Stocks Suffer 'Shocking' Down Week As Fed Balance Sheet Unexpectedly Shrinks

In case you wondered why stocks fell this week - after six straight weeks higher in the face of disappointing economic data - it's simple... The Fed balance sheet unexpectedly contracted for the first time in weeks.

(Click on image to enlarge)

Source: Bloomberg

It's been a mad week...

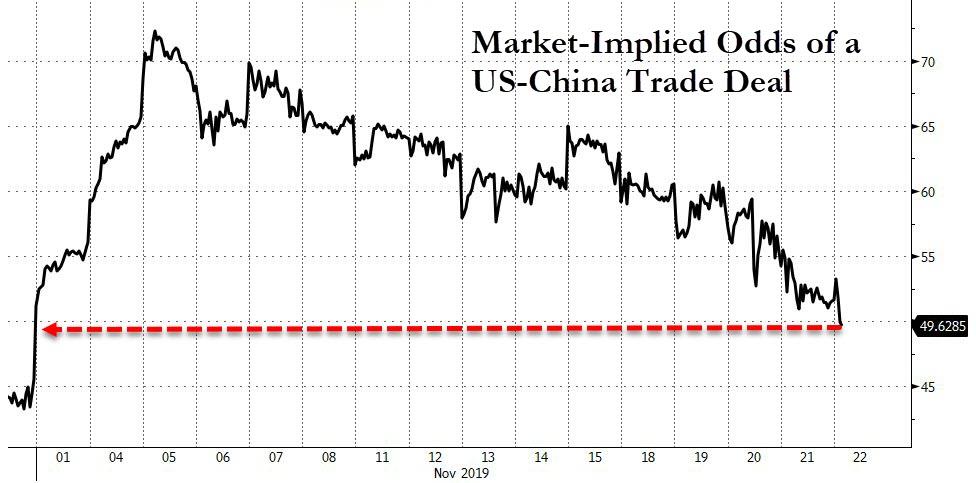

The market-implied odds of a US-China trade deal slipped back below 50% today...

(Click on image to enlarge)

Source: Bloomberg

Chinese markets were mixed with ChiNext and Shenzhen managing to cling to gains but the rest in the red as trade-deal hope faded...

(Click on image to enlarge)

Source: Bloomberg

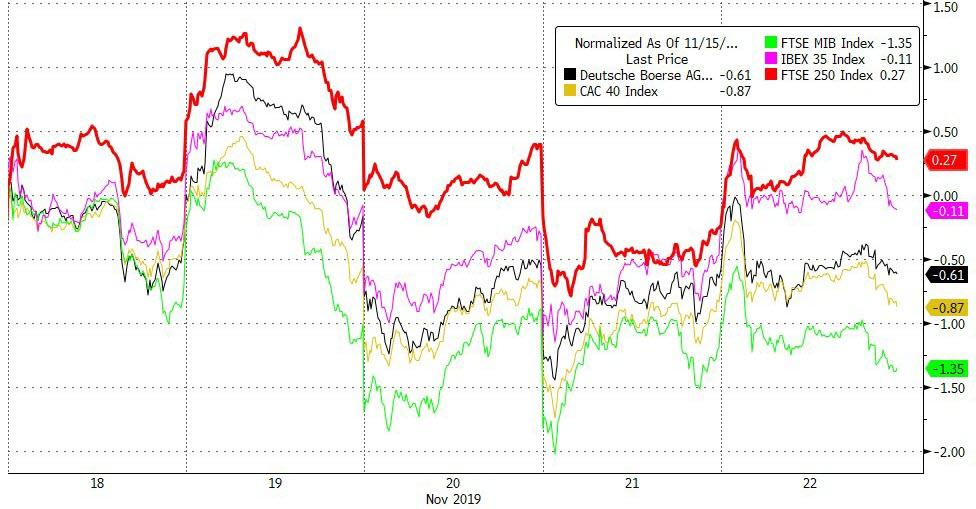

As election uncertainty fades (Johnson looks like winning by a landslide), UK's FTSE was the only major EU stock market green this week...

