The GDP Collapse: It Is What It Is

Jim discussed elements of the 2020Q2 advance release on Thursday. Here, I amplify some aspects that he mentioned.

Confirmation: A Catastrophe in the Making

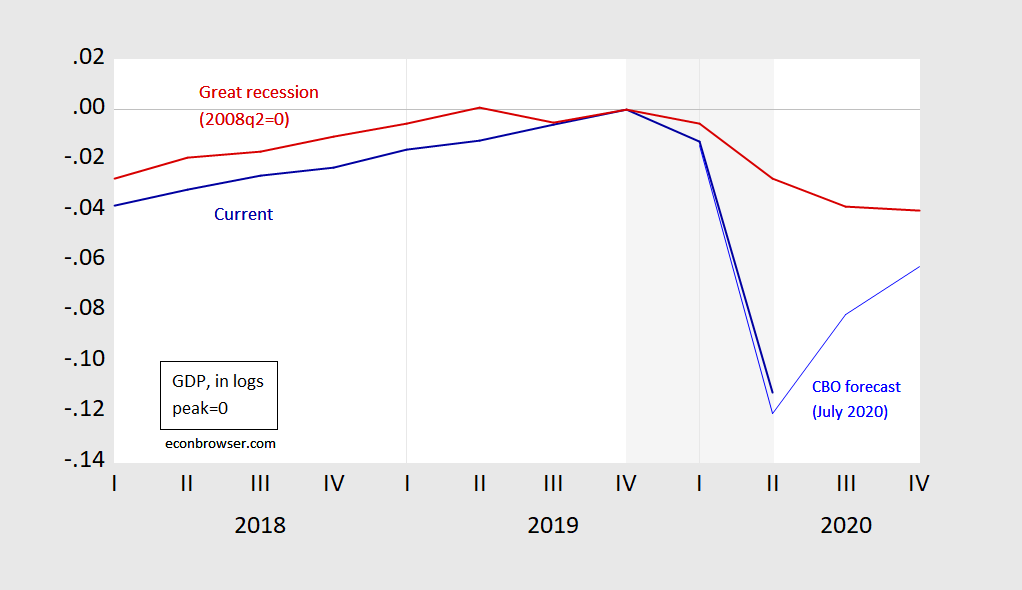

First, the Trump recession is truly catastrophic in scale; the pace of GDP decline is much greater than that in 2008. This is shown in Figure 1.

Figure 1: GDP in logs, normalized to 0 at 2019Q4 (NBER peak) (blue), and GDP normalized to 2008Q2 (red). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

A “No Confidence” Vote in Administration Policy and Investment

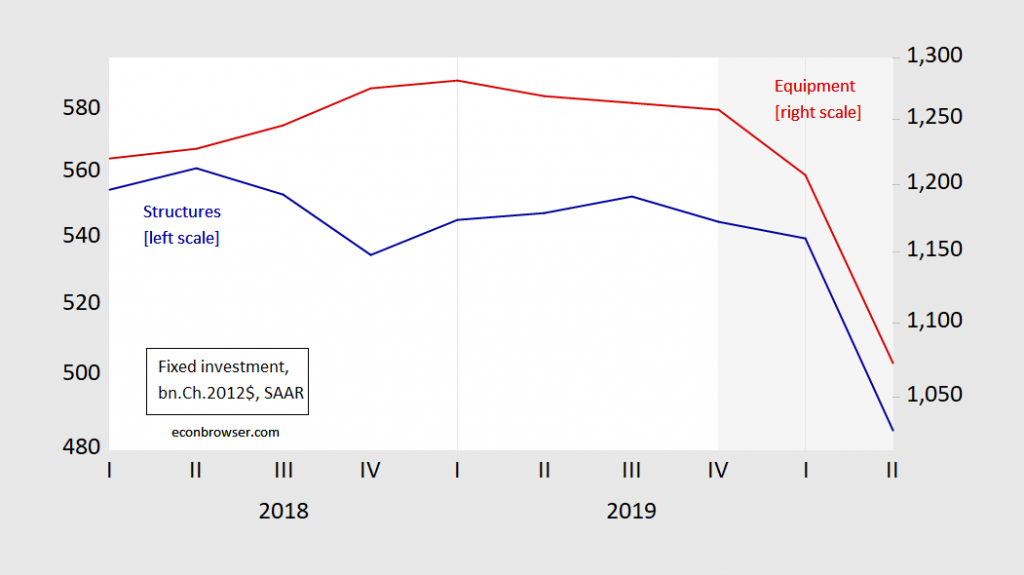

Second, investment has crashed — for both structures and equipment investment. That significant insofar as capital investment is forward-looking.

