Real GDP Is Likely Not Correct As The Inflation Estimates Are Weird

We revisited several times our original post published in 2011 on biased metrology of macroeconomic measurements. New data are needed to validate the original hypothesis or to reject it. It is important to retain in mind that economics as science often fails and gives counterproductive results due to inaccurate or biased measurements of the most basic macroeconomics variables – price inflation, labor force, unemployment, nominal GDP. In one of our previous posts, we focused on the estimates of real GDP in the USA before and after 1979 and here we extend the US case by several other cases. As mentioned before, we have devoted enough efforts to reveal and recover many trivial cases in our book “mecħanomics. Economic as Classical Mechanics”.

Real GDP (see Concepts and Methods of the U.S. NIPA for details) is the difference between nominal GDP and GDP deflator (price index). The latter is not easy to calculate or even evaluate. In this post, we showed that it is so much a sophisticated problem that before 1980 there was no practical difference between the cumulative inflation values of the CPI and the GDP deflator in the US, as originally was demonstrated in Figure 1 of the 2011 post. (The cumulative inflation, i.e. the cumulative sum of inflation rates, is different from the price index when differently calibrated in the beginning.)

In this post, we are trying to find significant breaks in the linear dependence between the CPI and dGDP (i.e. between two measured time series) as related to new definitions of inflation. It is important that our observation of a linear relationship between CPI and dGDP in the USA is also valid for other studied developed countries. For our model of the linear and lagged relationship between labor force, unemployment, and inflation, such definitional breaks in economic parameters are equivalent to the breaks in the statistically estimated relationship. In other words, the breaks in the general relationship are not related to the change in the economic behavior of the involved parameters. These breaks are fully artificial and induced by major economic agencies (BLS, BEA, etc.) on their eternal way to perfect definitions of economic variables.

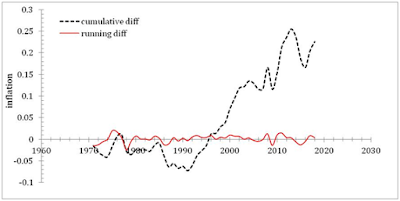

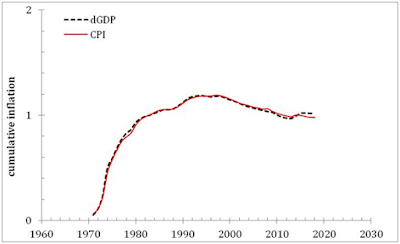

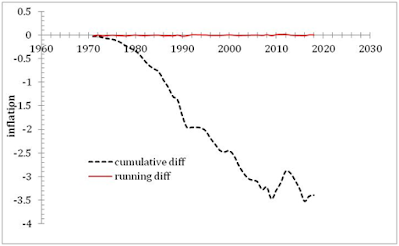

Figure 1 presents the case of the USA (here we use the OECD data): upper panel - CPI and dGDP inflation rates since 1971; middle panel – price change with time relative to 1970 (both variables are normalized to their respective 1970 levels); lower panel – the difference between the curves in the middle panel. We have changed the reference year for the USA from 1929 to 1970. Effectively, the CPI and dGDP curves in Figure 1 diverge from 1978. As we have already mentioned many times, before 1978 the CPI was used to estimate the overall price inflation. Since 1978, the GDP deflator has been used. The difference between these two variables cannot be neglected: the cumulative price change between 1978 and 2018 is 1.3 units or 25%. The lower panel of Figure 1 demonstrates that the cumulative CPI and dGDP price change differences is very close to linear dependence. As we reported before, the coefficient of linear dependence is 1.2 for the USA data (BLS and BEA). For the OECD data, the coefficient is 1.26, i.e. another set of definitions is used by the OECD.