(Click on image to enlarge)

Source: Bloomberg

After six straight weeks higher (7 for Nasdaq), US equity markets stunningly closed red for the week... DO NOT PANIC!

Trannies were the week's laggards with the rest of the US majors all down around 0.4% on the week...

(Click on image to enlarge)

Stocks were shockingly red this week despite an epic short-squeeze today...

(Click on image to enlarge)

Source: Bloomberg

As Nomura's Charlie McElligott warned (and nailed perfectly), gamma around S&P 3,100 was all that mattered this week for price action...

(Click on image to enlarge)

Credit continues to decouple from stocks since the start of November...

(Click on image to enlarge)

Source: Bloomberg

A mixed picture this week with the short-end of the curve higher in yield and long-end lower...

(Click on image to enlarge)

Source: Bloomberg

30Y Yields have collapsed in the last two weeks, back down to key support once again...

(Click on image to enlarge)

Source: Bloomberg

Additionally, the 'breakout' of the year's downtrend channel in 10Y has failed to spark more selling (and it is hovering at the intersection of critical technical levels)...

(Click on image to enlarge)

Source: Bloomberg

The Treasury curve (3m10Y) has flattened a dramatic 20bps in the last two weeks (after 5 straight weeks of steepening), the biggest such flattening since May...

(Click on image to enlarge)

Source: Bloomberg

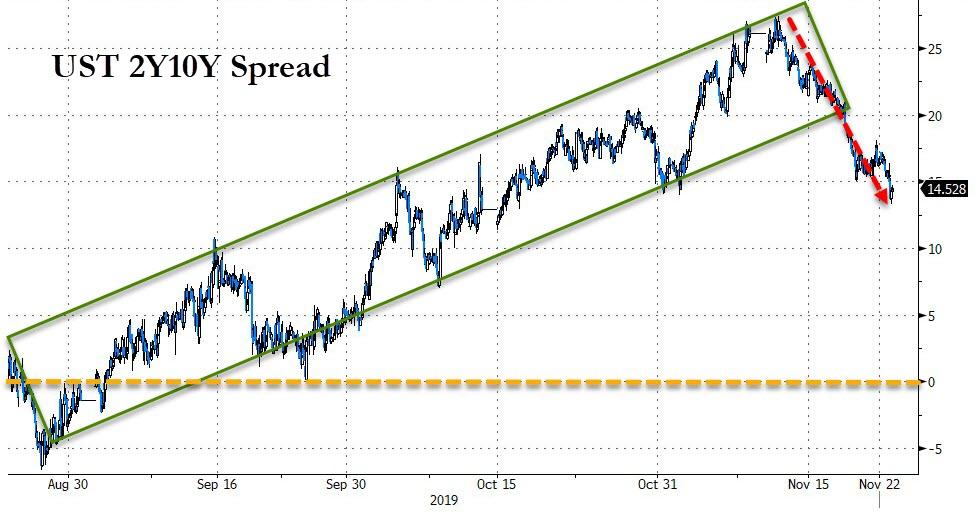

And the 2s10s curve has broken down from its uptrend channel...

(Click on image to enlarge)

Source: Bloomberg

As BMO's rates-desk notes:

If the 2s/10s curve is unable to steepen above the YTD high of 30.8 bp or reinvert below the -6.6 bp low, this 37.4 bp zone will be the tightest annual rage in history. A fact all the more remarkable given that 10s themselves have traded in a 137 bp range. At a high level this indicates that a shift in the structural level of interest rates has been the dominating theme in 2019. Lower for longer reflecting middling growth prospects and concerns about monetary policy effectiveness are powerful influences in the background; the past 24 hours have been a decent case in point.

And Treasury 'VIX' is testing back to its lowest since May...

