US: Inflation Bears Start To Growl

The Democrat takeover of Congress is prompting talk of more stimulus and a potential inflation "problem" down the line. Assuming the pandemic ends and the economy reopens fully there will be price level recovery in many sectors, but there are plenty of reasons that suggest fears of sustained high inflation readings are misplaced.

Inflation readings on the rise

Covid vaccinations and an economic reopening were already in most forecasts, but the Senate run-off election results from Georgia now make a swifter, more aggressive fiscal stimulus look more probable than just a few weeks ago. On the back of this, I’ve received more questions on inflation in the past week than I have in the whole of the previous 10 months and today’s CPI report is unlikely to dampen the fervor.

Headline inflation rose 0.4% month-on-month or 1.4% year-on-year, led by a 4% jump in energy prices. The core rate (excluding the volatile food and energy components) was more benign, rising 0.1% MoM%/1.6% YoY as the weak housing component held down the rest of the basket of goods and services. That said the YoY inflation rate is starting to climb – the annual rate of headline inflation was only 1.2% in November after bottoming out at 0.1%YoY in May.

Looking ahead, inflation will continue to rise. Assuming we do see a full reopening in the months ahead, the combination of increased demand in an economy that has seen supply capacity shrink is likely to generate rapid price increases in several components of the inflation basket. The question is whether this is merely price level recovery or the start of something longer-lasting and potentially destabilizing.

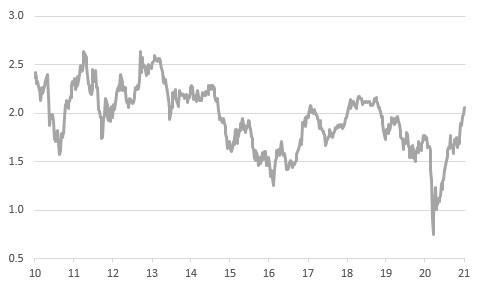

Market inflation expectations have moved higher - implied 10Y break even inflation rate using government index-linked bonds (%)

(Click on image to enlarge)

Source: Macrobond, ING

Price level recovery – not “inflation”

My view is that it is the former, although I do think that the consensus amongst economists looks a little complacent in the near-term. Out of 51 responses to Bloomberg’s monthly survey, the average forecast is for headline CPI to peak at 2.6% in 2Q. Personally, I see headline inflation pushing above 3% YoY in 2Q/3Q with core inflation (excluding food and energy) heading past 2.5% YoY.

However, comparing price levels between 2Q 2020 and 2Q 2021 gives a hugely misleading signal as to underlying inflation pressures. 2Q 2020 was when the economic pain of the pandemic was at its peak. Businesses were shut, travel stopped, people were told to stay at home. Companies were desperate for cash to pay staff and creditors so they were willing to sell at deep discounts. Airline fares plunged 30% between February and May, with hotel and motel prices falling 15% and clothing 8%. This was a period of extreme stress and remarkable price moves.

In contrast, we are all hoping that 2Q 2021 will be a period of economic re-awakening - the vaccination program will have gained momentum, the number of Covid cases and hospitalizations will have plunged thereby allowing Covid containment measures and economic restrictions to be lifted. With households and businesses free to spend, supported by high savings levels, low credit card balances, and additional government cheques, we are likely to see vigorous pent-up demand.

At the same time, there is justifiable concern that some supply capacity has been destroyed in some areas of the economy. Airlines have laid off staff and mothballed aircraft, many hotels, bars, restaurants, and gyms have gone out of business, while numerous retailers have shuttered stores. Consequently, vigorous demand coming up against supply constraints will allow for price levels to recover to pre-pandemic levels and possibly beyond very quickly. This could make the YoY inflation rates look alarming.

For example, assume airline fares, which fell 30% March-May 2020, return to pre-pandemic levels in May 2021, equivalent to a $100 flight becoming a $70 flight and then returning to a $100 flight. Well, the price of the flight going from $70 to $100 equates to an annual inflation rate of 43%, yet it is the same price as February 2020. Long story short, annual inflation rates are inevitably going to look bad.

Energy and dollar effects are marginal

We also recognize that higher energy prices could add to headline inflation. The Saudi Arabian production cut has helped to maintain the upward momentum in oil prices, which will increase the cost of gasoline and transportation costs more broadly. The weaker dollar, too, could help nudge import prices upwards although given the relatively “closed” nature of the economy – only 10% of economic activity is tied to international trade versus 30% plus for Europe - means that this impulse is often overstated.

Critically though, the sectors where there are most likely to be major price increases are small. Airline fares have a weighting of just 0.6 percentage points, hotels are 0.8ppt, car hire is just 0.1ppt while gasoline is only 2.8% of the total basket used to calculate the national inflation number.

Services dominate inflation and weak wages will weigh

Meanwhile, non-energy services make up 60% of the inflation basket, with housing alone accounting for 30% of the total. Actual rents in major cities are falling and owner equivalent rent is depressed for now. The contribution from these components will probably creep upwards as rising bond yields drag mortgage rates a little higher and house price increases start to feed in, but I don’t think this should be too concerning.

