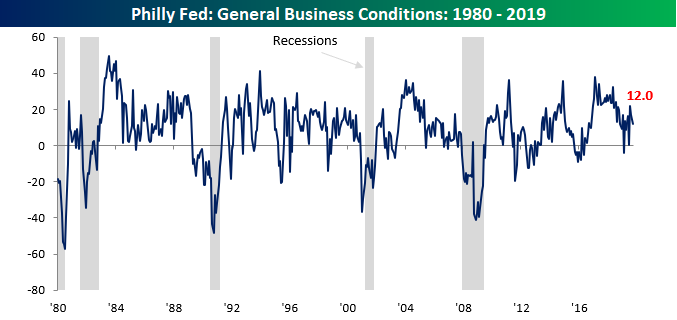

Smaller Than Expected Drop In Philly Fed

Economists were expecting overall sentiment in the September Philadelphia Manufacturing report to decline this month, but the actual drop wasn’t as large as expected. At a level of 12.0, the General Business Conditions index dropped from 16.8 but was better than consensus expectations of 10.5. At current levels, the overall reading of the Philly Fed is pretty much right in the middle of its range from the past few years. Not too hot and not too cold!

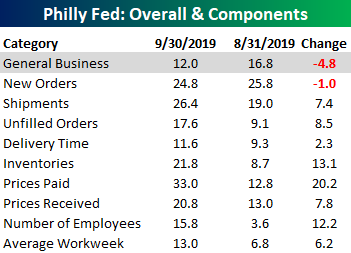

While the headline index of the report showed a modest loss, underneath the surface it was a pretty strong report. The table below shows the m/m change in each of the report’s subcomponents. While the headline index declined 4.8 points, the only other component that was lower on a m/m basis was New Orders as the remaining eight all improved relative to August. The last time we saw such strong breadth was back in March 2016 coming out of the oil-induced slow down, and the only month where breadth in the report was stronger was back in August 2009.

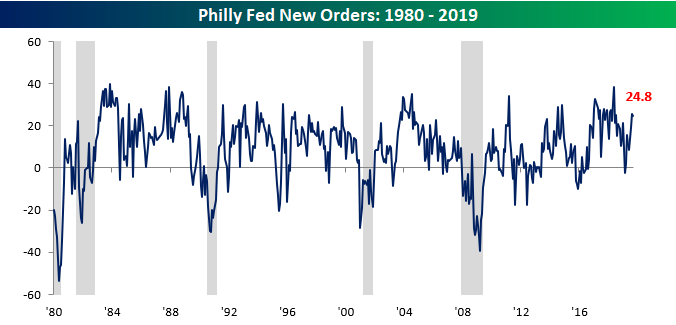

While New Orders was the only sub-component of the Philly Fed report that declined this month, the losses were modest, and the actual level of 24.8 is still relatively strong compared to other readings in the last two years.

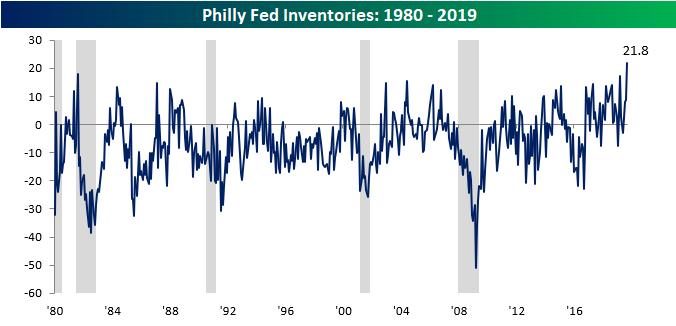

Finally, one component which was very strong this month was Inventories. September’s reading of 21.8 was the highest in the history of the survey (dating back to 1980).

Disclaimer: Read our full disclaimer here.