Rollercoaster Week Ends With Buying Panic As World Sinks Into Recession

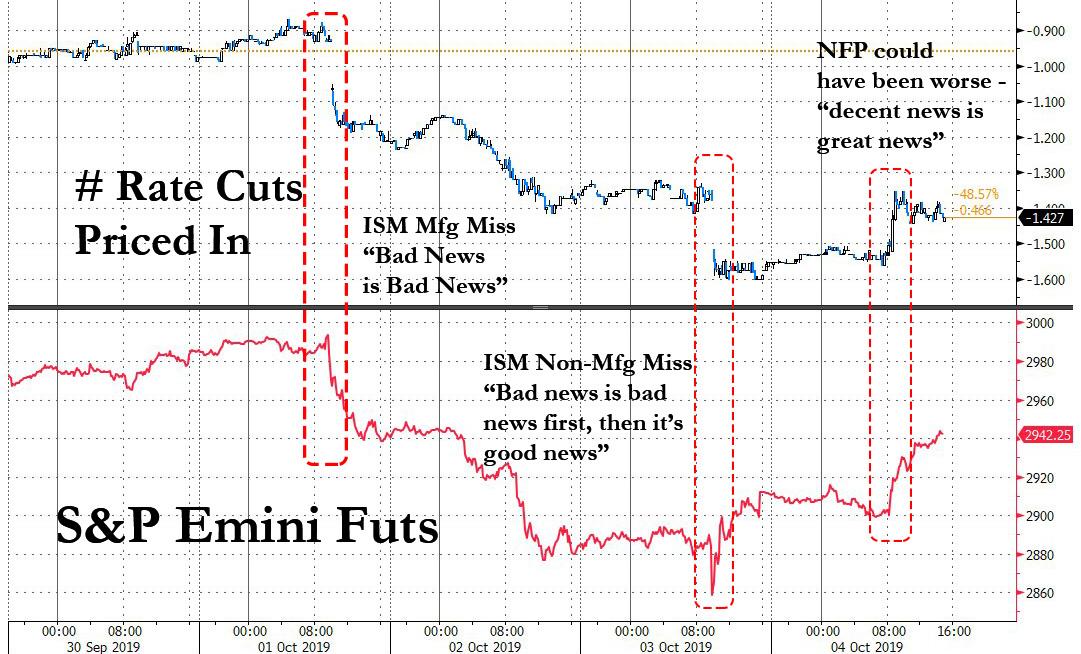

It has been a remarkable, rollercoaster week for the market, which first plunged after a dismal manufacturing ISM print, the lowest in a decade, as stocks shocked traders by responding correctly for once to shitty economic data...

Stocks inexplicably respond to economic data; traders everywhere stunned pic.twitter.com/kxpau1Sv96

— zerohedge (@zerohedge) October 1, 2019

... then briefly plunged some more after the non-manufacturing ISM also badly missed expectations on Thursday, only to reverse the drop just as violently as liquidity junkies observed the jump in October rate cut odds, reassuring traders that the Fed "got their back" again, and pushing the S&P sharply higher as "bad news was great news". The week then culminated with today's disappointing payrolls report, which however could have been even worse, and as rate cut odds dropped modestly, stocks surged as "decent news was great news."

In other words, we went from "bad news is bad news" to "bad news is first bad news... then great news" to "decent news is great news." In the end, after starting the week off around 2,970, then plunging as low as 2,860, the S&P is almost back to unchanged and set to close the week just barely changed at 2,950.

(Click on image to enlarge)