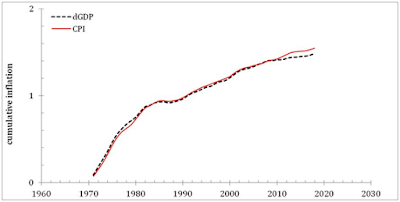

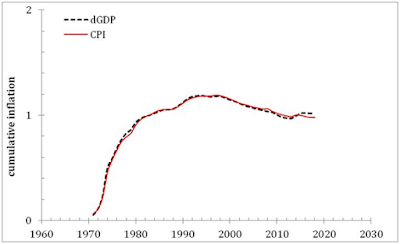

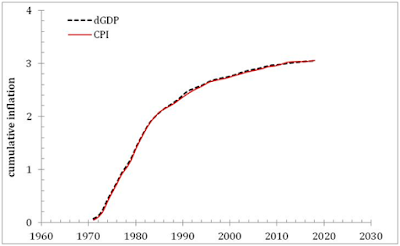

Figure 2 presents the same curves as in the middle panel of Figure 1, but the dGDP time-series is multiplied by a factor of 1.26. Now, the fit between the two curves is almost perfect. There is a small deviation from this linear link after 2008. It might be related to the formation of a new link after some change in dGDP definition in 2008. The potential change in the regression coefficient related to the period after 2008 is small and one has to wait for new data to estimate this coefficient statistically. In Figure 3, we present a tentative model with the dGDP additionally (to 1.26) multiplied by 0.8 after 2008. The fit is much better and the total multiplication factor compared to the pre-1978 definition is 1.008, i.e. practically 1. Are we in the pre-1978 definition era again? When analyzing the linear and lagged dependence between labor force, unemployment rate, and inflation we have to introduce “non-structural” or artificial breaks (structural breaks are equivalent to the change in economic behavior) in 1978 and 2008.

Figure 1. Upper panel: The evolution of the CPI and GDP deflator in the USA since 1970 according to OECD data. The CPI inflation curve is higher than the GDP inflation one. Middle panel: Cumulative price change according to price indices: CPI and GDP deflator. Lower panel: The difference between curves in the upper (running) and middle (cumulative) panels.

Figure 2. The evolution of the cumulative inflation (the sum of annual inflation rates) for the CPI and GDP deflator in the USA since 1970. The dGDP is multiplied by a factor of 1.26.

Figure 3. Same as in Figure 2, but the dGDP after 2008 is additionally multiplied by a factor of 0.8. In fact, the total multiplication coefficient (1.26*0.8) = 1.0, i.e. the same as before 1978.

Figure 4 presents the case of the UK. Panel a) repeats the plot published in 2011. We reported the deviation between the CPI and dGDP since 1978 as in the USA. Panel b) presents the same case with the OECD data for the period between 1955 and 2018. One can see a clear kink in the dGDP curve between 1994 and 1996, which is absent in panel a). This is likely a later OECD revision. Interestingly, the dGDP curve is above the CPI one. In the USA, the order is the opposite. The difference between the CPI can be overcome by two corrections: the dGDP is multiplied by a factor of 0.98 since 1978, as shown in panel c), and the kink is corrected by a constant -0.055 – panel d). As a result, the overall fit since 1955 is excellent and we have to take the break in 1978 into account when assessing our model statistically.

a)

b)

c)

d)

Figure 4. The case of the UK. Described in the text.

Figure 5 presents the case of Austria. The cumulative price change (CPI and dGDP) curves in panel a) demonstrate the start of deviation around 1990. Panel b) shown the running (inflation) and the cumulative difference between the curves in panel a). The pivot point is 1991. We have corrected both time periods – before and after 1991. The pre-1991 period has a very small multiplication factor of 1.005 and the after-1991 period is the best fit with coefficient 1.17 – panel c). The model linking the dGDP inflation with labor characteristics definitely needs a data-driven brake in 1991.

a)

b)

c)

Figure 4. The case of Austria. There is a break in 1991.

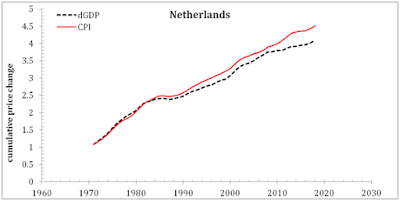

Figure 5 presents the Kingdom of the Netherlands. The CPI curve is above the dGDP one. The relatively good fit between the curves needs three breakpoints – 1982 (coefficient 1.2), 1997 (0.8) (both changes are shown in panel c), and 2009 (2.0) - panel d).

a)

b)

c)

d)

Figure 5. The Kingdom of the Netherlands

In Figure 6, we present Japan. The CPI is above the dGDP – panel a). The cumulative difference in panel b) is an almost linear function of time. The multiplication factor between 1974 and 2018 is 1.25, but the CPI is constant after 1996 – panel b). This constant can be fit only with a 0 linear coefficient or a constant added to all dGDP or CPI inflation readings after 1996. In panel d) we added -0.011 to each reading of the CPI inflation since 1997 and obtained a good fit between the CPI and dGDP. We are sure that the Japan Statistics did not add 0.011 to the CPI inflation estimates in order to keep it above 0. It would be a good trick to avoid formal deflation, which is observed in the dGDP since the mid-1990s, but it would be a bad trick for the economic models we have been developing for Japan.

a)

b)

c)

d)

Figure 6. Japan

Italy is a perfect case with one constant describing the whole difference between 1970 and 2018. Figure 7 presents the original CPI and dGDP time-series – panel a), the difference – panel b) and the overall fir when the dGDP is corrected by a factor of 0.94. The overall fit is excellent through the studied interval and no breaks are needed in the model. For Italy, the CPI is below the dGDP curve.

a)

b)

c)

Figure 7. Italy

Disclosure: None.