Past The Peak Of Political Risk?

For over a year, investors have had to embed a risk premium for adverse political developments into global asset prices. For example, a US challenge to the long-standing consensus on the benefits of free trade has been a novel and unwelcome development. Furthermore, the uncertainty surrounding the form and timing of any departure of the UK from the EU has had a dampening effect on investment and profits on both sides of the English Channel. We are now seeing progress being made on both these questions during October which raises the prospect that they may be in the rear-view mirror for 2020. We continue to believe bearish positions on European equities may over-cautious in the context of still very low yields on government bonds.

It may have been some time coming, but the recent détente between the US and China which resulted in a “Phase 1” agreement on trade is consistent with the timing of the run-up to Trump’s re-election campaign next year. Naturally for the Trump administration, this preliminary “deal” has been announced long of fanfare and short on detail, with the actual text still under negotiation. The actual text, when it is complete, is due to be signed off between Trump and China’s President Xi mid-November.

Nevertheless, the proposed US/China agreement opens the way to a de-escalation of the tariff war currently underway. The prioritization of farm products over the arguably much more important issues of respecting intellectual property rights and forced technology transfer in our view drops a hint that domestic US politics may be the driver of a deal. From a negotiating perspective, the phasing of negotiations has echoes of the manner in which the EU boxed the UK in at an early stage by the use of pre-commitments, prior to negotiating the more contentious parts of the Brexit deal.

We note also US Commerce Secretary Ross’ recent public comments that indicate the proposed new tariffs on the European autos sector due next month may be replaced with talks between the two sides. The situation remains fluid but the direction of travel on US tariffs appears to have shifted to a more conciliatory approach as the economic damage of US trade policy – and perhaps the damage to Trump’s re-election chances – has become clearer.

Should the initial agreement between the US and China be formalized in November we believe it may signal the end of the chapter of Trump’s rather experimental use of US trade policy to achieve domestic political goals. Global markets would in our view welcome such a development. Any reduction in international policy uncertainty would also help release business investment which has been put on hold pending clarity on the US/China trade conflict. This would further support economic momentum over the coming quarters.

In respect of Brexit, the situation may still be unresolved but it has progressed significantly since September. Only a few weeks ago many doubted that PM Johnson would be able to re-open the Withdrawal Agreement. It is in our view a material change for the UK government to have finally obtained a Parliamentary majority voting in favor of a Brexit agreement this week, despite a rejection of the timetable placing the passage of the legislation on pause.

A further extension to Article 50 is being considered by the EU at present and we expect a short extension to be forthcoming in due course. While there are still significant risks, the prospect of no-deal on October 31 remains remote, in our view. Instead, we view the highest probability scenario is PM Johnson’s revised Withdrawal Agreement being passed by Parliament in coming weeks. As a result, Brexit uncertainty from that point will diminish significantly and the transition out of the EU will be relatively smooth when it occurs. Political risks will shift to the longer-term (where the market impact will be minimized) as attention turns to the UK’s future trade agreement with the EU over the coming years.

In recent years, UK profits growth has suffered from Brexit uncertainty but this is hardly a surprise to investors; for example, business investment growth has been lackluster since the referendum. For 2019, the median profits growth forecast has fallen to just 2%. However, we may be reaching the point where it just takes the removal of the uncertainty to see a pick-up in corporate investment spend, which at least in part will be catch-up spending deferred from prior periods.

In addition, we believe the UK government will be determined to add fiscal stimulus over the Brexit period while the Bank of England will be on hand to offer monetary support. Despite the recent rally, sterling still appears good value on a trade-weighted basis and UK equity markets remain inexpensive. 2020 could still be a better year for UK markets than the consensus expects. We believe the outperformers in a bullish scenario of Brexit-with-a-deal would be domestically focused UK equities, which may benefit twice over – first from a reduced Brexit risk premium and then from a UK fiscal stimulus. UK overseas earnings and exporters are likely to have to contend with a stronger pound.

Getting Brexit done may also offer the chance to shift UK politics back to the center-ground. Over the last 20 years, the UK’s political dynamics have steadily shifted from the centre towards appealing to the fringes of the political spectrum. The UK is not in recent years alone in this regard and similar dynamics are evident in both continental Europe and the US. Increased popular support for ideas away from the mainstream has manifested itself in a weaker showing for the main UK parties and wafer-thin majorities, achieved through coalition politics. The lurch towards Euroscepticism within the UK’s Conservative government under PM Johnson is one example of previously fringe ideas gaining ground. However, a distinctly corporate-unfriendly set of Labour policy initiatives lurks in the background for now but remains a political risk for investors.

The UK’s Labour party has for example proposed extensive re-nationalization of privatized industries and increased rates of corporation tax. More radical proposals include the seizure of 10% of public company equity for the benefit of workers in “inclusive ownership funds” together with new rules to ensure 1/3 of company board seats are comprised of worker representatives. For now, the weak performance of the Labour party in the polls since mid-year may give investors some comfort that a Labour government remains only a theoretical possibility and these unconventional policy ideas will never be implemented.

The benefit of getting Brexit done for investors is not just the reduction in economic uncertainty however, as a battle for the currently vacated center-ground of UK politics could then restart at the next election. This would further reduce the UK country risk premium for UK equities which has been evident in valuation terms, relative to other markets since the Brexit referendum.

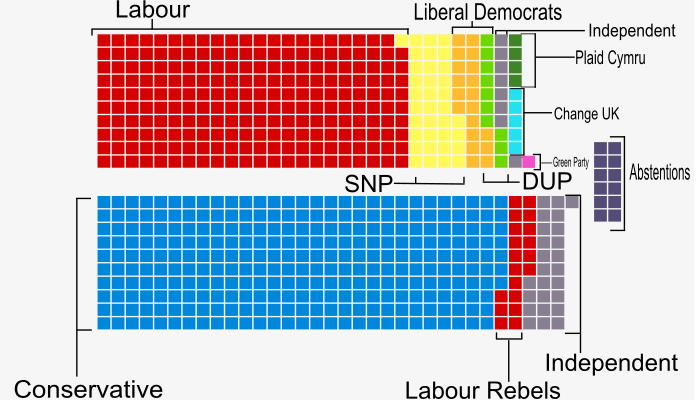

MP’s voted 329 to 209 for a second reading of the Withdrawal Agreement Bill, before defeating the programme motion Source: Edison Investment Research

While we recognize that downgrades to 2019 GDP growth forecasts and beyond are still in evidence, the cause of the slowdown in growth is often attributed to trade developments and Brexit. There are signs however that we have reached “peak politics” and the tide is now flowing in the other direction. Furthermore, the delayed impact of lower global interest rates over the past 9 months may be about to become evident in the economic data over coming quarters. With both the US Fed and ECB having restarted asset purchase programs, we continue to believe bearish positions on European and UK equities may over-cautious, especially in the context of still very low yields on government bonds.

Disclaimer: Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and ...

more