Key Events This Week: Retail Sales, Fed Speakers And Senate Takes On Stimulus

It's been a slow start to the week with much of Asia still closed for the Lunar New Year, and the US Presidents’ Day holiday today, although as DB's Jim Reid writes "it has been a pretty eventful year so far with riots on Capitol Hill, the Georgia election results and huge associated potential stimulus numbers, the taper debate (becalmed for now), various bubble debates, Bitcoin up nearly five-fold since October, the EC vaccine saga, virus mutations, and who can forget the remarkable Reddit story."

Still, as Reid adds, "over the last week or two markets have calmed down and returned to the liquidity/ risk on trade" with the DB strategist predicting that it "will be a very strong year for the global economy as I think life will look very different in the summer (even with some restrictions still), with an abundance of pent up demand. However, that will likely bring its own issues with bond yields vulnerable if we see summer inflation (even if only transitory) and if the US technology bubble bursts as the “old” economy becomes relatively more attractive again and as day traders/retail have less time to invest in these chosen stocks. Before we get there the upcoming stimulus checks may find their way into equity markets so if there is a bubble it may inflate more first before any correction. So I reiterate that I don’t think this will be a low vol year so enjoy the quiet period ahead while you can."

But first, we have to get through this week, where the main event on the data front, is not until Friday with the next batch of flash PMIs published then. As a reminder, January did see a divergence between the major economies as while a number of composite PMIs were below 50, including the Euro Area, the UK, and Japan, the US economy continued to show promising signs, with the composite PMIs rising to the highest level (58.7) since March 2015.

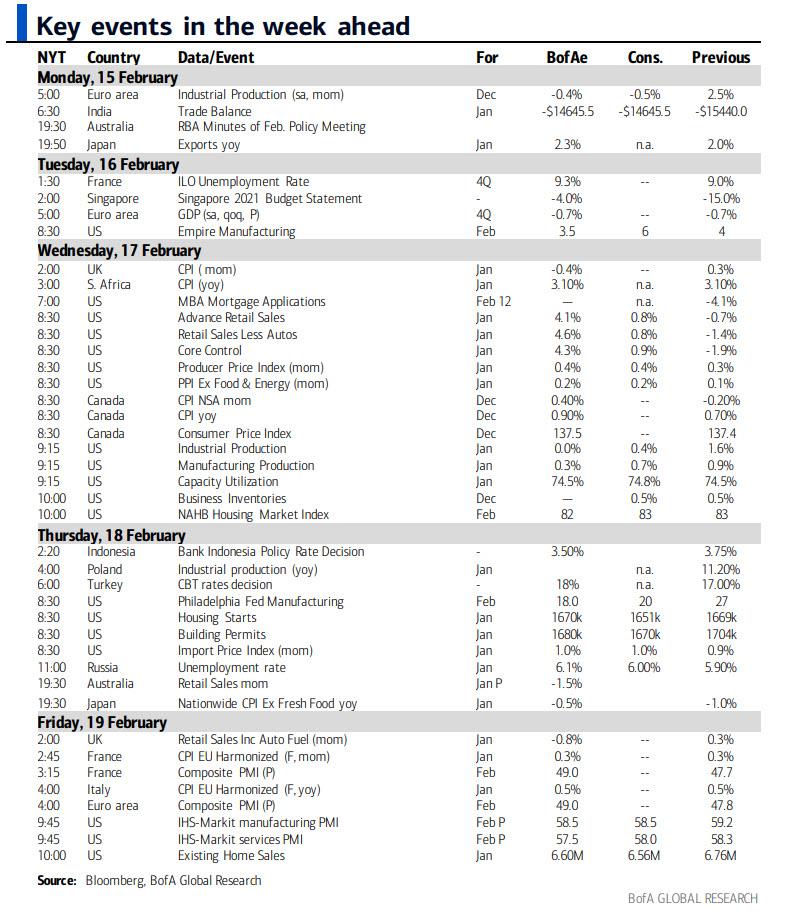

The coming week will also see an increasing amount of hard data releases for January, including retail sales, industrial production, PPI (all Wednesday), housing starts and building permits (both Thursday).

From central banks, the next big round of monetary policy decisions won’t come until mid-March now, but we will get a number of meeting minutes released over the coming week, including from the Federal Reserve (Wednesday), the ECB (Thursday), and the Reserve Bank of Australia. We also get a bunch of Fed speakers. Otherwise, the policy decisions will come from emerging market economies, with Bank Indonesia expected by DB’s economists to cut their policy rate by 25bps on Thursday, and the Central Bank of Turkey also deciding policy that same day.

