US: Stagflation Nation?

Inflation pressures are building just at the time the economy is showing signs of slowing. It is the latter that will drive Fed policy with another 25bp rate cut expected next week.

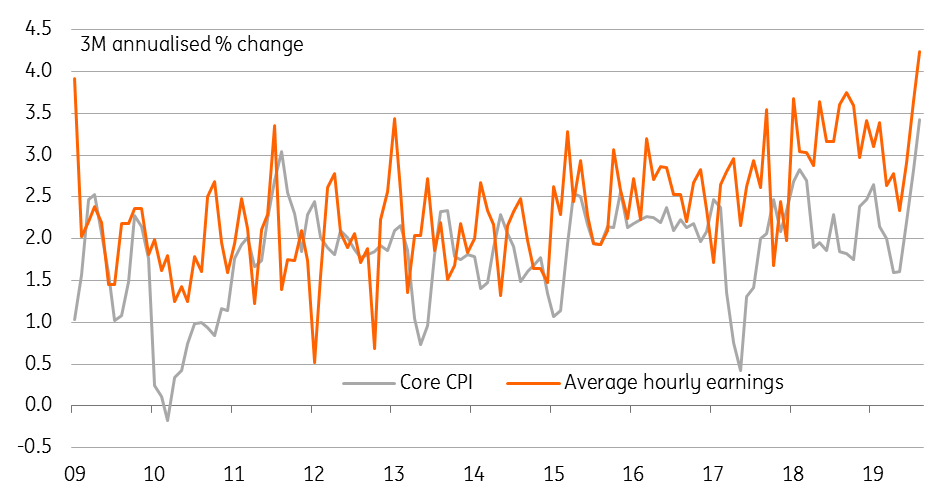

US core (ex-food and energy) consumer price inflation for August has posted the third consecutive 0.3%MoM reading, above the 0.2% figure expected by the market. This has pushed the annual rate up to 2.4%YoY, the highest reading since September 2008 while the 3-month annualized rate is now running at 3.4%. Given the recent acceleration in average hourly wage growth – currently running at a 4.2% annualized rate – the US economy is experiencing is biggest pick-up in inflation pressures since before the global financial crisis.

Prices and wage growth are accelerating

Source: Macrobond, ING

In terms of today’s CPI report the details show that medical care costs, tobacco and housing costs (through the owner equivalent rent component) are responsible for most of the acceleration, but there have also been some big swings in apparel prices. However, food price inflation is modest, posting three consecutive flat monthly readings while the hefty falls in fuel prices have dragged the energy component lower. As such headline monthly inflation figure came in at 0.1%MoM or 1.7%YoY.

Looking ahead there is the potential for the latest round of tariff hikes, which tended to be focused on consumer goods, to be passed on in prices. This means core inflation is likely to remain elevated and therefore consistent with the Fed’s mandate. On the face of it, this has the potential to limit the scope of additional Federal Reserve rate cuts.

However, we have to remember that inflation tends to be a lagging indicator and policymakers will instead be focusing on the deteriorating growth outlook when the Federal Reserve meeting starts next week. In this regard there are signals that the manufacturing sector is in or at least heading towards recession, the investment numbers are weakening and businesses are becoming more cautious about hiring.

With the dollar remaining firm and other central banks embarking on policy loosening the Federal Reserve will cut rates 25bp next week and we expect additional policy loosening in December and 1Q20.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more