Trade-Deal Doubts, Peak 'Put-Puke', & Extreme Greed Spark Stock Stumble

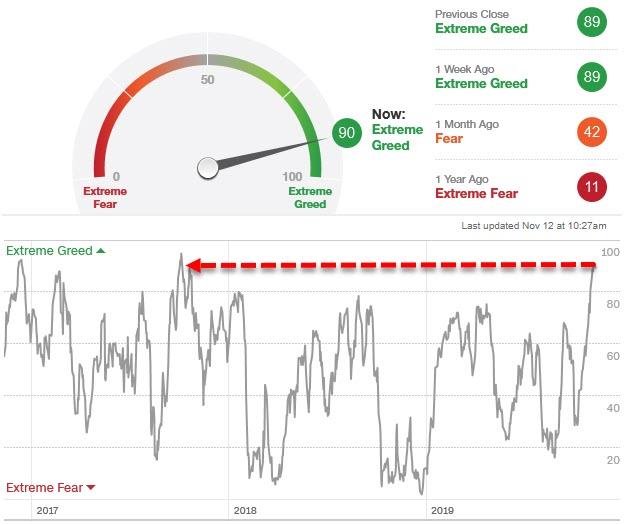

If "greed" is good...then "Extreme Greed" is better...

(Click on image to enlarge)

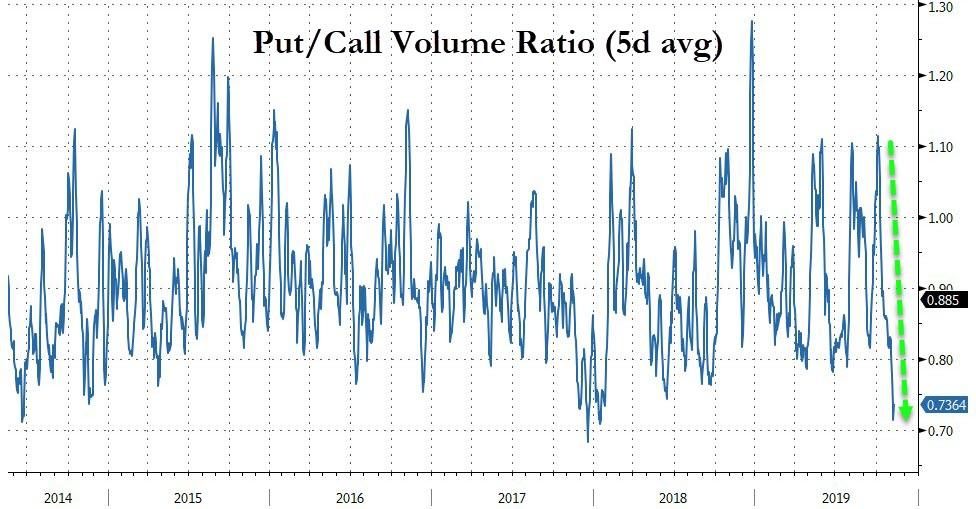

And when you're 'extremely" greedy, you don't need hedges... hence the "put-puke" - which saw a very modest reversal today after days of collapse...

(Click on image to enlarge)

Source: Bloomberg

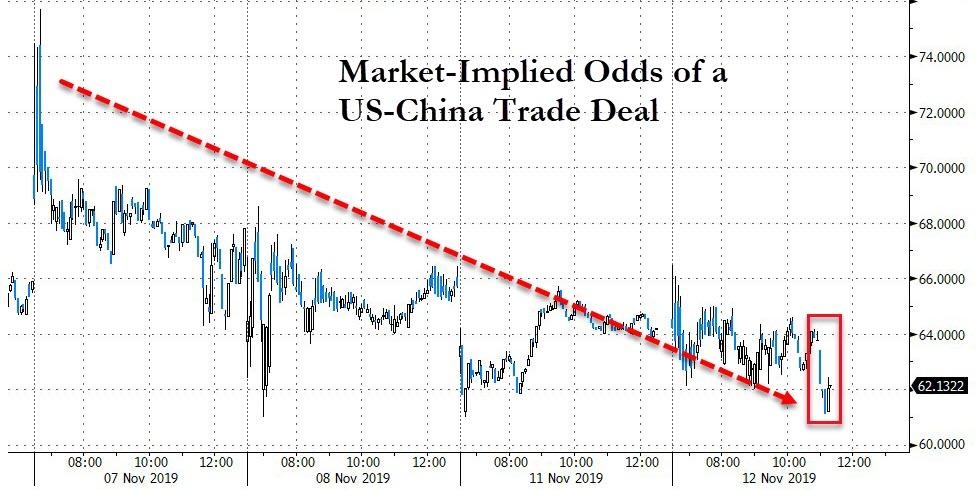

And, thanks to Trump's comments and China Global Times' "lies" response, the market's pricing of a US-China trade deal slipped...