A full breakdown of economic key events this week is below, courtesy of BofA:

(Click on image to enlarge)

Elsewhere, earnings season is starting to wind down now, with around three-quarters of the S&P 500 having reported. However, the coming week will still see a further 54 in the index report, as well as 67 from the STOXX 600. In terms of the highlights, on Wednesday we’ll hear from Rio Tinto and British American Tobacco, followed by reports on Thursday from Walmart, Nestle, Applied Materials, Airbus, Daimler, Barclays, and Credit Suisse. Finally, on Friday, releases include Hermes International, Deere & Company, Allianz, and NatWest Group.

(Click on image to enlarge)

With the spectacle of the second Trump impeachment officially over, the Senate will now begin to debate the House's stimulus proposals this week. DB's economists believe that it is possible that the Senate could move quickly towards a floor vote without making many changes to the House package. However, their base case is that it will take a few weeks as moderate Democrats pare back Biden’s $1.9tn package through amendments. Indeed the House Ways and Means Committee last week took some steps to pare back the number of people eligible for stimulus checks, which lowered the cost of that part of the bill by $60bn.

In terms of the latest on the virus, the UK PM Johnson confirmed that his government has met its target of immunizing everyone who wanted a jab over the age of 70, along with people who live or work in nursing homes, health service workers, and those who are most vulnerable to Covid-19. Meanwhile, Japan is set to begin vaccinations on Wednesday with medical personnel being the first ones to receive the shots.

Courtesy of DB, here is a Day-by-day calendar of events

Monday, February 15

- Data: Euro Area December industrial production

- Earnings: BHP

- Other: Presidents’ Day holiday in the US

Tuesday, February 16

- Data: Japan December tertiary industry index, core machine orders (23:50 UK time)

- Germany February ZEW survey, US February Empire State manufacturing survey, December foreign net transactions

- Earnings: CVS Health, AIG

Wednesday, February 17

- Data: UK January CPI, EU January new car registrations, Canada January CPI, US January PPI, retail sales, industrial production, capacity utilization, December business inventories, February NAHB housing market index

- Central Banks: Federal Reserve release January meeting minutes, Fed’s Rosengren speaks

- Earnings: Rio Tinto, British American Tobacco

Thursday, February 18

- Data: US January housing starts, building permits, weekly initial jobless claims, February Philadelphia Fed business outlook, Euro Area advance February consumer confidence, Australia flash February manufacturing, services and composite PMIs (22:00 UK time), Japan January nationwide CPI (23:30 UK time)

- Central Banks: Monetary policy decisions from Bank Indonesia and the Central Bank of Turkey, ECB release January meeting minutes, Fed’s Brainard and Bostic speak

- Earnings: Walmart, Nestle, Applied Materials, Airbus, Daimler, Barclays, Credit Suisse

Friday, February 19

- Data: Flash February manufacturing, services, and composite PMIs from Japan, France, Germany, Euro Area, UK and US, Germany January PPI, UK January retail sales, public sector net borrowing, Canada December retail sales, US January existing home sales

- Central Banks: Fed’s Rosengren speaks

- Earnings: Hermes International, Deere & Company, Allianz, NatWest Group

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the retail sales report on Wednesday and the Philadelphia Fed manufacturing index on Thursday. There are numerous speaking engagements from Fed officials this week.

Monday, February 15

- There are no major economic data releases scheduled. NYSE will be closed. SIFMA recommends bond markets also close.

Tuesday, February 16

- 08:30 AM Empire State manufacturing survey, February (consensus +6.3, last +3.5)

- 11:10 AM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will deliver remarks on community bank regulation to the American Bankers Association Conference for Community Bankers. Prepared text and moderated Q&A are expected.

- 12:30 PM Kansas City Fed President George (FOMC non-voter) speaks: Kansas City Fed President Esther George will speak at the UMKC Real Estate Virtual Symposium. Audience Q&A is expected.

- 01:00 PM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will discuss the economy at a virtual event hosted by Rice University. Audience Q&A is expected.

- 03:00 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will discuss the economy, monetary policy, and inequality at an event hosted by the University of San Francisco.