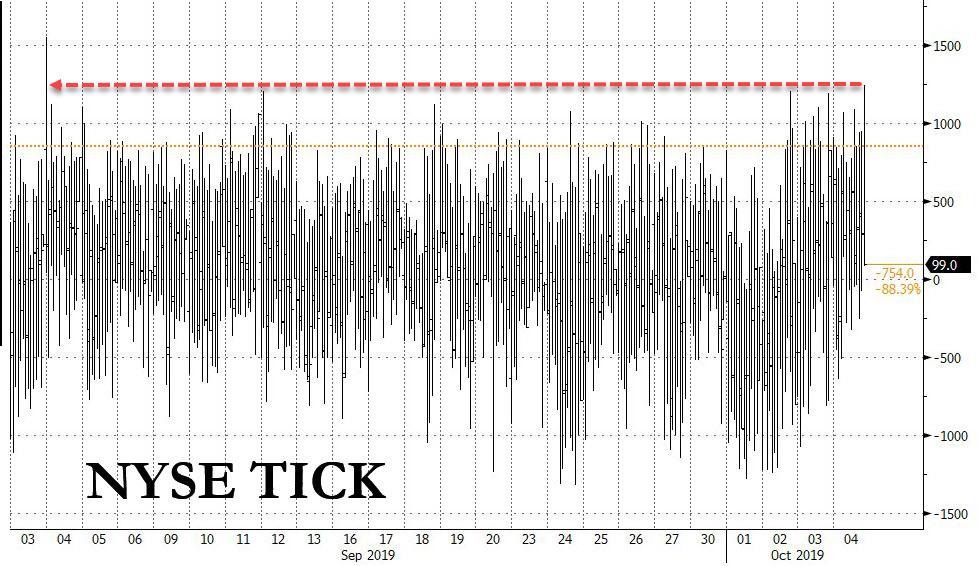

While stocks levitated all day, the buying frenzy was only truly unleashed in the last hour of trading, when stocks exploded higher, pushing what until 3:30 pm had been a "MOC for sale" imbalance to a $1.5BN MOC to buy at the close of trading, and triggering the biggest buying program since Sept 4, as the NYSE TICK printed at 1245.

(Click on image to enlarge)

Today's low-volume equity euphoria was so powerful it pushed every single sector in the green, led by the financials, tech, and homebuilders.

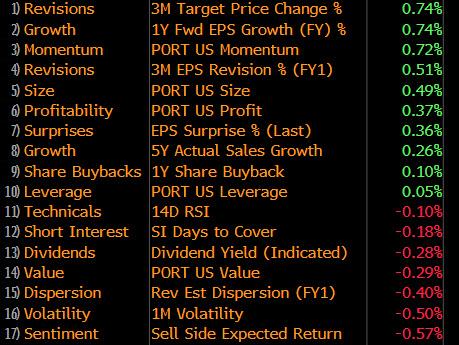

(Click on image to enlarge)

Looking below the surface showed that we regressed to a familiar regime, one where momentum and growth stocks led the move higher, while value tumbled as the market once again fell in love with "growth leaders" suggesting that the surge in the market was driven by expectations of global economic slowdown and even more central bank intervention.

(Click on image to enlarge)

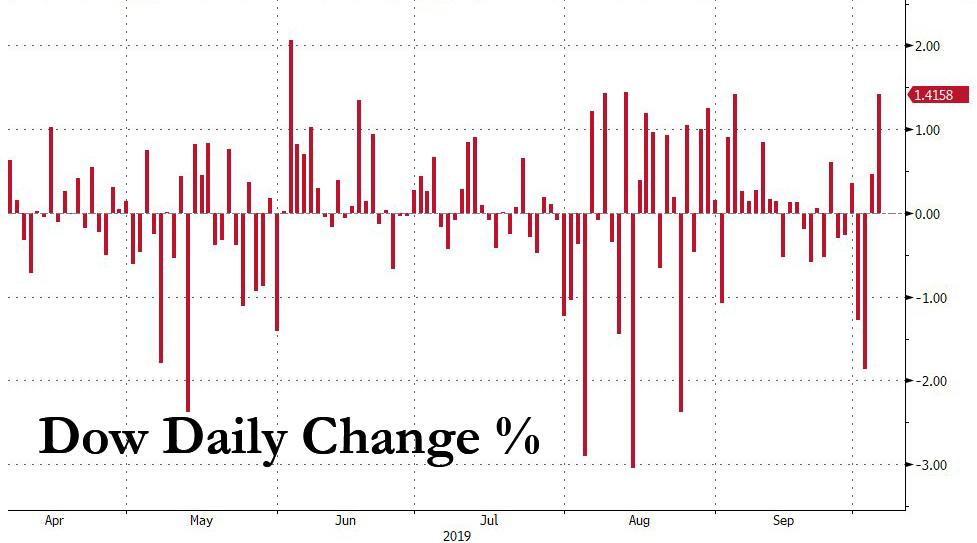

Whatever the cause, the scare of the early half of the week, which had sent the market on pace for its worst week of the year, disappeared with the Dow staging a remarkable, 828 point rally from the Thursday lows, and the Friday ramp was the strongest since mid-August.

