The 'Greening' Of Bitcoin: Will China's Forced Mining Exodus Crush Anti-ESG Case?

China's crackdown on crypto may have a silver lining after all.

While Beijing's bitcoin battering efforts - for myriad reasons including a lack of centralized control (translation: use our CBDC or else), a pathway for capital outflows (translation: use our CBDC or else), and the latest somewhat humorous "crypto does not meet China's carbon goals" - have, along with Elon's tweets, tamped down enthusiasm for the cryptocurrency; the perhaps unintended consequence of the actions of Musk (reversing his advocate position by highlighting the anti-ESG case) and China's regulatory crackdown (again) will be the 'greening' of crypto and inevitably enabling more progressive asset allocators to move reserves its way.

"In recent days, crypto-currency trading has been too hot in China which attracted many individual investors. It's necessary that the government rolls out warnings in case any large risks materialize," Cao Yin, managing director of Digital Renaissance Foundation and a bitcoin investor, said.

And it could be happening sooner than expected as China's Global Times (broadly considered Beijing's mouthpiece) reports that China's recent ban on bitcoin-related activity will reshape the landscape of the global mining industry and force more Chinese miners to migrate overseas, such as to the US.

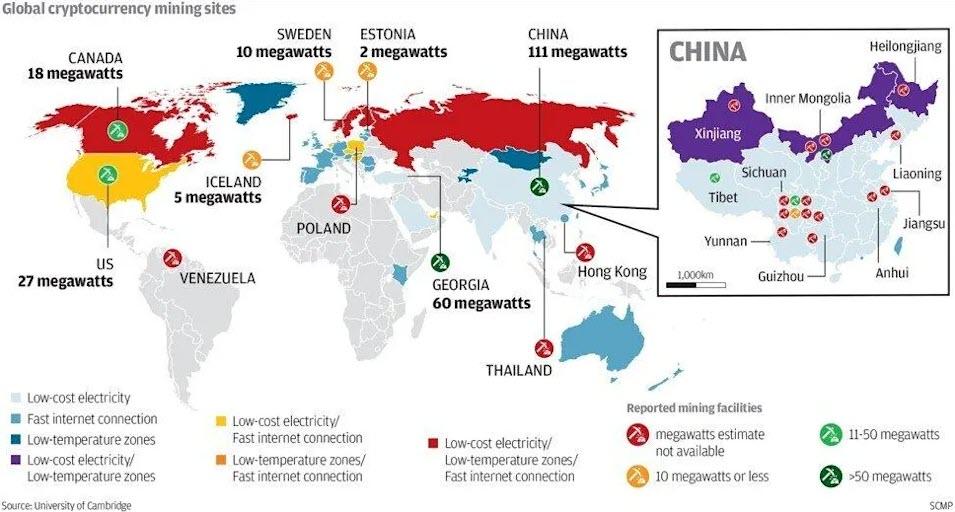

"Chinese miners account for over half of the global crypto network's processing power, and this will also weigh on the development of the global mining industry in the long run," the insider said.

Some bitcoin mines use thermal power sources that can't pass the government's environmental impact assessments, and thus run counter to the country's carbon-neutrality goals, Cao said.

But, as Global Times writes, according to Cao, some bitcoin mines in China are now ready to purchase carbon emissions quotas. The exodus started in 2017 but is now speeding up, as mines look for regions with cheaper electricity rates and more friendly policies.

"It's possible that bitcoin mines may eventually move out of China, but production and exports of bitcoin mining machines won't stop in China because of market demands," Cao said.

The rotation from relatively power-hungry Proof-of-Work currencies to less power-intensive Proof-of-Stake currencies remains but has lost some of its sheen recently...

(Click on image to enlarge)

Circling back to where we started, China could be about to become bitcoin bulls' best friend...

China is the bitcoin bears biggest friend: as long as bitcoin can be mined in China it is "dirty"

— zerohedge (@zerohedge) May 21, 2021

Once China bans bitcoin mining there, the anti-ESG case collapse

Of course, this all comes a day after Elon Musk and Michael Saylor "spoke with North American Bitcoin miners. They committed to publish current & planned renewable usage & to ask miners WW to do so. Potentially promising."

It wasn't immediately clear if any Chinese bitcoin miners are part of this organization - they should be, after all the dirtiest bitcoin mining takes place in China's infamous Xinjiang region - but it's a start, and if indeed we are about to see mining standardization, one which pushes more output to the US and other "clean" regions, this could be just the catalyst that eliminates the biggest ESG complaint against cryptos.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more