Wednesday, February 17

- 08:30 AM PPI final demand, January (GS +0.4%, consensus +0.4%, last +0.3%); PPI ex-food and energy, January (GS +0.2%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, January (GS +0.2%, consensus +0.2%, last +0.4%): We estimate that headline PPI increased by 0.4% in January, reflecting solid increases in energy, food, and core prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade, partly reflecting a likely boost from increased Medicare payments.

- 08:30 AM Retail sales, January (GS +2.0%, consensus +1.0%, last -0.7%); Retail sales ex-auto, January (GS +2.2%, consensus +0.9%, last -1.4%); Retail sales ex-auto & gas, January (GS +2.1%, consensus +0.6%, last -2.1%); Core retail sales, January (GS +2.2%, consensus +0.9%, last -1.9%): We estimate that core retail sales (ex-autos, gasoline, and building materials) rebounded by 2.2% in January (mom sa). High-frequency data suggest a sharp improvement in retail goods spending following the disbursement of the $600 stimulus checks and the reinstatement of unemployment top-up payments. We also expect a partial rebound in restaurant spending that supports the ex-auto ex-gas category. We estimate +2.0% and 2.2% for the headline and ex-auto measures, respectively, reflecting higher auto sales and gasoline prices.

- 09:00 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will take part in a virtual panel discussion hosted by the Maryland Chamber of Commerce.

- 09:15 AM Industrial production, January (GS +0.5%, consensus +0.4%, last +1.6%): Manufacturing production, January (GS +0.8%, consensus +0.7%, last +0.9%); Capacity utilization, January (GS 75.0%, consensus 74.9%, last 74.5%): We estimate industrial production rose by 0.5% in January, reflecting a further increase in manufacturing production but a pullback in the utilities category. We estimate capacity utilization rose by 0.5pp to 75.0%.

- 09:15 AM Boston Fed President Rosengren (FOMC non-voter) speaks: Boston Fed President Eric Rosengren will take part in a virtual panel discussion hosted by the Concord Coalition.

- 10:00 AM NAHB housing market index, February (consensus 83, last 83)

- 02:00 PM Minutes from the January 26-27 FOMC meeting: At its January meeting, the FOMC left the funds rate target range unchanged at 0–0.25%, as widely expected. During the press conference, Chair Powell said the focus on tapering is “premature.”

Thursday, February 18

- 08:00 AM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Lael Brainard will speak at a climate finance summit hosted by the Institute for International Finance. Text and moderated Q&A are expected.

- 08:30 AM Housing starts, January (GS flat, consensus -0.7%, last +5.8%); Building permits, January (consensus -2.0%, last +4.5%): We estimate housing starts remained unchanged in January. Our forecast incorporates higher permits but a small drag from snowfall early in the month.

- 08:30 AM Initial jobless claims, the week ended February 13 (GS 725k, consensus 765k, last 793k); Continuing jobless claims, the week ended February 6, consensus 4,423k, last 4,545k): We estimate initial jobless claims declined to 725k in the week ended February 13.

- 08:30 AM Import price index, January (consensus +1.0%, last +0.9%)

- 08:30 AM Philadelphia Fed manufacturing index, February (GS 18.0, consensus 20.0, last 26.5): We estimate that the Philadelphia Fed manufacturing index declined in February to 18.0, reflecting reversion after a large jump in January and weaker business confidence measures in the beginning of February.

- 10:00 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will take part in a virtual discussion on educational inequality.

Friday, February 19

- 08:00 AM Richmond Fed President Barkin (FOMC voter) speaks; Richmond Fed President Thomas Barkin will take part in a virtual discussion hosted by the Rockingham Chamber of Commerce.

- 09:45 AM Markit Flash US Manufacturing PMI, February preliminary (consensus 58.5, last 59.2)

- 09:45 AM Markit Flash US services PMI, February preliminary (consensus 57.9, last 58.3)

- 10:00 AM Existing home sales, January (GS -3.0%, consensus -2.0%, last +0.7%): We estimate that existing home sales declined by 3.0% in January after edging up 0.7% in December. Existing home sales are an input into the brokers' commissions component of residential investment in the GDP report.

- 11:00 AM Boston Fed President Rosengren (FOMC non-voter) speaks: Boston Fed President Eric Rosengren will give a virtual speech to the Yale Economics Development Symposium. Prepared text and audience Q&A are expected.

Source: DB, BofA, Goldman

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more