Figure 2: Fixed investment in structures (blue, left log scale), and in equipment (red, right log scale), in billions Chained 2012$, SAAR.NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

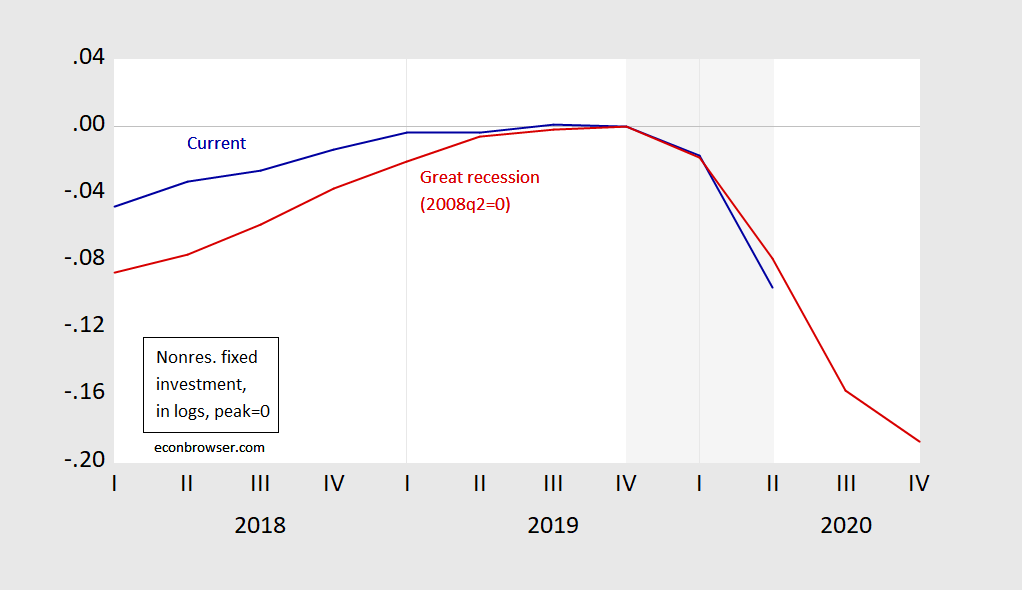

This decline is even more rapid than in 2008Q4; 31.5% now vs. 24% then.

Figure 3: Nonresidential fixed investment in logs, normalized to 0 in 2019Q4 (blue), and normalized to 0 in 2008Q2 (red).NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

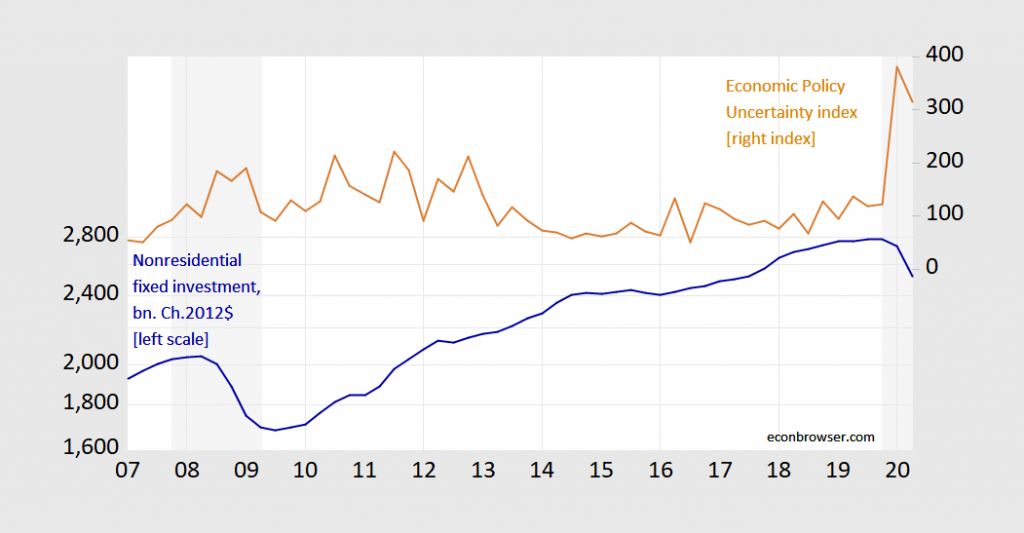

Certainly, some of the crash is due to the crash in aggregate demand — as in the 2007 recession — but some is due to uncertainty, including policy uncertainty. Policy uncertainty levels currently dwarf those of the Great Recession.

Figure 4: Nonresidential fixed investment in billions Chained 2012$ SAAR (blue, left log scale), Economic Policy Uncertainty index (tan, right scale).NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, policyuncertainty.com via FRED, and author’s calculations.

