US Economy Still Expected To Expand At Moderate Pace In Q1

The coronavirus is weighing on economic estimates around the world and it’s likely that the US will eventually feel some of this pain. The degree of the macro price tag for America remains a guessing game at this point. As a baseline, we can monitor how the first-quarter nowcasts evolve in the days and weeks ahead. On that front, the latest numbers point to a slightly softer increase in output for Q1 vs. the previous quarter.

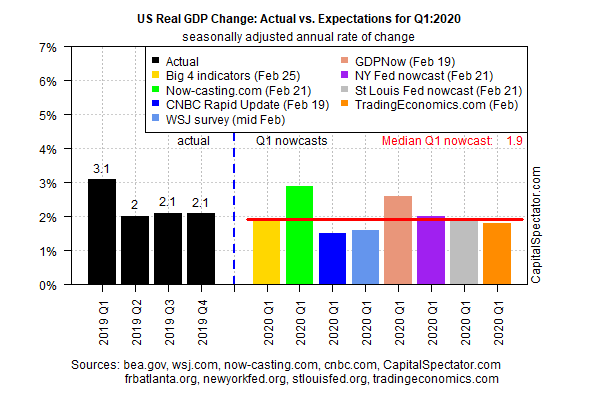

US growth is on track to increase 1.9% in the first three months of 2020, according to the median nowcast for eight models monitored by CapitalSpectator. That current estimate is up a bit from the previous outlook for a 1.7% gain, published earlier this month.

A 1.9% rise in Q1 growth, if correct, would mark a fractionally slower pace in the economic expansion vs. Q4’s 2.1% advance. But in the current environment, economic growth that holds near the recent trend would be welcome. The question, of course, is whether the macro trend can maintain a moderate pace as the coronavirus spreads to countries around the world, including the US?

Richard Clarida, the vice chairman at the Federal Reserve, said in a speech on Tuesday (Feb. 25) that the COVID-19 outbreak that appears to becoming a global pandemic could affect the US economy at some point. “But it is still too soon to even speculate about either the size or the persistence of these effects, or whether they will lead to a material change in the outlook,” he advised.

Meanwhile, warning signs are flashing in some corners, including recent sentiment data. Notably, the preliminary estimate of the US Composite PMI, a GDP proxy, fell in February, indicating a mild economic contraction—the first negative print for the index since 2013. “Weakness was primarily seen in the service sector, where the first drop in activity for four years was reported, but manufacturing production also ground almost to a halt due to a near-stalling of orders,” said Chris Williamson, chief business economist at HIS Markit.

Factoring in the coronavirus is tricky, but some economists are beginning to trim economic estimates. Mark Zandi, chief economist of Moody’s Analytics, for example, is projecting that growth will be lower by by six-tenths of a percentage point at 1.3% in Q1—a bigger reduction vs. more his previous outlook for trimming by four-to-five-tenths of a point.

Analysts remind, however, that modeling the economic impact of the coronavirus remains a work in progress. “We are still learning about how this complex virus spreads and the uncertainties are too great to permit reliable forecasting,” observes Kristalina Georgieva, managing director of the International Monetary Fund.

Looking further out in time, forward estimates of one-year changes for US GDP currently anticipate a slowdown in Q1 and in the quarters to come. Year-over-year growth in GDP is expected to slip to 2.1% in the first three months of 2020 vs. the year-earlier quarter. The trend is on track to decelerate further as the year unfolds, based on The Capital Spectator’s average estimate from a set of combination forecasts.

The main task at this point is monitoring the incoming data and watching how the nowcasts evolve. Friday’s January numbers on personal income and spending are on the short list in the days ahead. The bigger test awaits in the February data, which offers a more realistic profile how the coronavirus is impacting the US. On that front, next week’s schedule offers several key updates to watch, including February numbers for the ISM Manufacturing Index and payrolls.

Disclosure: None.