Key Events In EMEA And Latam Next Week - Sunday, February 24

The weakness in German business surveys is a troubling sign for central and eastern Europe. PMI data from Poland and the Czech Republic next week will shed light on the depth of the slowdown in manufacturing while in Hungary, the focus turns to the central bank

Image Source: Shutterstock

National Bank of Hungary: On hold for one more month

The National Bank of Hungary is expected to leave its policy rate unchanged for another month. We see the central bank waiting for February's inflation data (namely core CPI ex. tax) to overshoot the 3% target before starting monetary policy normalisation, which should be conducted via an adjustment in the FX swaps - providing HUF liquidity - and a hike in the overnight deposit rate.

The central bank might highlight in its press release (once again) that recent developments in the eurozone and the ECB’s dovish communication warrants a cautious and gradual approach, but in our opinion, this won’t cause a delay in the expected start of normalisation in March.

Other than that, we expect producer prices to increase significantly, which is another signal of inflation strengthening. The statistical office will also release the detailed 4Q18 GDP data, and we expect really strong figures in domestic factors such as consumption and investment activity.

Czech Republic: 4Q growth under scrutiny

The market and the Czech National Bank will scrutinise details of 4Q18 GDP growth, which surprised on the upside in the flash release (2.9. vs 2.3). Industrial production and services were relatively weak in 4Q18, but some one-off factors are likely, such as strong investment activity by the government.

Moreover, February's manufacturing PMI is likely to remain below the 50-point threshold given the weakness in the German PMI.

Poland: Recovery in manufacturing PMI? Not likely

The second GDP reading for 4Q18 should confirm growth of 4.9% year-on-year. We expect a moderation of both private consumption expenditure and investment. Revisions to the growth structure in 2018 seem likely - the annual reading suggested a neutral net export contribution, while quarterly indicators so far have signalled a negative drag.

The PMI is unlikely to recover further in February. We expect a reading of 48.4. The weak confidence of German manufacturing businesses suggests a significant downward risk to our forecasts.

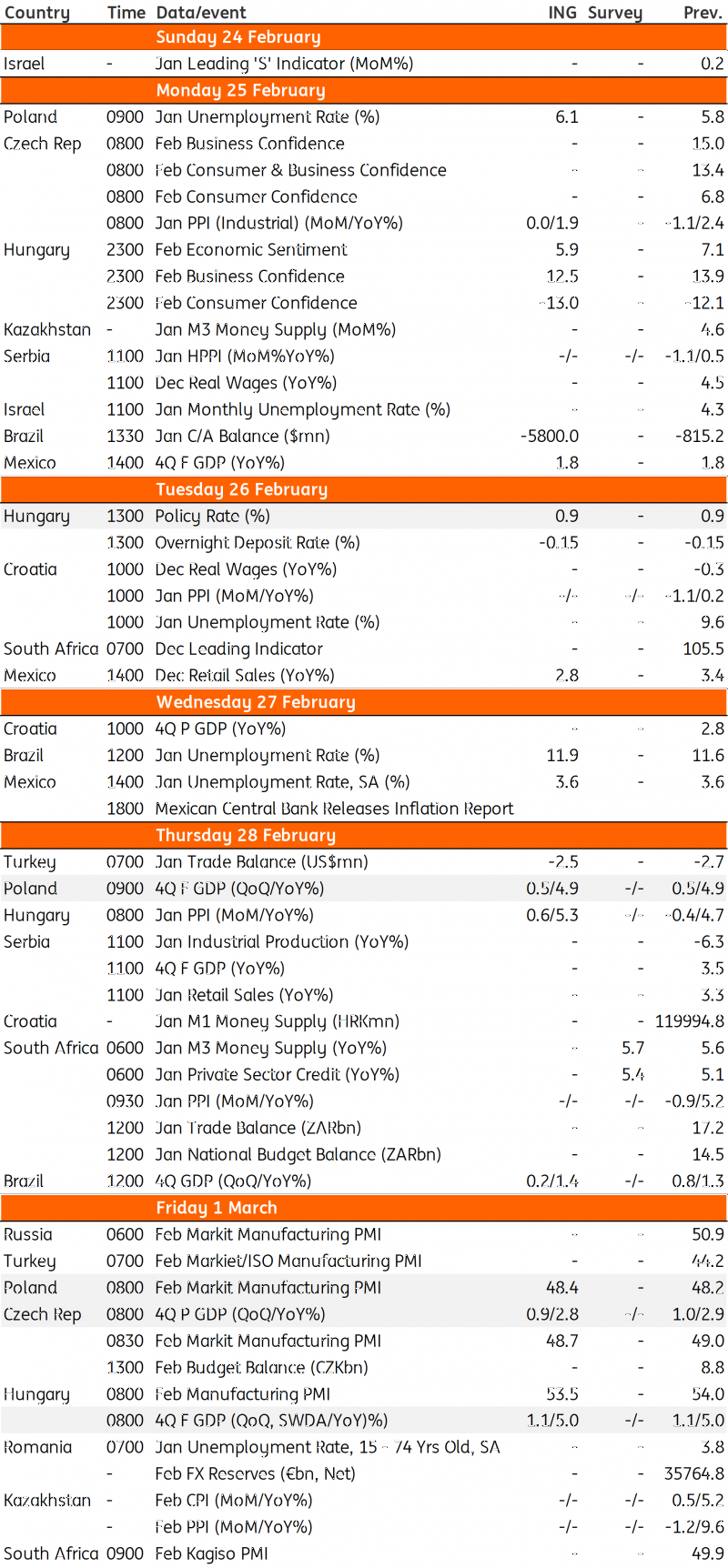

EMEA and Latam Economic Calendar

ING, Bloomberg

Disclaimer: The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial ...

more