(Click on image to enlarge)

Source: Bloomberg

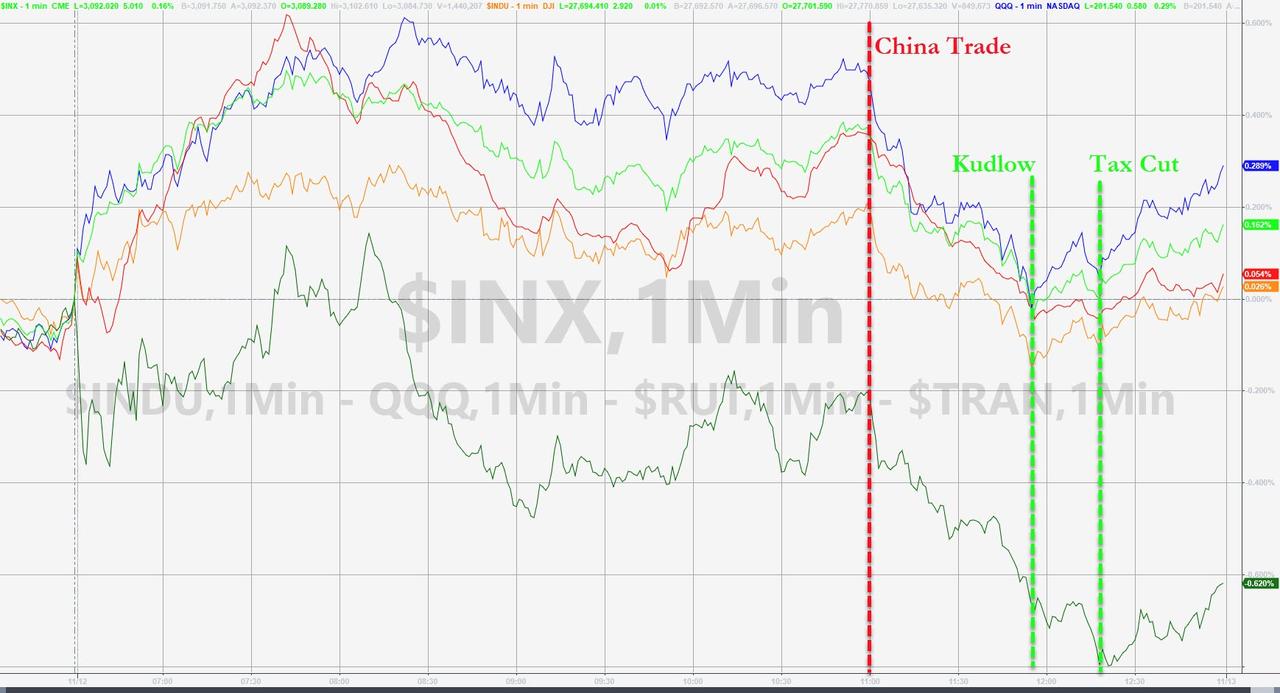

Which sent US equity markets red after hope-filled overnight markets expected something great from Trump's speech, (but Larry Kudlow came on CNBC around 1500ET and jawboned stocks and then a well-timed headline on tax cuts lifted stocks a little more)...

(Click on image to enlarge)

Source: Bloomberg

Big reversal in cyclical stocks today as hope for Trump's trade speech faded...

(Click on image to enlarge)

