Trump Saw CPI And Went 'Uh Oh'

President Trump reversed on adding tariffs on multiple consumer products yesterday. Why yesterday? Because yesterday coincided with a scary CPI number. I think the president realized that the Fed is going to be much closer to their 2% inflation target which means fewer rate cuts. It could mean rate hikes.

Quick Review

If you go back to our article a month ago when Fed Chair Powell turned dovish we were surprised that inflation was probably going to start running higher. Cutting rates when inflation accelerates is a very strange nuance.

That's why we said then, "Something's not quite right."

This is playing out and I think the Fed's going to have to backtrack on all their lovey-dovey dovish predictions of rate-cuts-forever no matter what.

Why?

Because inflation is picking up.

Trump Worried About The CPI

Here's what President Trump said yesterday,

“We’re doing this for the Christmas season. Just in case some of the tariffs would have an impact on U.S. customers.”

Let me break that down for you.

I ask you this - what "impact" could "tariffs" have on "customers?"

Tariffs raise prices for consumers. Fair.

That's precisely the economic number that reported yesterday - the CPI, the consumer price index.

And it jumped now two months in a row.

President Trump saw that number and likely went "uh oh," inflation is moving up and that's going to stop the Fed from cutting rates.

That's also why he wants to push off tariffs until the holidays. By then goods already have been shipped at the lower prices ahead of newer tariffs.

Why else?

Let the Fed worry about tariffs' inflation impact in 2020. But the Fed typically doesn't like to raise rates in an election year. So President Trump wants to push off this next round of tariffs to next year so the Fed doesn't have to meddle with elections by raising rates.

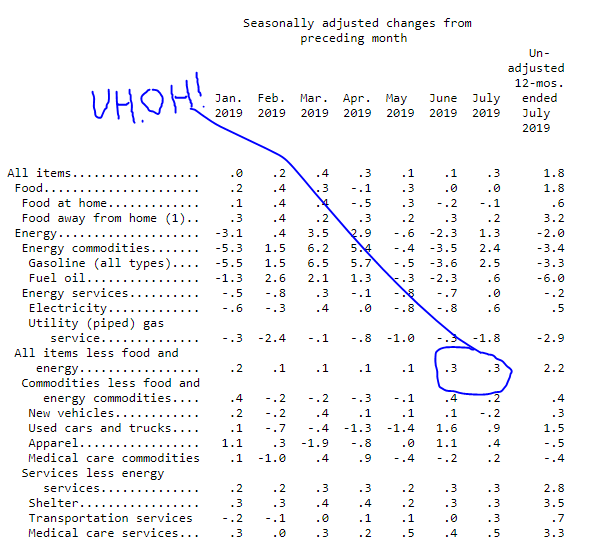

Here are the numbers that President Trump saw yesterday that helped him to decide to back off on further affecting consumer prices.

You can see the uh oh written there which is probably something he wrote.

(Click on image to enlarge)

But The Market Liked It Yesterday?

If the market liked it yesterday I think it should have moved up all day. It didn't "follow through" much from the early burst showing you some bought, but some funds were selling based on that CPI risk.

Here's what we told subscribers yesterday, and I think it explains the market's move today (even though I don't hear the media talking about it, which makes this call even more exciting).

Here's from yesterday,

"Inflation is moving up.

That CPI causes big changes at the Fed. I had warned about this. The Fed had internal disagreement on the last rate move. I believe future rate cuts are going to be more in question now. You know the market's not going to like that when that news comes out. I don't see how you can lower rates when inflation is accelerating and jobs are strong.

The Fed and central banks think they are too smart. They will manage the inflation number to the basis point. But really when inflation hits their 2% target it then hits 2.1 2.2 2.3 and they say they will raise rates if inflation goes above 2%. So lowering them now risks higher rates in the future. Markets don't like that. They know that. They have to start to adjust their thinking.

Without Trump's news today you'd likely have a much weaker market today, of course.

Inflation is the biggest risk to this decade-long market move. Inflation causes bonds to drop and takes the low rate floor out from under the market.

The trade news is bullish though, but will China respond positively or are they intent on waiting for a new president? Not sure. If they wait, then today's news doesn't help us much and this grinding trade negotiation continues to build economic and earnings risk.

We take it step by step. But I think it's very likely the trend is that this trade war continues to drag out, but that the Fed needs to change their tune.

You remember how hard it was for Fed Chair Powell to actually say more rate cuts are coming (at his recent Fed decision press conference) and the market got killed on waiting for him to finally say it. It's going to get tougher for him to say that now, much tougher with inflation.

I'll give the larger net short position another day. If anything from the big open, the market went sideways. So the action today wasn't so conclusive. Strong but not follow through strong. Follow through strong today would have meant to me more to come. Markets moving up all day tell me more to come. We didn't get that today.

I think the rate concerns affected some portfolio manager decision-making today. Inflation has been tame in this bull run and hasn't been the story. If that changes, market dynamics change for the worse.

I'm not getting "beared" up yet but there are some things that are inching in place to get there."

The Fed is now getting trapped. Cutting rates now with inflation hitting their targets is virtually insane. It risks inflation jumping from here. They know that.

The next round of Fed speakers, I believe are going to have to reverse.

Either way, I don't see how the market likes it.

Conclusion

Yesterday's President Trump move I think was after seeing that CPI number and he went, "uh oh." The Fed is going to have a tough time cutting. They need to.... (don't say it please don't say it) raise rates?

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own ...

more