No Recovery Without Recovery in Services Demand

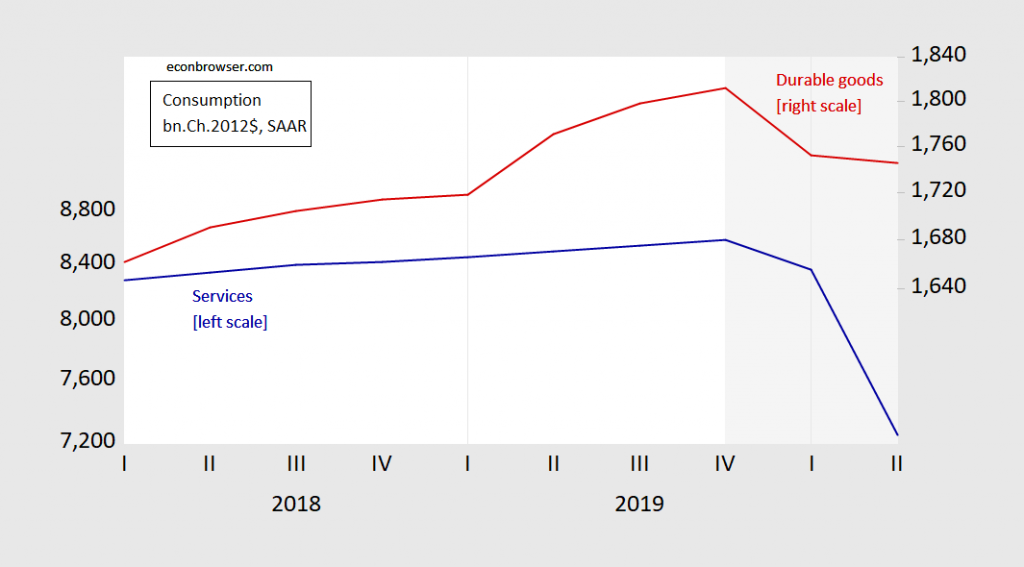

Third, this is a different kind of recession, in many ways, but importantly in the sectoral origin. As Jim Hamilton noted, the decline in services consumption was 43.5% on an annualized basis, while durable goods consumption was relatively flat.

Figure 5: Services consumption (blue, left log scale), and durable goods consumption (red, right log scale), all in billions Chained 2012$ SAAR. NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, and author’s calculations.

Of the 9.8 percentage point decline in GDP (not annualized), 5.9 percentage points were accounted for (in a mechanical sense) by services consumption decline. Jim provides a breakdown of the services consumption decline in his post.

Services consumption will not fully recover until such time as the Covid-19 infection rates are at manageable levels that do not deter such consumption activities. The Administration’s current policy stance is unlikely to encourage that development; one could argue that it — in toto — is impeding that outcome.

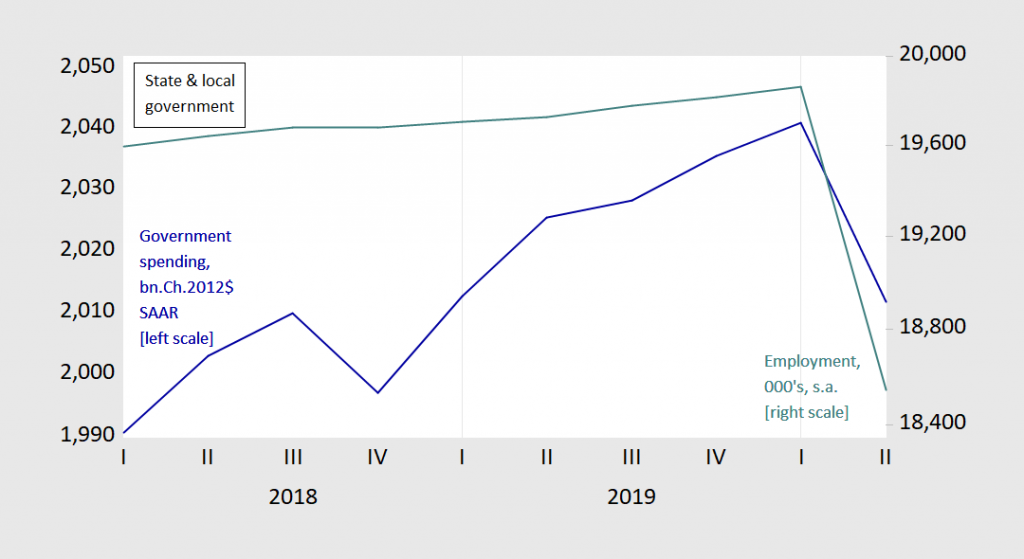

State and Local Government Spending Collapses

Fourth, the biggest threat to the economy may be avoidable. One of the lessons of the Great Recession is that constraints on state and local government spending — exacerbated by ill-advised state income tax cuts — was one of the reasons for the torpid pace of recovery. So far, we have not replicated completely that experience, but with Republican opposition to further Federal transfers to the state, we are in danger of repeating that error.

Figure 6: State and local government spending, billions Chained 2012$ SAAR (blue, left log scale), and state and local employment, 000’s, s.a. (teal, right log scale). Source: BEA 2020Q2 advance release, BLS employment situation June release.

This is why it is critical, as many economists have argued, for the next recovery package to include substantial aid to the states and localities.

Disclosure: None.