(Click on image to enlarge)

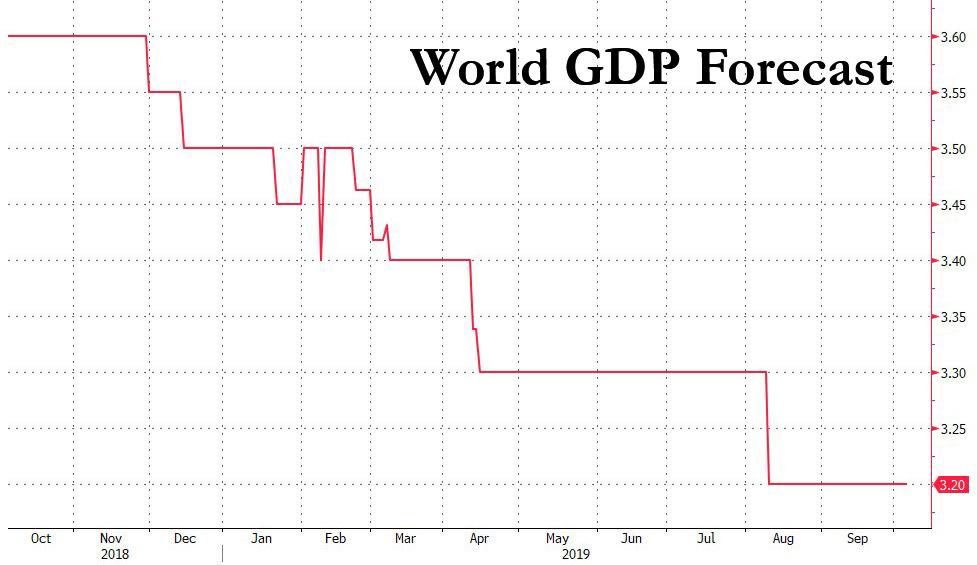

As all this is happening, the world continues to slide faster toward a recession...

(Click on image to enlarge)

... now that China's credit creation machinery appears to be completely broken, and Beijing's attempts to rekindle China's massive credit impulse get ever weaker.

(Click on image to enlarge)

Yet as equities surged, bond yields tumbled, and despite rebounding slightly after today's NFP report, the 10Y yield sank all day, closing near session lows.

(Click on image to enlarge)

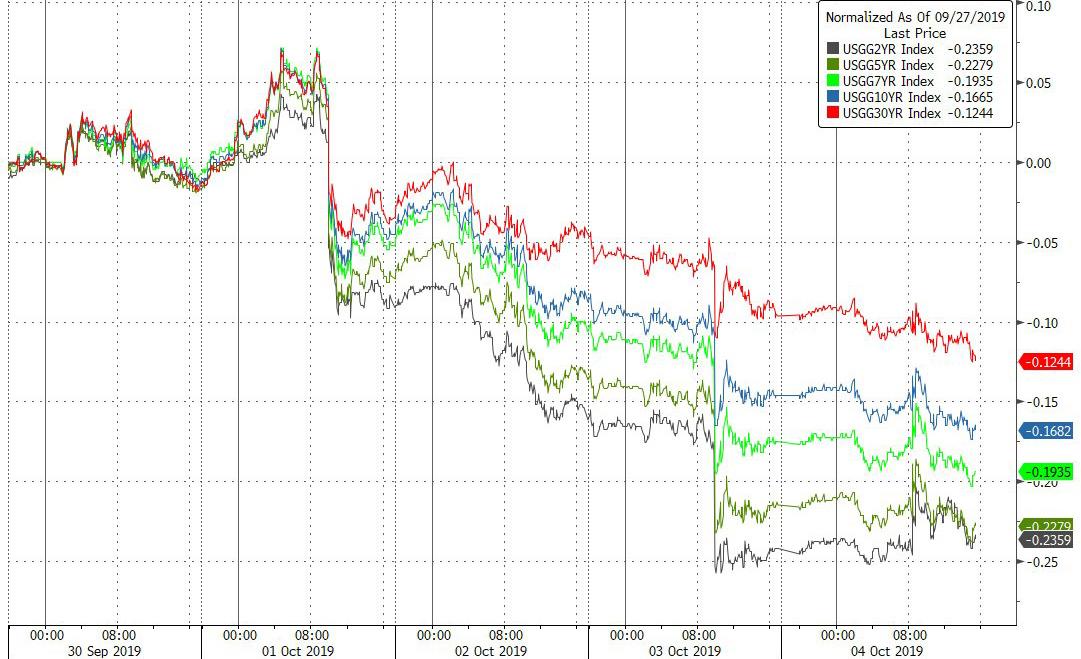

It wasn't just the 10Y yield sliding: the entire curve gravitated lower...