Elsewhere in the service sector it is wages that drive inflation. We have barely had any wage inflation over the past decade and I see no reason for that to change soon, especially when we consider there are still 10 million fewer people in work than before the pandemic started.

Inflation will spike, but it won’t last

So, bringing it all together, we are likely to see a near-term spike in inflation on base effects of a reopening economy in 2021 versus a calamitous period in 2020, but that will fade through the second half of 2021. Headline inflation may stay a little elevated through 2022 on strong growth and some supply constraints, but new businesses will pop up and supply will gradually be restored. Longer-term inflation is going to be primarily driven by wage costs given the US is a service sector economy. I continue to doubt that we will see “sustained” US inflation meaningfully above 2% over the longer term.

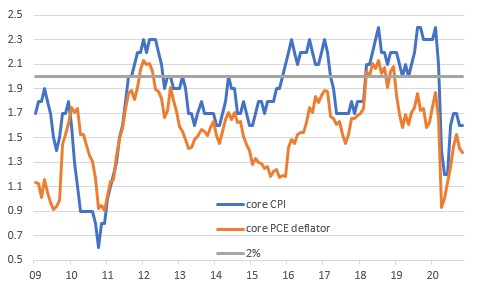

Moreover, the past decade has shown how hard it is to consistently achieve the Federal Reserve’s 2% inflation target. Their favored measure - the core personal consumer expenditure deflator - has hit or risen above 2% on just 13 occasions out of a possible 144 since the Global Financial Crisis – a less than 10% success rate despite massive quantitative easing and huge tax cuts!

Remember too that the Fed has recently moved the goalposts and is now saying it won’t raise interest rates until inflation “ is on track to moderately exceed 2% for some time”, backed up by their dot plot diagram suggesting no rate hike until 2024. This only reinforces our view that the Federal Reserve will “look through” this period of above-target inflation.

Hitting 2% inflation isn't easy... (YoY inflation measures excluding food & energy)

(Click on image to enlarge)

Source: Macrobond, ING

But it could be bad news for bonds

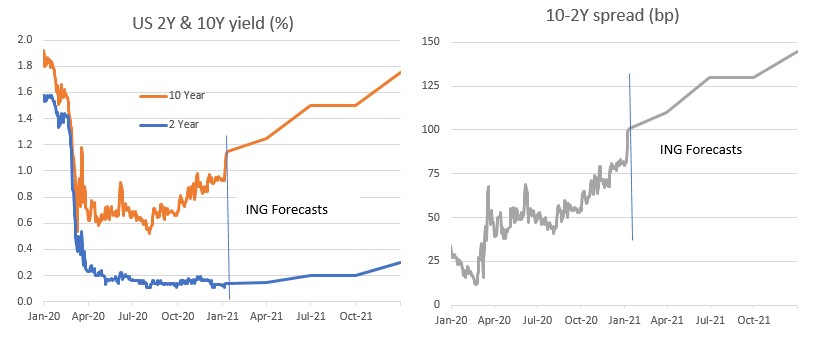

Nonetheless, 2Q into 3Q will be a period where inflation readings look high and this could spook some investors. Break-even inflation rates calculated from government index-linked bonds have risen sharply and longer-dated yields have broken decisively higher with the 2-10Y yield curve at its steepest since May 2017. The latter move may also partially reflect some anticipation of higher debt issuance under President Biden and a Democrat-controlled Senate and/or the recent discussions about potential tapering of the Fed’s QE program, which is currently operating at a rate of $80bn of Treasury purchases and $40bn of mortgage-backed securities purchases every month.

These developments are on the one hand a positive, in that they reflect optimism about the economic outlook, but it's also likely to be causing some anxiety at the Fed given the timing, speed, and scale of the move in yields. We are still in the middle of the pandemic with Covid cases, hospitalizations, and deaths at record highs. Looking towards Europe, we have to acknowledge there is the risk that mutated strains gain a foothold here in the US, which could result in more containment measures that will inevitably be economically damaging. There is also the question mark over how long it will take to get herd immunity and whether the vaccines actually offer permanent immunity. Economic uncertainty remains very, very high.

Yield curve continues to steepen

(Click on image to enlarge)

Source: Macrobond, ING

Yield Curve Control back on the agenda?

The Fed will be wary that higher borrowing costs will worsen the growth story at a time when the economy is losing jobs and consumer spending is falling. Consequently, we expect the Fed to more forcefully state they believe any inflation spike will be temporary. Note that St. Louis Fed President James Bullard and Boston Fed President Eric Rosengren both downplayed the prospects of asset purchase tapering yesterday.

If this does not work and yields push higher too far too fast – say threatening to get to 1.5% on the 10Y well before herd immunity is likely to be reached – then the prospect of yield curve control would come onto the agenda. This would involve either increasing asset purchases, or more likely, adjusting the current level of purchases to focus on the longer end of the yield curve.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more