Unfortunately The Twin Shocks In China Will Mean A U Or L Shaped Recovery

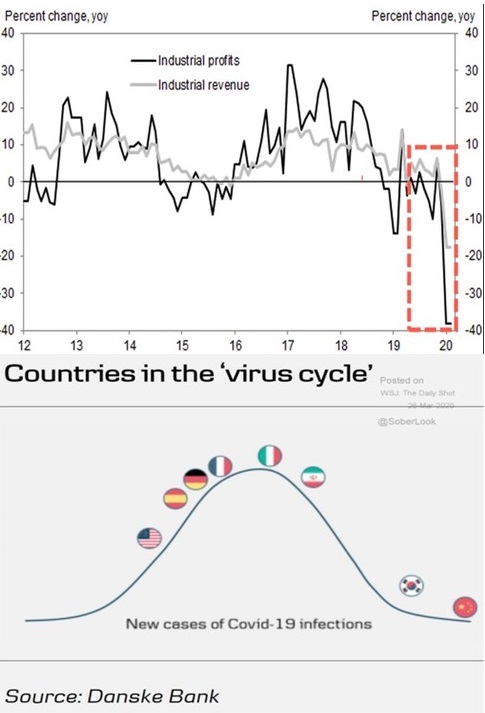

Excessively idealistic analysts who have been touting a V-shape recovery in China and the world, in the first half of the year, are looking at the best case as a U-shape or even maybe an L-shape. Twin shocks, first being a supply shock, beginning from shutdowns in China, now the demand shock originating from the Western world, is unfolding right in front of us. On Friday morning, China reported that Chinese industrial profits crashed the most on record in January-February. This implies numerous Chinese firms are attempting to endure, coming up short on cash, and the very edge of bankruptcy as demand from abroad has collapsed. That flat global economy As the first quarter closes, industrial demand in China illustrates that their economy is not prepared for what's coming. Numerous Chinese industrial facilities have been ramping-up on government reports; their pandemic curve has flattened. But many trade countries that China relies on, chiefly the U.S., are still flattening the curve. As Thomas Friedman put it, a flat world is not limited by physical distance due to modern transportation and trade creating opportunities for commerce anywhere in the world. We are all now beginning to see what flattening really means.

Disclosure: None.