Stocks Ignore Terrible Jobless Claims Report

Terrible Jobless Claims Report

After seeing the jobless claims reading, it was shocking that the stock market didn’t decline significantly on Thursday. It barely moved as it didn’t react to the big miss. An analyst claimed stocks didn’t fall because the prior day’s retails report was great. That’s not how it’s supposed to work. Only new data and expectations about the future should impact stocks.

Either way, the prior week’s report was revised from 1.542 million claims to 1.566 million. This report (the week of June 13th) had a very slight decline to 1.508 million which completely missed estimates for 1.22 million. This is a huge negative as it signals the labor market almost stopped improving.

Specifically, this was the 11th straight decline in claims, but it was the smallest as claims only fell 3.7% from the prior week. At this rate, it would take months to even get below 1 million, let alone below the previous record high. This report puts a dent in the V-shaped recovery thesis.

(Click on image to enlarge)

This report is the week of the June BLS reading which means the weakness was very bad timing. It seems like the market is pricing in a quick turnaround. It loved the May BLS reading. If the June reading shows less jobs were created, it would likely be bad for stocks.

On the one hand, workers are being incentivized to stay unemployed. On the other hand, COVID-19 is coming back with a vengeance in a few states such as Arizona, Florida, California, and Texas. South and the west are the problematic regions.

With this many people unemployed, there needs to be an increase in benefits following the end of the $600 program at the end of July. That’s only in 6 weeks and we still have over double the claims of the previous record high. In order to end this benefit, leaders need to be extremely confident that most of these people are choosing to not work. That doesn't appear to be happening.

Leaders need to act because the areas seeing COVID-19 trouble will still see it this summer. Furthermore, there were 761,000 pandemic unemployment claims which was a 66,000 increase from the prior week. Total was 2.2 million if you include these claims.

Jeoff Hall, the managing Economist for Refinitiv, stated he has lost confidence that initial claims will be below 1 million by the week of July 4th. Pace of declines has slowed. We don’t want to see a stalling of improvement in the economy because the economy isn’t close to fully recovered. Data went from depressionary to recessionary. Even though the economy might not technically be in a recession now, this recovery is worse than most recessions.

This was an overall terrible report when you look at initial claims, their revision, the pandemic claims, and the continued claims reading. Continued claims fell 0.3% as they were only down 62,000 to 20.544 million. If you’re basing your prediction of job creation on continued claims, it’s likely the June report will be weak. Technically, the survey week for continued claims is next week, but the past 3 readings have all been bad.

Since the survey week of the last report, claims are only down 297,000. If you look at the May survey week, it was up from April, but down significantly from the week before which may have played a role in the data. That's not to say that this June labor report will definitely be bad because the data is so hard to predict. The economy is changing quickly and the data is less reliable than usual because the percentage filling out the surveys is falling.

This report certainly strikes a blow to the record economic surprise index. It's hard to grasp why stocks ignored this. It seems like stocks go up no matter what comes out, whether it’s bad economic news or geopolitical news. On continued claims, Jeoff Hall said we’d be lucky to see continued claims fall below 10 million before the end of Q3.

More weak data will eventually spook the market which is locked in that the economy will go back to normal within a few months. One of the only parts of the economy that’s back to normal is housing.

No Fiscal Stimulus Would Be A Disaster

The stock market is assuming the government will pass another fiscal stimulus. One should come because this is an election year. If nothing is passed and the economy gets worse, it would be a disaster heading into November. President Trump has ads showing how effective the stimulus was. You would think more support would be coming.

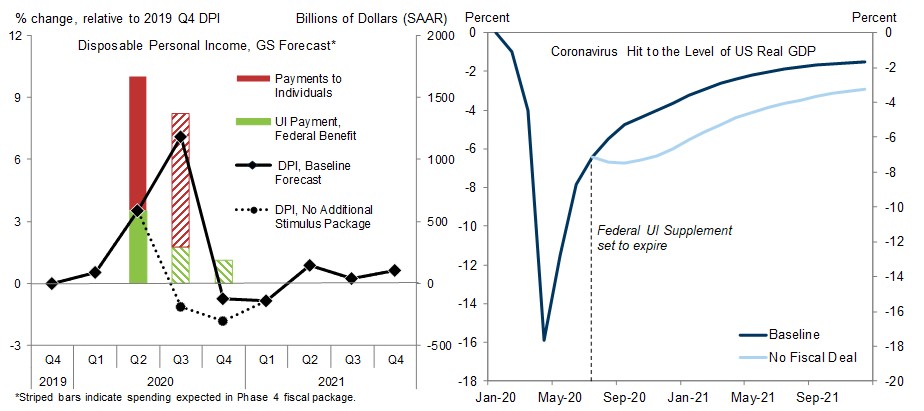

The chart on the left shows 2 scenarios. The solid line is the one with help from the government. As you can see, in Q2 income growth was much lower than the total help because of how many people lost their jobs. In Q3, the line is almost at the top of the bar because it expects income losses to be less severe as people get their jobs back.

Therefore, even with less direct payments and unemployment benefits, income growth spikes. That’s a little too optimistic. On the other hand, without help income growth goes negative. Goldman anticipates negative income growth in Q4 in both scenarios. At a certain point the consumer won’t be supported by the government, but the longer that’s delayed, the quicker the economy can rebound.

(Click on image to enlarge)

In theory, if there is no 2nd wave and the government passes a stimulus, the recovery won’t reverse. That’s what the stock market expects. Because the market has already priced in the best case scenario, it’s easy to be cautious even if you’re not negative on the economy. The chart on the right shows my point as the economy recovers most of its losses by early 2021 with help from the government. Without help, the economy experiences a setback which it doesn’t get back even by the end of next year.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more