Source: Bloomberg

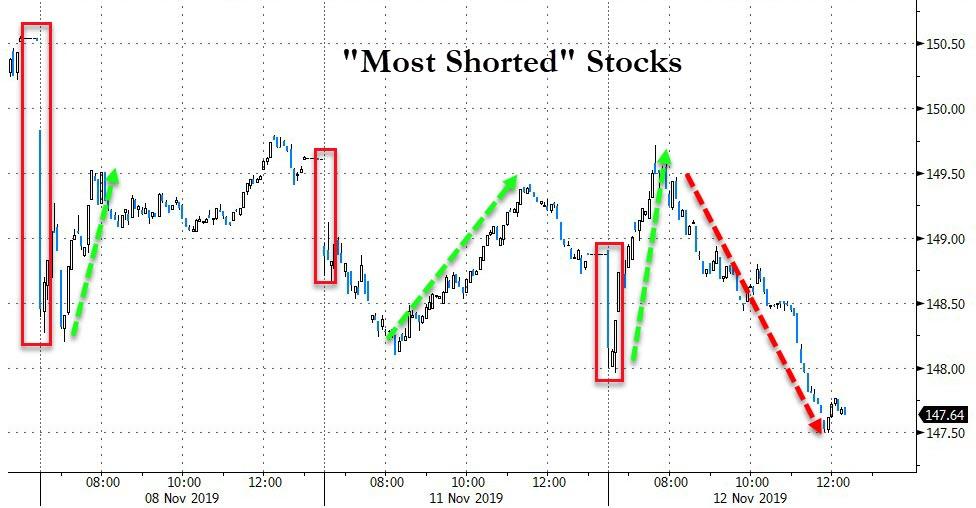

Shorts were squeezed at the open once again BUT this time it was different as "most shorted" stocks were slammed lower...

(Click on image to enlarge)

Source: Bloomberg

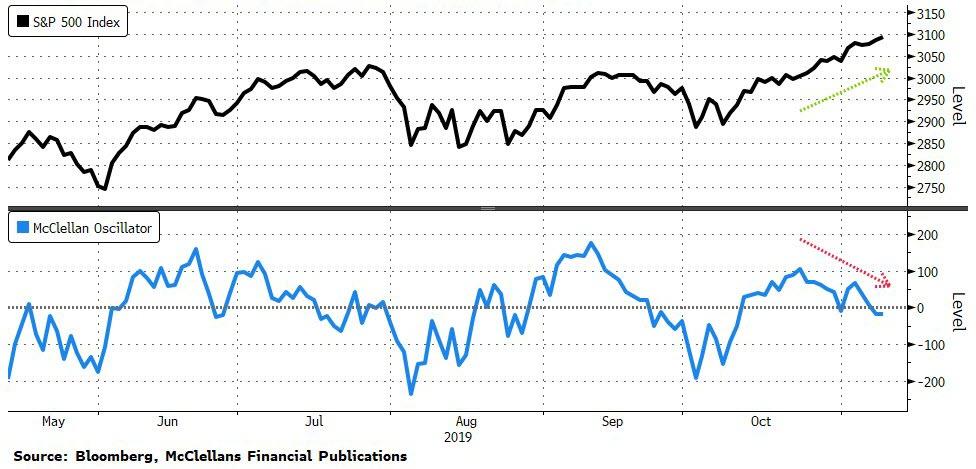

The recent series of fresh record highs for U.S. stocks is not being matched by a gauge of broader market strength, suggesting the gains should be treated with caution.

(Click on image to enlarge)

As Bloomberg reports, The McClellan Oscillator, a measure of breadth momentum, is trading below zero -- an “unusually weak reading” with the S&P 500 Index at all-time highs, according to Sundial Capital Research Inc. founder Jason Goepfert. The divergence is a modest near-term negative for stocks, having preceded poor short-term returns in the past, he wrote in a note Monday.

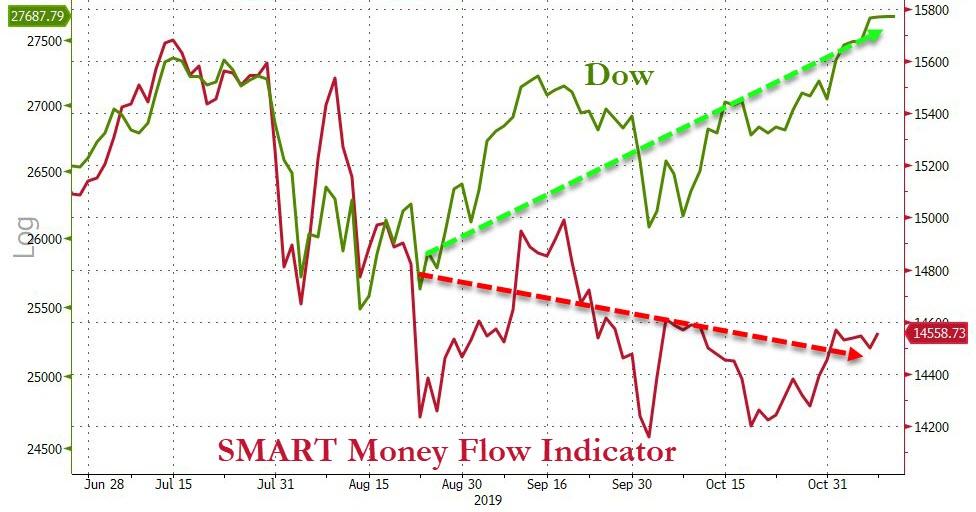

And the SMART Money flow remains unimpressed...

