Rising Costs And Less Capacity: Shipping’s Extraordinary Global Predicament

The vessels delayed by the Ever Given incident are on the move but problems aren’t over. Ocean freight has already been disrupted by the pandemic, leading to spiking container tariffs and 7 out of 10 vessels arriving late. The Suez incident will keep the market off balance for longer, fuelling ongoing capacity constraints and elevated rates.

The Ever Given container ship was refloated in the Suez Canal at the end of March

Reliability of container shipping deteriorates further

After successfully refloating the container carrier Ever Given, the impact on already stretched supply chains is yet to follow. The last of the 350 vessels delayed by the blockage resumed their journeys over Easter, which will lead to an expected wave of calls at Europe’s largest port, Rotterdam, from the second half of this week. The port will adapt where possible but longer waiting times to enter the terminals seems inevitable. The port handling bottleneck and transport capacity constraints further down the line will push deteriorating delivery times up further for shippers of electronic products, clothes, and manufacturing components; and they will last longer than the Suez blockage itself.

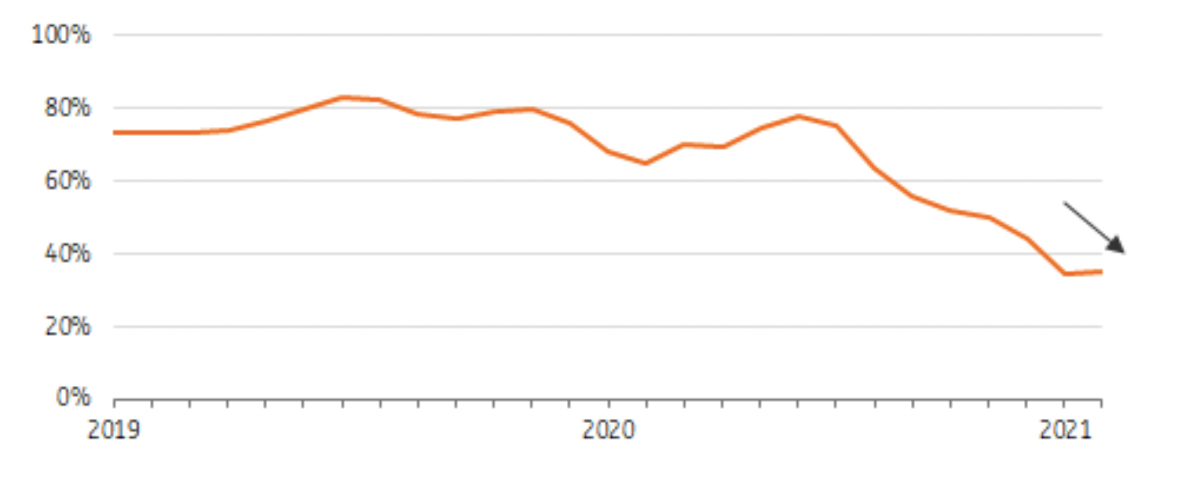

Normally 75% of container vessels arrive on time globally but in the last two months, this reliability measure sank to only a third, as you can see in the chart below. The Suez blockage will drag vessel reliability further down in April, leading to inefficiency and extra costs.

Share of containers arriving on time expected to further drop due to the Suez blockage

The reliability of container vessels worldwide (share of vessels arriving on time)

(Click on image to enlarge)

Source: Sea Intelligence, ING Research

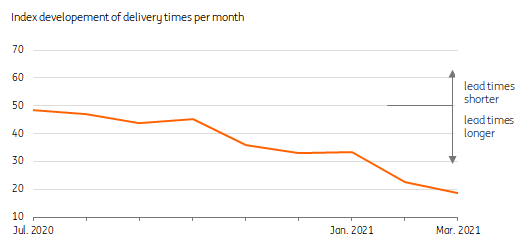

Lead times for manufacturers in the Netherlands further deteriorate

(Click on image to enlarge)

Source: NEVI

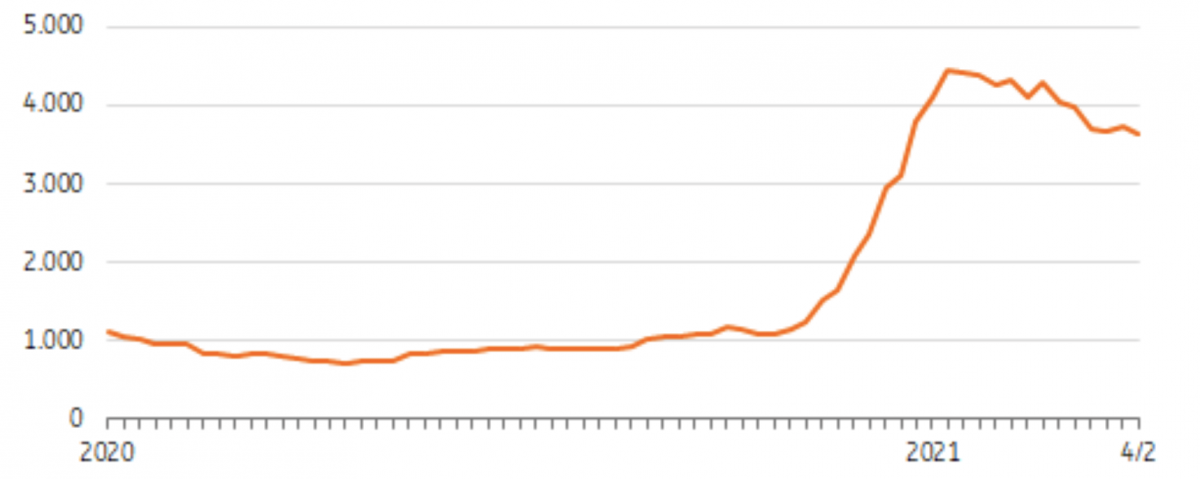

Stretching of supply chains will keep tariffs higher for longer

The grounding of the Ever Given came at a critical moment for global supply chains and the container shipping market. Following the mix of an unexpected swift return of volumes, delayed vessels, capacity constraints in ports, and container shortages, tariffs spiked in the fourth quarter of last year, as you can see below.

The cost of shipping a 20ft container from Shanghai to Europe peaked at $4,400 in mid-January, roughly four times the 10-year average. While elevated tariffs on the East-West trade had started to slide after the Chinese New Year, spot rates stopped decreasing. In order to rebalance capacity, the container network liner Maersk temporarily stopped short-term spot bookings and short-term contracts. These factors resulted in new capacity constraints, while spare capacity is already scarce, putting renewed upward pressure on container rates which had just started to decline.

Suez blockage leads to new upward pressure on container rates

Development of containerized freight rates (spot) Shanghai-Europe trade $ per TEU (20ft) (40ft=*2)

(Click on image to enlarge)

Source: Clarksons, ING Research

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more