Market Briefing For Monday, Oct. 8

Investors and pundits who were blindsided by the ongoing distribution and insider selling are catching on to the deception. Note that nobody is talking about buybacks now (most require bond offerings; a characteristic that goes away as interest rates firm); nor the insider selling so evident throughout the year's first half.

As I wrote then; buybacks were a fine palliative for shareholders thrilled by superficially higher earnings; while of course initial perceptions of tax cuts also helped that picture. But as huge insider holders benefited from price appreciation; it was a golden invitation to lighten-up; and that's why we had historic insider-selling (is that the untold story of 2018's first half?).

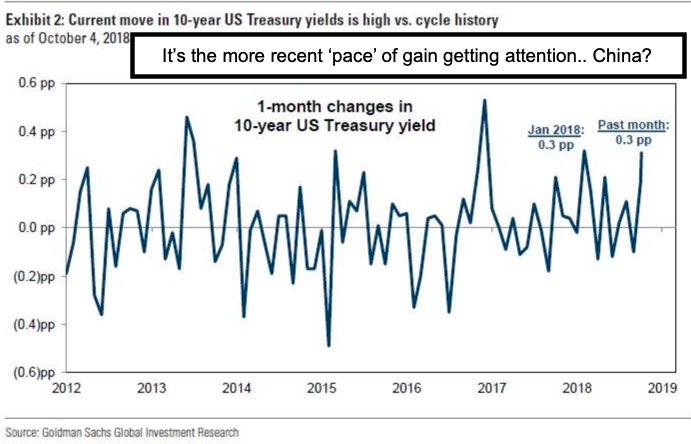

Not to mention the interest rate climb, out of the 'emergency low rate' hole that was maintained far too long (for which I blame Bernanke); set-up the faster-than-consensus recovery. Hence I pointed-out money managers just can't have it both ways for long. They wanted a 'dream world' of low rates, a growing economy, and continued buy-backs to extend the advance.

Ripple Effects

For my part this overdue decline (other than rotational selling for months; so it's really not entirely new; and why I have been persistently concerned in recent weeks) has more to go. And it's not just higher rates hurting small companies; though that's part of it too of course. Mostly it's 'debt service'; a lack of future buy-backs; trade issues; and worries about Midterms.

How do you handle this? Easy. You're already prepared if aligned with my views. You retain core investment (or some speculative) holdings; but for months have used rallies (plenty of 'Rinse & Repeat' bounces) to achieve greater liquidity and cash reserves, preparing for bargains 'down the road'.

Meanwhile, we've warned for a year how high-priced properties were only selling at sharp price reductions; and then even rental concessions to get (mostly millennials) into deluxe rental properties. Everyone went overboard in the big markets like New York and San Francisco; while South Beach or much of Coastal Florida, was already showing signs of price concession (for the same and other reasons; not just demographics and rising tides).

More recently I've shared evidence of 'proportions' of assets in equities for now; and it's historic. That suggests that a serious market implosion would have 'ripple effects', beyond stocks. In other words, lots of normal wealth (or personal assets) is 'perceived wealth', with families having more than traditional proportions of assets tied-up in equities. This is often because of the very trend 'many think' makes them safer; using funds and ETF's.

I ponder how whether managers often play with investing 'sectors', without really solid analysis of the stocks within such ETF's. I mentioned this when they trotted-out the XLC (Communications ETF); and combined telecoms (the traditional components) with stocks like Facebook and Google. These type of management approaches do increase 'Beta' (some actual 'Alpha' ETF funds have been created). Making ETF's more responsive (as warned in a recent 'Briefing') of course is intended to create upside momentum; at the same time I thought it makes them even more dangerous in a decline.

Similarly; the hedge guys who played catch-up (generally not agreeing with us that 'if Trump won the market's going to the Moon') also disagreed about it 'not going to interstellar space' as I have contended this year. So sure they will fight this decline; it may only be a correction, depending on of course interest rates and Midterms; but they were being greedy; and of course they 'need' a Red not Blue wave, if they seek an eventual new leg higher in the S&P; and that might be more in basic stocks than FANG's, incidentally. But stay tuned, as that's a topic to explore a month hence.

In-sum: leverage worked for fee-based money managers on the way up; and it works against them in a downturn. Those who not only leveraged, but kept nearly-zero cash balances, are in a real quandary. If they sell the market persists declining. If they use more 'leverage' to buy and try holding prices together (or push them up); the risk is if or as that falters, they have even less cash or leverage potential; and compound their downside risk.

Bottom-line: a simply (and historically normal) 20% correction can totally wipe-out a hedger or fund that is leveraged by a favor of 4 to 1 or more; as some of them are. Such liquidations would impact the broader market and trigger more selling; so that's the calamity risk as opposed to correction. It is impossible to yet divine the Midterms, and a relief rally that would ensue if things go a certain way; but it is feasible that failure there would heavily contribute to eroding perceptions of investment prospects for next year.

Donald Trump may be capping-off one of the best week of his Presidency; because of how he has achieved so much of his agenda, whether one has full agreement with it or not. I do not in a few areas; but do with respect to the market. Now, regardless of anyone's view of Kavanaugh, it appears he will will on the Supreme Court, with all that implies. There are quite a few major issues percolating down-the-line for the Court; so the next thing we'll have (after President Trump presumably gloats tomorrow) is one would of course hope; getting back to the place of bipartisan votes regarding Court appointments. I don't know how you get to the Center easily for now. This era of raw agenda politics remains distressing. Susan Collins gave quite a moving speech if you happened to hear it; regardless of one's politics.

Conclusion: downward revisions of earnings calls; buybacks mostly now history; and things not as optimistic as many perceived. Upside mitigated for the S&P and the economy; because like I said: 'not interstellar space'. A few stocks went beyond the Moon while most 'orbited'. Those that got too crazy face trouble returning; 'lack of 'fuel' to fight the pull of gravity.