October Budget Deficit Surges 34% To $134 Billion, Worst In Five Years

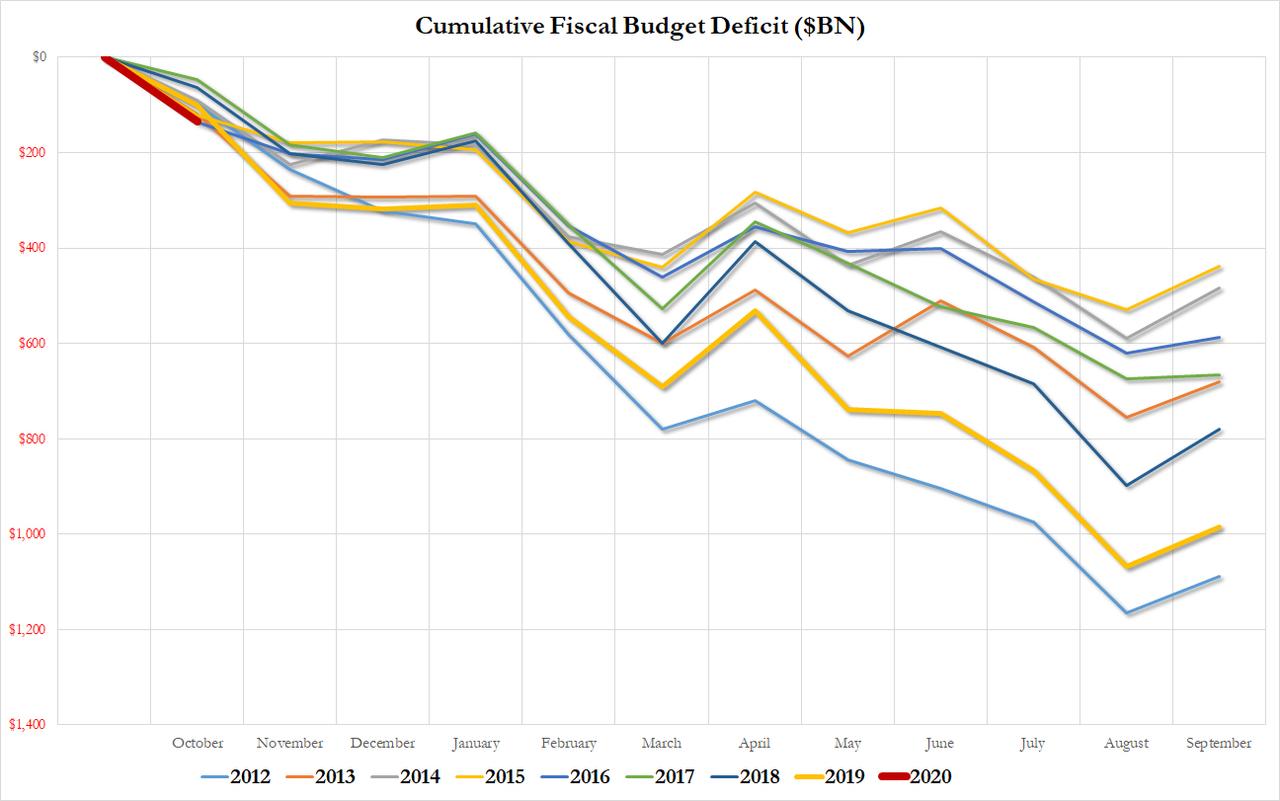

One month after the Treasury reported that in fiscal 2019 the US budget deficit hit $984 billion, a 26% increase from a year earlier, and the largest annual deficit since 2012's $1.1 trillion, today the US Treasury released the latest monthly deficit data which revealed that in October, the first month of Fiscal 2020, the US deficit shortfall hit $134 billion, a $34 billion, or 34%, increase to the $100 billion deficit in October 2018, bigger than the average forecast of $130 billion.

(Click on image to enlarge)

October's deficit was the biggest in five years, just shy of the $136.5 billion in October 2015, and sets the US on the path to surpassing a $1 trillion deficit for the first time in eight years.

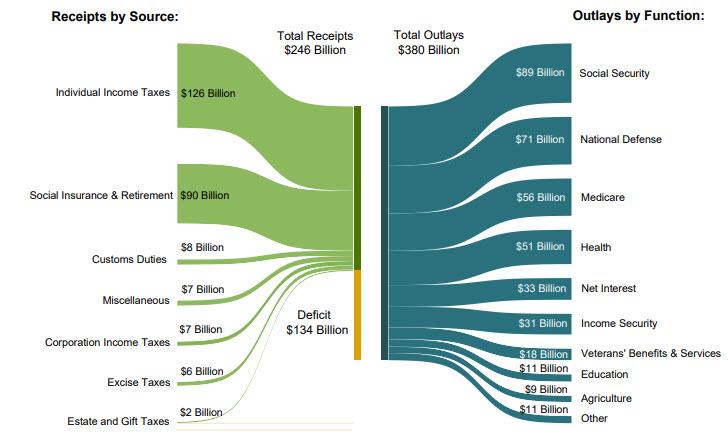

In the first month of fiscal 2020, income of $246 billion dropped 2.8% from a year earlier, while spending of $380 billion jumped 7.6%. The biggest sources of income were individual income taxes ($126 billion), social insurance and retirement ($90 billion), while the biggest outlays were social security ($89 billion), national defense ($71 billion), medicare ($56 billion) and health ($51) billion, while the US Treasury spent $33 billion on interest on the Federal debt, roughly the same that it spent on veterans' benefits, education, and agriculture combined.

(Click on image to enlarge)

The monthly deficit would have been greater had Trump not imposed tariffs on Chinese goods: in October, customs duties boosted US revenue by $7.8 billion, up from $5.6 billion a year ago, and represents tariffs U.S. companies paid on imports of Chinese merchandise.

In October, the cumulative 12-month deficit gap hit 4.7% of GDP, the largest since May 2013. The US has not had a full-year budget surplus since 2001.

(Click on image to enlarge)

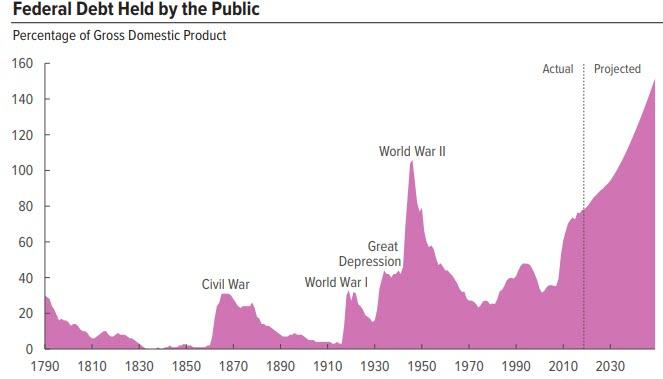

So far this year, the CBO's forecast is spot-on: the budget office estimated the October deficit would be $133 billion, and it sees the total federal deficit topping $1 trillion in the current and 2021 fiscal years, about 5 % of GDP.

Addressing Congress earlier on Wednesday, Fed Chairman Jerome Powell said that "the federal budget is on an unsustainable path" that ultimately could limit lawmakers’ ability to support the economy in a downturn. During the question-and-answer period before the Joint Economic Committee, Powell said lawmakers can’t ignore deficits and that it’s important for the economy to grow faster than debt. Alas, one look at the CBO's long term debt forecast suggests that by that definition, the US is probably doomed.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more