(Click on image to enlarge)

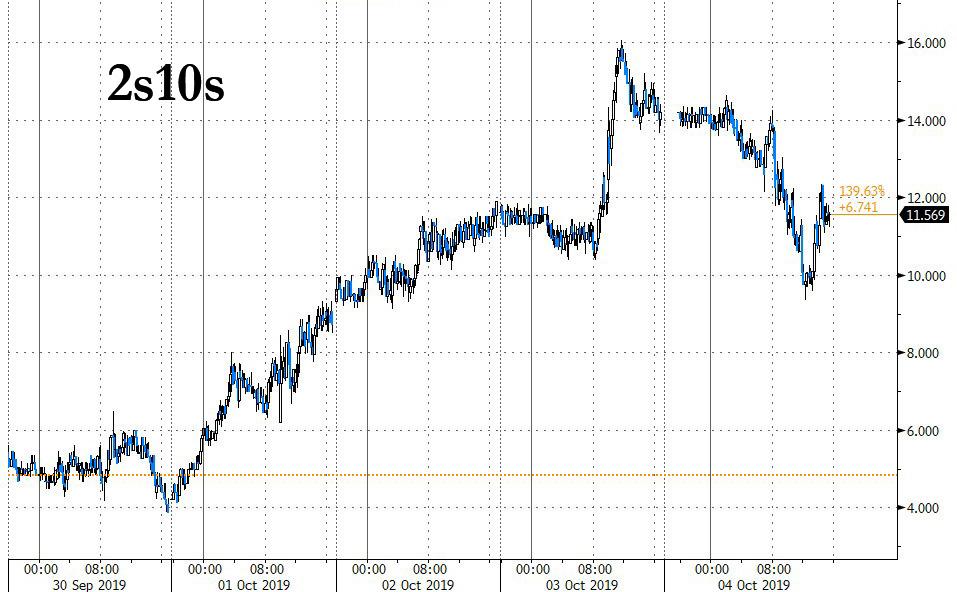

... and since the short-end got hammered the most, the yield curve steepened substantially, with the 2s10s blowing out from 5bps to start the week, to a high of 16bps on Thursday as 2Y yields tumbled, only to fad some of the move higher on Friday.

(Click on image to enlarge)

There was also a sharp reversal in the Bloomberg dollar index, which after hitting multi-year highs just before Tuesday's Mfg ISM, tumbled as currency traders priced in more rate cuts by the Fed. It closed the week at the lows.

(Click on image to enlarge)

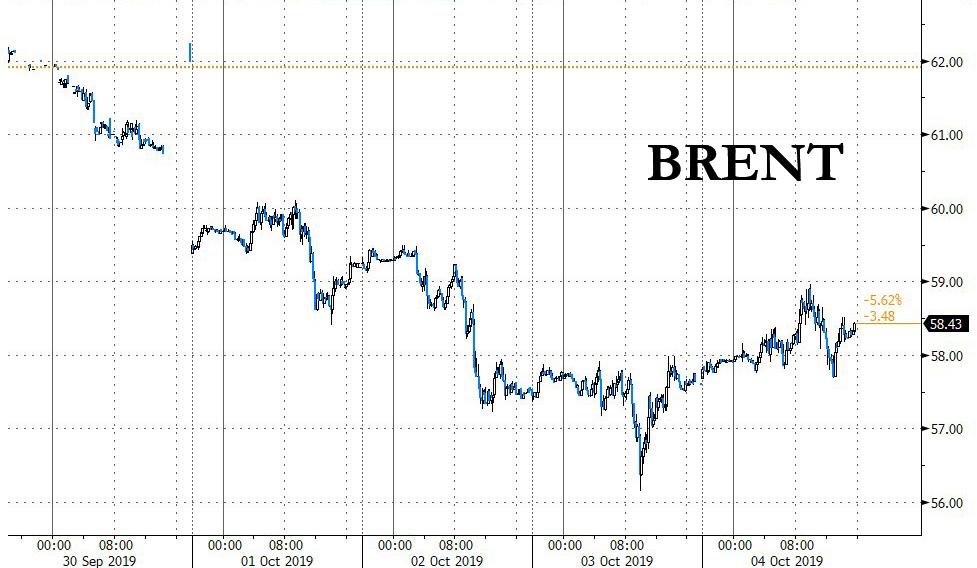

Similar to bonds, commodities hardly shared stocks euphoria, and Brent tumbled from $62 to $56 on Thursday, before recovering some losses on Friday, still down nearly 6% on the week.

(Click on image to enlarge)

The good news: traders get to do it all over again next week, when we finally get some real news - instead of just lies, rumors, and speculation - from the upcoming US-China trade talks. If the two countries fail to reach some agreement, the pain observed in the first half of this week is likely to make a dramatic return.

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more