The Pandemic And Zombie Companies

“Bankruptcies fell 40 percent last year in France and Britain, and were down 25 percent on average in the European Union. Without government intervention, including billions in state-backed loans and subsidized payrolls, European business failures would have almost doubled last year, according to a study by the National Bureau of Economic Research, a private American organization.” (NYT, Jan 25, 2021)

“In the 1980s, only 2 percent of publicly-traded companies in the U.S. were considered ‘zombies,’ a term used by the Bank for International Settlements (BIS) for companies that, over the previous three years, had not earned enough profit to make even the interest payments on their debt.… The zombie minority started to grow rapidly in the early 2000s, and by the eve of the pandemic, accounted for 19 percent of U.S.-listed companies. It’s happening in Europe, China, and Japan, too.” (Tom Friedman, NYT, Jan 26, 2021)

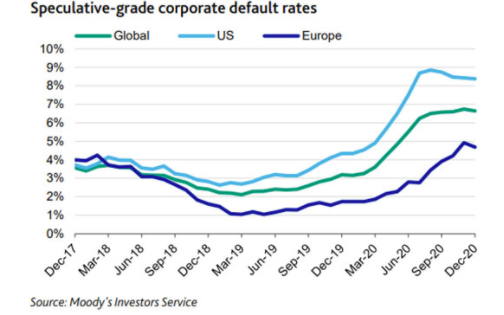

“Governments face the difficult task of balancing near-term risks of premature austerity with a medium-term need to curb debt expansion…. Defaults will continue to rise. Even though we expect very low funding costs through 2021, higher leverage and a large share of vulnerable corporates are likely to induce further defaults, resulting in the 12-month speculative-grade default rate rising to around 9% in the U.S. and 8% in Europe by September 2021, versus 6.3% and 4.3% in September 2020.” (David C. Tesher, Feb. 3, 2021)

As government's withdraw their stimulus measures, will there be a surge of business defaults? What would schumpeter think about a new wave of zombie companies?

There are differences of opinion among economists as to how they expect the pandemic recession to end. This writer is part of pessimistic camp that believes that there will be longer-term serious consequences resulting from the pandemic recession. My worry is grounded on the possibility of a very unsatisfactory outcome.

I will concentrate here on two aspects of the negative scenario.

One main concern is that because of the pandemic the labor market has changed so significantly in the advanced economies that we may be years away from ever returning to full employment.

My other main concern is that even when the pandemic is fully over, the recession will have left behind a new generation of zombie companies, which in turn could result in a surge in defaults which could have catastrophic effects.

Zombie companies are those at the financial margin. They need debt to operate, and with government pandemic assistance were able to earn just enough to survive and service their debt.

Indeed, my sense is that it will soon become evident that many companies will not be able to survive later this year or next year unless the government subsidies continue to prop them up. My concern in this regard is that the support for the firms from governments and central banks could suddenly vanish.

Then of course you have the million-dollar question. How do you deal with these zombie companies when the economy is clearly recovering, and government deficits are still extremely high?

In other words, COVID-19 could cause a wave of businesses to default over the next two years as government's withdraw their stimulus measures.

Should governments continue using deficit financing to support these companies, or do you let the creative destruction process have its way out of this mess.

The phrase creative destruction was first used in the early 1940s by economist Joseph Schumpeter to describe disruptive technologies at work.

He wrote about real-life examples of creative destruction, such as Henry Ford’s assembly line. In his words, “the structure of an economy is always changing from within, incessantly destroying the old structures and incessantly creating a new one.

" Consider that in the third quarter of 2020 the number of Chapter 11 bankruptcy filings in the US rose to its highest level since the 2009 financial crisis. Moreover, this trend is expected to continue into 2021 according to a financial data compiled by the US law firm Polsinelli. (NYT, Jan. 25, 2021)

In addition, as the following chart illustrates, “the number of corporate defaults globally totaled 209 in 2020, nearly double the count in 2019, with the oil and gas, business services and retail sectors accounting for the most defaults.” (Moody’s Investor Service, Jan. 12, 2020)

In closing, is creative destruction an acceptable rationale for abandoning businesses that may have been driven to financial ruin by the pandemic?

Making this policy decision even more perplexing is the fact that the pandemic recession has also triggered some clear winners due to asset bubbles, particularly in equity prices and in residential real estate.

(Click on image to enlarge)

It seems that a fair portion of the problem can be laid at the feet of the federal reserve bank and it's policies and actions. Certainly the very low interest rate on both savings and debt is a fair part of the reason that efficiency and cost-effectiveness have not been held as important. It does appear that all of the efforts on the part of the fed have been intended to protect the stock market and that 1% crowd, without much regard for anyone else. It certainly seems that this needs to change, and unfortunately Superman is AWOL at this time.

Unfortunately, I do not have a clear vision of the solution, or even the specific set of changes required.

What is clear is that greed has a high price, and that the payment is coming due, and that it will not be a happy time for quite a while. My hope is that the changes can be made without a lot of violence and destruction. That mob event at the capital was not the way to do it.