The Fed Is Absolutely Right

We had three consecutive months of negative CPI readings at this time last year.

Producer prices had fallen for three months in a row.

Commodity prices were falling by more than 20% across the board.

Fast forward to now, and we have a situation where, thanks to the reopening of the market, vaccines, and all of the fiscal juice in the system, demand has surged and so has headline inflation.

The recent acceleration in inflation seen in April will be temporary though.

What's going on isn't a structural "regime shift", but rather a "pendulum" swinging back from a sudden deflationary demand shock caused by the pandemic.

To claim the vaccines and the re-openings are going to build the conditions for an increase in demand is borderline deceptive.

All of this will be shown in the data in September and October when the supply side will catch up to the demand side.

Neither inflation nor an early Fed taper are the main risks to the stock market and other risk assets. In reality, expect a post-stimulus growth shock in Q4 could lead to widespread re-pricing.

By late summer (or early fall), expect the inflation we're seeing today to reverse.

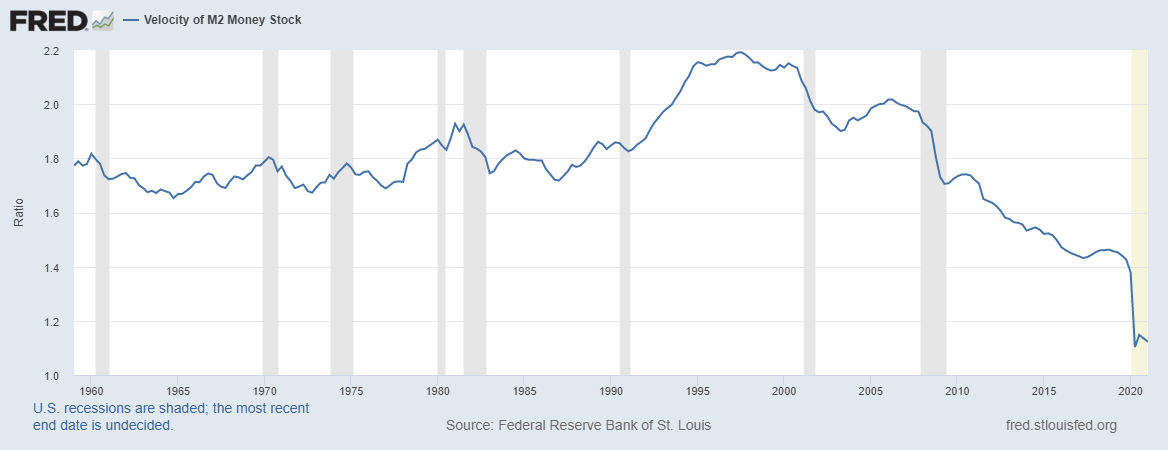

AND you can't forecast inflation just by looking at the money supply.

You still need to look at money velocity, which has been declining for decades.

Remember, productivity adjusted wages, not nominal wages alone, are what causes inflation.

(Click on image to enlarge)

Disclosure: The information provided here is for educational purposes only and should not be construed as a solicitation of an offer to buy or sell securities.

A direct investment in an index is ...

more