(Click on image to enlarge)

Source: Bloomberg

The dollar lurched higher today, pushing for recent highs...

(Click on image to enlarge)

Source: Bloomberg

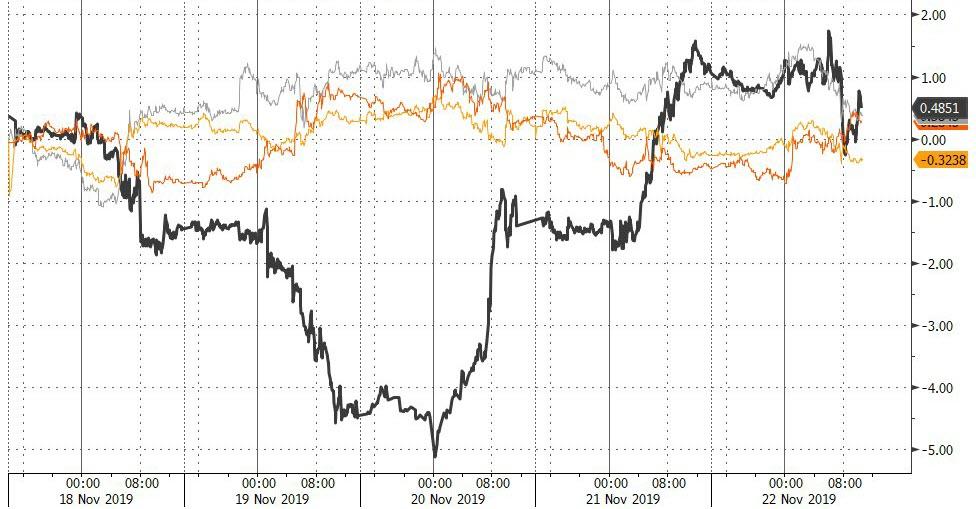

As the dollar rallied, offshore yuan faded this week...

(Click on image to enlarge)

Source: Bloomberg

Crypto carnage after China cracks down on local exchanges...

(Click on image to enlarge)

Source: Bloomberg

Bloodbath in Bitcoin this week...

(Click on image to enlarge)

Source: Bloomberg

Despite a rally in the dollar this week, commodities ended modestly positive (apart from gold's small drop)...

(Click on image to enlarge)

