New Fed Stress Test Toughens Stock & Economy Crash Scenario, Eases Jobless Extreme

Having confirmed in December that all banks comfortably passed their stress tests (allowing them all to buy back stocks and up dividends), The Fed has decided to raise the bar (albeit modestly) for its Adverse Scenario in the next round of stress tests.

The top 19 US banks will have to prove they can withstand a 55% collapse in stock markets in this year’s stress tests, regulators said on Friday, outlining the parameters for an exercise that decides how much banks can pay out to their shareholders.

"The banking sector has provided critical support to the economic recovery over the past year. Although uncertainty remains, this stress test will give the public additional information on its resilience," Vice Chair for Supervision Randal K. Quarles said.

Additionally, The Fed said that banks with large trading operations will be tested against a global market shock component that stresses their trading, private equity, and other fair value positions. Additionally, banks with substantial trading or processing operations will be tested against the default of their largest counterparty.

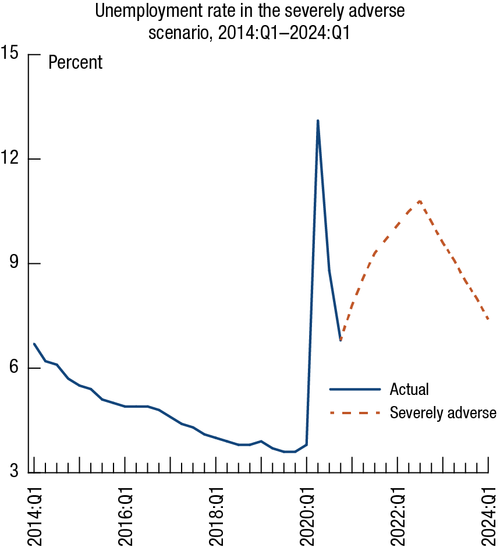

But while the new adverse scenario increases the equity stress (from 50% drop to 55%) and worsens the economic impact (from 3% GDP decline to 4%), it softens the employment stress by decreasing the peak unemployment from 12.5% to 10.75% (note that the current rate is 6.3% but Fed Chair Powell recently said it was more like 10% due to labor force participation disruptions).

“The scenarios are not forecasts and the severely adverse scenario is significantly more severe than most current baseline projections for the path of the US economy under the stress,” the Fed said.

Full Stress Test details below:

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more