(Click on image to enlarge)

Source: Bloomberg

Having reopened after yesterday's Veterans Day closure, bonds were bid today...

(Click on image to enlarge)

Source: Bloomberg

A massive 10-part $30 bn debt issue from Abbvie (to fund its purchase of Allergan) perhaps explains the surge in yields late last week as managers enacted rate-locks...

(Click on image to enlarge)

Source: Bloomberg

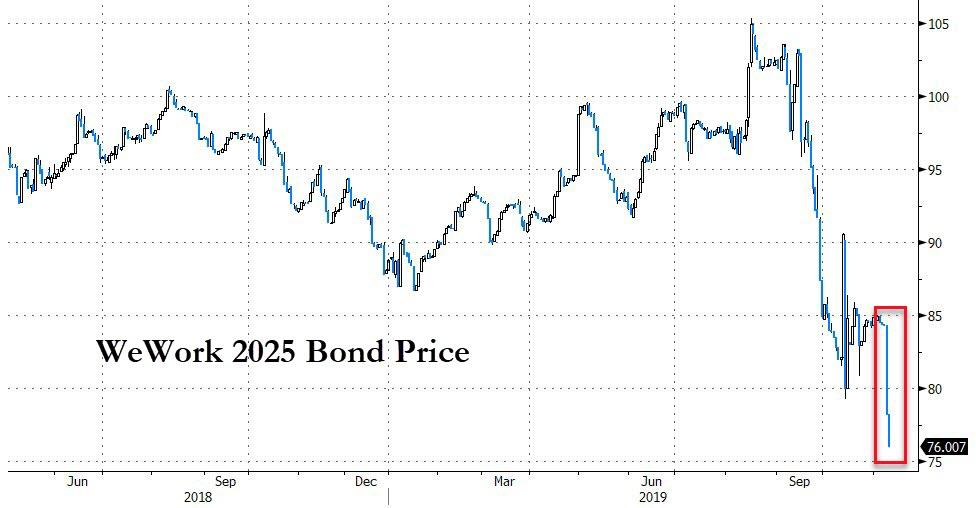

Meanwhile, elsewhere in bond-land, it appears the idea of Legere taking over as CEO has done nothing for WeWork as its bonds collapse to new record lows (yield now at 14.5%)...

(Click on image to enlarge)

Source: Bloomberg

And just in case you wondered, the cost of hedging against a Chinese currency devaluation or sovereign debt crisis is the lowest since 2008...

(Click on image to enlarge)

Source: Bloomberg

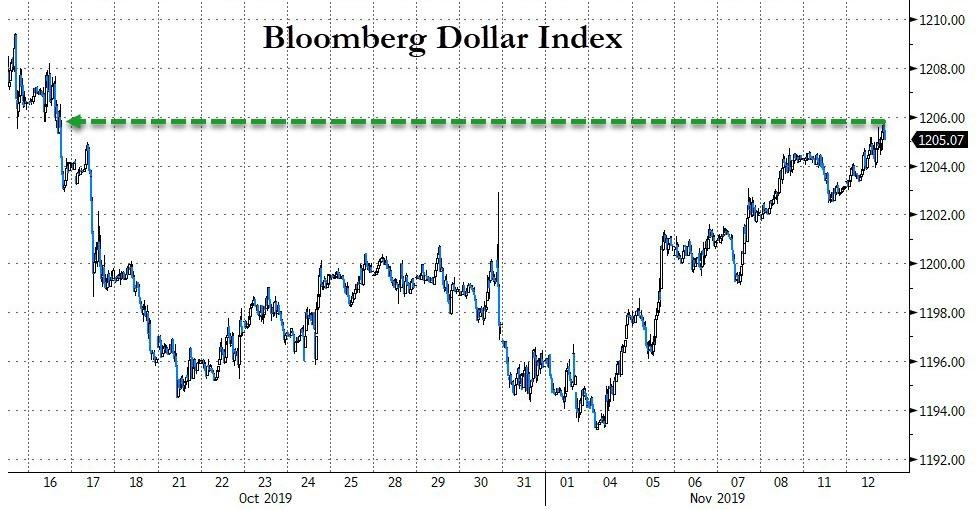

The dollar rallied for the 6th day of the last 7...