Source: Bloomberg

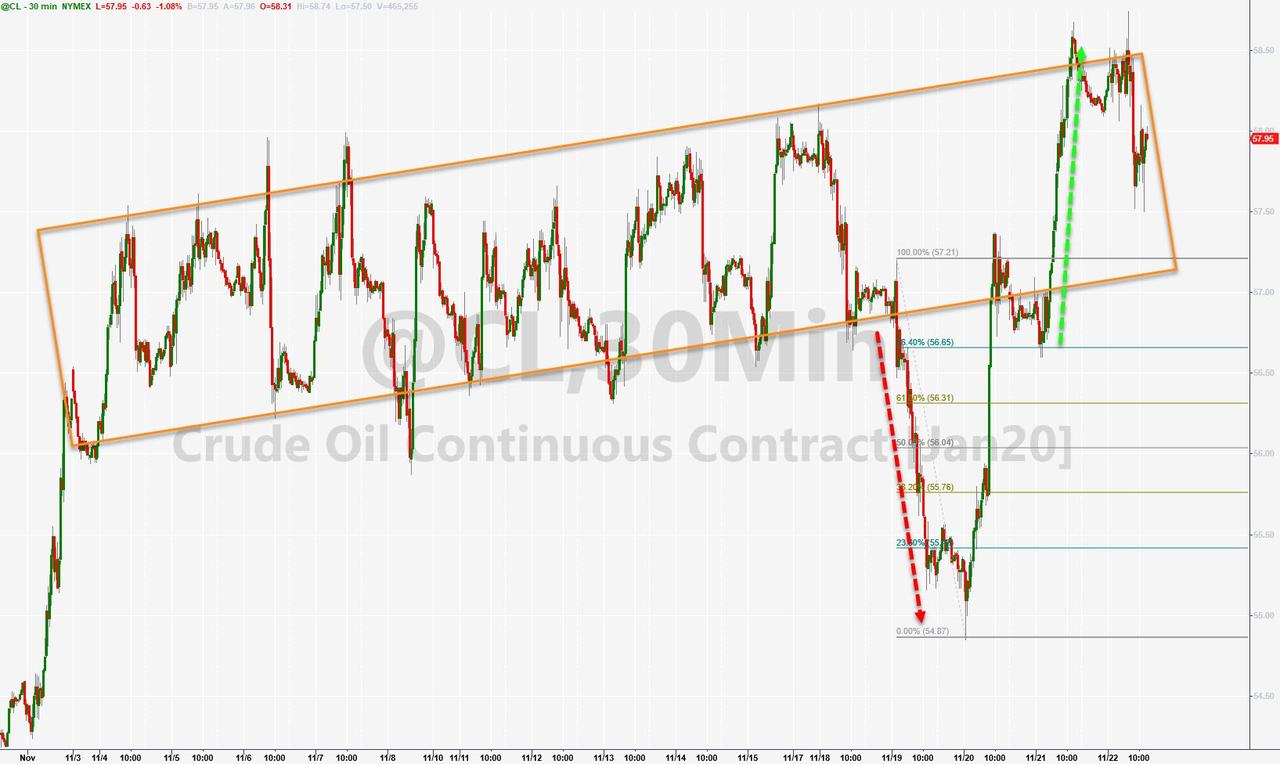

WTI has traded in an upward channel for a while with chaotic trading this week to get back to $58 by the close...

(Click on image to enlarge)

And finally, it's not the fun-durr-mentals...

(Click on image to enlarge)

Source: Bloomberg

...it's Fed liquidity, Stupid!

(Click on image to enlarge)

Source: Bloomberg

And don't forget, it has never cost more (1175 hours of 'average' work) to buy the stock market than it currently does...

(Click on image to enlarge)

Source: Bloomberg

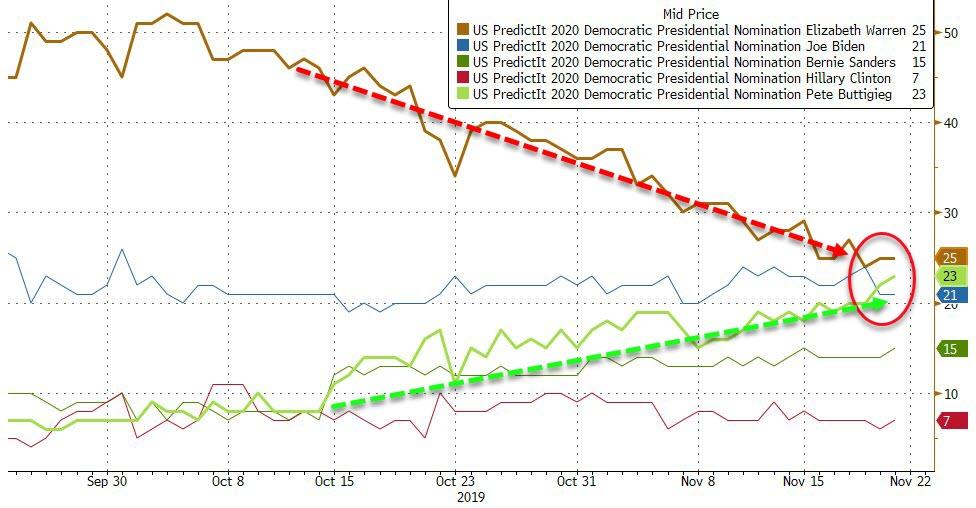

Oh, and Mayor Pete is now beating Biden...

(Click on image to enlarge)

Source: Bloomberg

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more