US: Fed Holds, But Optimism Is Creeping In

The Federal Reserve has left monetary policy unchanged and continues to signal the first rate rise won't happen until 2024. However, the forecasts point to a more positive outlook while we believe that there is a better growth and employment story that will lead to an earlier QE taper and a summer 2023 rate hike.

Federal Reserve

Stable rates, stable QE

No surprises from the Federal Reserve as they unanimously leave monetary policy unchanged. The Fed funds target range remains 0-0.25% and their quantitative easing program is untouched. The statement reiterates that the $120bn of monthly asset purchases split $80bn for Treasuries and $40bn for MBS will continue “until substantial further progress has been made toward the committee’s maximum employment and price-stability goals.”

The descriptive element of the statement is little changed from the one released in January other than to acknowledge economic indicators have “turned up recently, although the sectors most adversely affected by the pandemic remain weak”.

It isn’t exactly effusive stuff, but their accompanying forecasts suggest much more optimism versus December and in the accompanying press conference Fed Chair Jerome Powell at least acknowledges that the situation is improving. Nonetheless he also argues that the economy is a long way from being healed.

By implication, withdrawing the stimulus too early outweighs the risks from withdrawing it later and “no-one should be complacent”. The message remains the Fed is going to do all it can to make sure the recovery happens and it feels it can remain patient before removing stimulus.

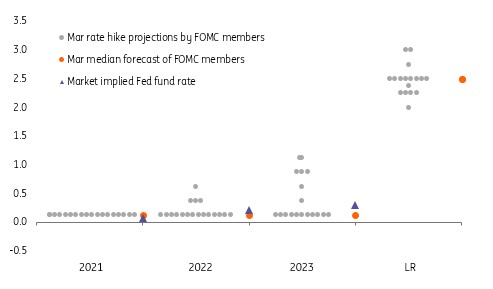

Fed dot plot of individual members forecasts for Fed funds target rate

(Click on image to enlarge)

Source: Federal Reserve, ING

Dot plots still favouring a 2024 rate hike

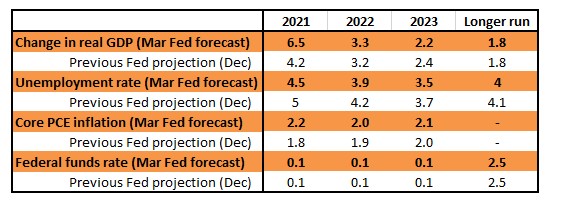

The Fed have published new forecasts and have raised their 2021 growth forecast (it is YoY% change between 4Q21 and 4Q20) from 4.2% to 6.5% and lowered their 4Q21 unemployment forecast to 4.5% from 5.0%. They also raised their inflation forecasts with the core PCE deflator expected to end the year at 2.2% rather than 1.8% and come in at 2% in 2022 and 2.1% in 2023.

Despite this the all-important dot plot shows modest changes, but the median forecast remains for no rate rise before 2024. There has been some movement though with 7 FOMC members out of 18 now predicting a rate rise by end-2023, up from 5 out of 17 three months ago. We also now have 4 members going for a rate rise in 2022 versus 1 in December. Once again no-one predicts a rate rise this year while the long-run target for the Fed funds rate remains 2.5%.

This isn’t a surprise. Bringing forward the median forecast for the first-rate hike into 2023 wouldn’t had fitted Fed Chair Jerome Powell’s narrative. Signaling an earlier move would have given more ammunition for the bond market to push yields significantly higher just when Powell has been indicating his concern that “disorderly conditions in markets or a persistent tightening in financial conditions that threatens the achievement of our goals”.

Federal reserve economic forecasts versus December 2020

(Click on image to enlarge)

Source: Federal Reserve, ING

What is "substantial further progress"?

The over-riding message remains there will be no change in the Fed’s stance until “substantial further progress” has been made. This rather vague statement gives the Fed plenty of flexibility on when and how to respond to ongoing improvements in the economy. Nonetheless, we are getting a few more clues about what it might constitute.

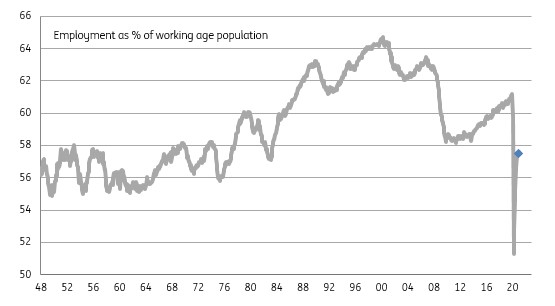

The Fed has signaled it feels there is significant slack in the economy and it is hard to argue with that given there are nearly 9.5mn fewer jobs than just 12 months ago. Indeed, there is a clear sense that the unemployment rate doesn’t give a true reflection of the state of joblessness. After all, the labour force participation rate – the proportion of people of working age that are actually engaged with the labour market – fell from 63.4% in January 2020 to 60.2% last May and has only recovered to 61.4% now.

We therefore argue that looking at employment as a proportion of working age population is a better measure right now. While it has improved to 57.6% from a low of 51.3%, it remains lower than the worst reading during the Global Financial Crisis and is on a par with the early 1980s recession when female worker participation was lower than it is today. We suspect the Fed would like to see this ratio get back closer to 60% before declaring “substantial further progress” has been made.

