas).