The US China Phase 1 Deal Interpeted: Break Thing, Claim To Fix Thing, Repeat

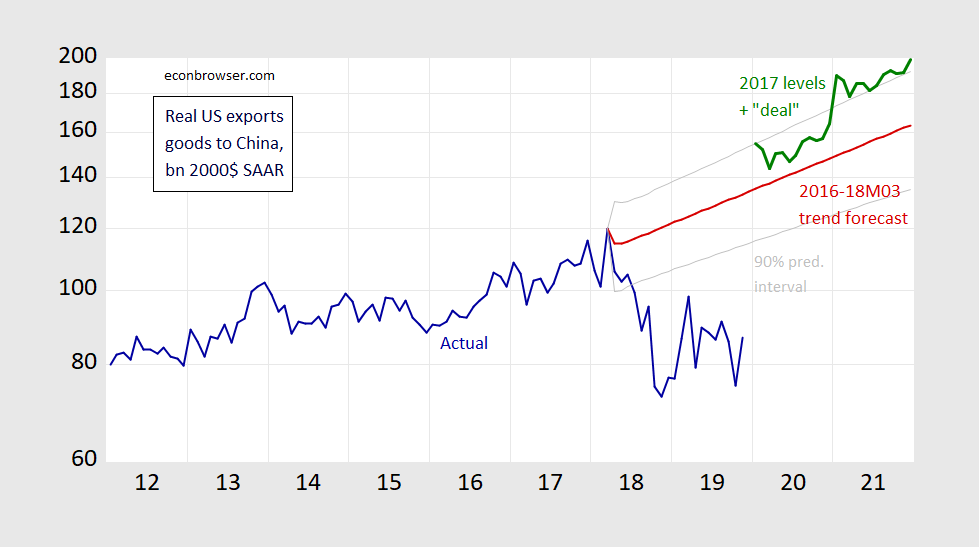

Through 2018M03, US exports to China were growing smartly. The Section 232 and Section 301 actions were announced. The “deal” essentially restores real exports to China to the pre-shock trend for 2020, above for 2021 (if you believe!).

If the commitments to the deal’s export provisions are upheld, then there is a quantitatively important impact, at least insofar as the US-China bilateral balance is concerned.

However, what if nothing had happened in the US-China trade war. Well, we might have gotten to where we are supposed to be with the deal…

(Click on image to enlarge)

Figure 1: US goods exports to China, log-transformed, seasonally adjusted using ARIMA X11, deflated by price index for all US commodity exports (blue), forecast based ARIMA(1,1,1) in logs 2016-18M03 (red), 90% prediction interval (gray lines), and implied deal levels based on 2017 baseline (green), using implied level of export prices for 2019M12 extrapolated from 2016M03-2018M06. All in bn 2000$, SAAR on log scale. Source: BEA/Census, BLS, and author’s calculations.

Disclosure: None.