Nonetheless, with the vaccination program going well and the US on track for a broad re-opening in the second quarter, job opportunities will become more abundant. There is no reason why a 60% employment ratio cannot be achieved this year.

Employment as a proportion of working age population

(Click on image to enlarge)

Source: Macrobond, ING

A slow twist and a 2023 hike

Given this backdrop we suspect we could see a more meaningful change in the Fed’s language at the June FOMC meeting when they will again provide a new set of economic forecasts. At that point we do expect a majority of Fed officials to signal they expect a 2023 rate hike, which could open the door for a tapering of their asset purchases by December.

Such discussions would likely add to the upside pressure on Treasury yields and could generate another “taper tantrum”, but the economy should be in a much stronger position to weather it by then.

The latest Bloomberg survey of analysts show 49%, like us, think the taper will start at or before the December FOMC meeting with 51% thinking it will be 2022. 69% think the taper will be sharp with monthly asset purchases being cut to zero within a year while 44% think there will be a shift in the distribution of the purchases to target long-term security purchases.

We suspect the taper could last a little longer – perhaps up to 18 months. We also see a stronger chance of a “twist” operation that involves weighting more of the remaining purchases towards the long end of the curve than the consensus does.

Such action may help mitigate against a sharp steepening of the yield curve, but the Fed could feel the need to announce even greater flexibility, i.e., not sticking rigidly to a monthly target for asset purchases and instead focus on a range for asset purchases by a certain date. They would be signaling they are prepared to halt the taper and actually increase purchases on a temporary basis, depending on market circumstances. This could reduce the likelihood of a major sell-off in Treasuries and help dampen volatility.

While there is still a long way to go and a lot could change, our central case remains a first hike in summer 2023 with the Fed funds rate peaking out in the 2-2.5% range in 2025.

Treasury market implication

The overall tone from the Fed leaves the back end of the curve absolutely unprotected. The impact effect on both ends of the curve has been jumpy, but the net effect so far is a mild push lower in short yields and a net upward tendency in long yields. This remains a very accommodative Fed, meaning low carry costs for longs and no real barrier to a test higher in the 10yr yield in the coming weeks.

The subsequent pull lower in market rates seen likely reflected the nuance that Chair Powell choose to attach to the 2023 dots, where he emphasized that more members were looking for a first hike on 2023 than before - the median has not moved, but the composition of it has; he made a point of emphasizing this, which was instructive. This provides some semblance of back end protection at least for the back end to cling to.

There is little doubt that the Fed chatted on the front end. With SOFR peppering the 1bp area, it is certainly worthy of attention. The Fed has most control over the front end of the curve, and while SOFR is not an explicit policy rate, it is still clearly a very important rate ahead as we morph from Libor to it. Although the Fed did not choose to hike the rate on excess reserves at this meeting, it is one option that they continue to have at their disposal should they desire to frame the front end differently. For now the IOER rate remains at 10bp, with the effective funds rate at 7bp (within the zero to 25bp corridor). SOFR at just 1bp looks off though; a liquidity mop and/or a collateral add is required.

Just because the Fed choose not to make any formal announcements on the supplementary reserve ratio, does not mean it was not discussed. In fact, it likely was, and most probably at length. We should get an announcement at some point in the next week or so. Soundings from some US banks in recent weeks suggested that the Fed was looking at re-including Treasuries and commercial bank deposits at the Fed back into the calculation of the ratio. But an extension on the same terms remains most likely, perhaps with a target re-inclusion of one or both at some point in the future.

FX market greets FOMC with a sigh of relief

FX markets have welcomed the largely unchanged FOMC statement and the set of economic projections which sees some orderly US expansion without premature tightening of Fed policy. Only time will tell whether this was the Fed’s best avenue to prevent a further disorderly sell-off in the bond market, but for the time being those currencies exposed to the recovery have rallied and the dollar has weakened.

There has been a lot more discussion recently about the dollar’s ‘smile’ curve. To the extreme left of the smile, the dollar does well in a severe risk-off market and flight to quality (like last March). To the extreme right of the smile curve the dollar does well in the later stages of a US economic cycle and where we shift to see bearish flattening of the US curve as the Fed tightens policy (as opposed to bearish steepening witnessed today). And somewhere in between those extremes the dollar softens as the Rest of the World is allowed to breathe and activity currencies perform well.

Today’s FOMC delays fears that the Fed is shuffling closer to the extreme right of that smile curve and is happy to remain in a reflationary setting, supporting equities, commodities. That is our preferred stance this year and why we’re bearish on the dollar.

Assuming that we do not see another major leg higher in US Treasury yields (a quick move in the 10 year to 2.00% would certainly do a lot of damage) expect commodity FX and selected EM currencies to push ahead against the dollar. We say selected EM currencies since there are important central bank rate meetings due over the next three days in Brazil, Turkey and Russia, where important tightening of policy needs to be seen to address macro-political challenges in each.

We are bullish EUR/USD, but have to acknowledge the delay in Europe’s vaccination programme as a threat to our summer forecast of 1.25. In short, the EUR looks very unlikely to lead the charge against a weaker dollar.