(Click on image to enlarge)

Source: Bloomberg

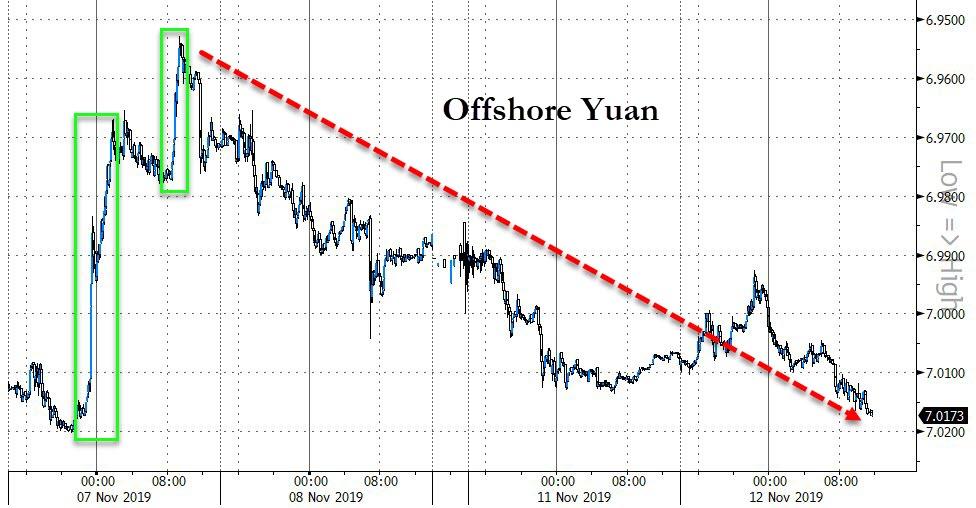

Offshore Yuan slipped lower today as trade deal odds fell...

(Click on image to enlarge)

Source: Bloomberg

The Chilean Peso plummeted to a record low, over 800/USD for the first time...

(Click on image to enlarge)

Source: Bloomberg

Cryptos were somewhat volatile today but ended almost unch...

(Click on image to enlarge)

Source: Bloomberg

Commodities were divergent today with crude and copper sliding as PMs rallied late on...

(Click on image to enlarge)

Source: Bloomberg

Gold was hit multiple times but rebounded each time and ended marginally higher...

(Click on image to enlarge)

Finally, it seems the upside momo from trade headlines has been used up as markets seemed more comfortable selling rips today on any hesitation...

$SPX algo’s when a new trade deal headline hits pic.twitter.com/xdBuDPvlUP

— MONETARY MAYHEM™ (@MONETARY_MAYHEM) November 12, 2019

And very quietly, the money is moving away from Elizabeth Warren...

(Click on image to enlarge)

Source: Bloomberg

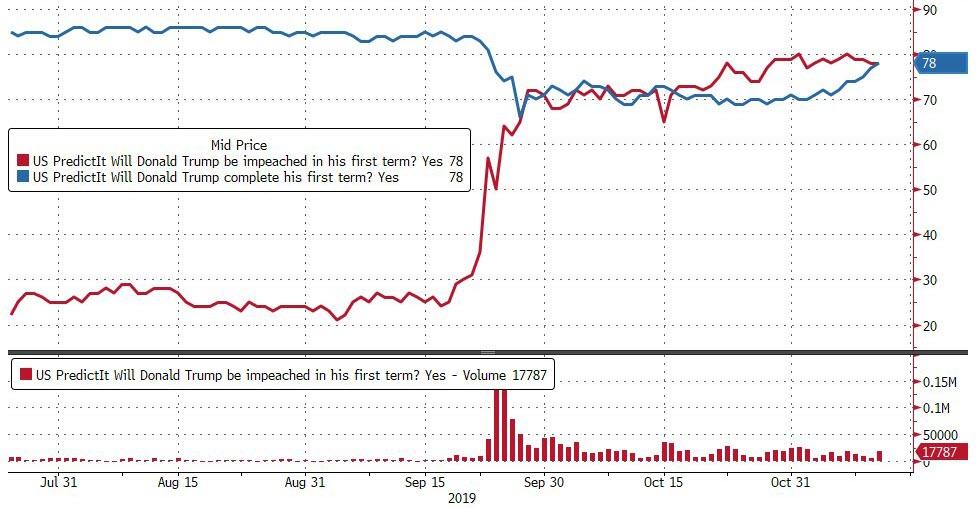

And while the odds are high that the House impeaches, they are just as high that the Senate won't and Trump will serve out his first term...

(Click on image to enlarge)

Source: Bloomberg

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more