JPM Joins "Overheating" Bandwagon: Sees 6.4% GDP As Stimulus Forecast Doubles To $1.7TN

Just a week after Goldman unleashed a wave of worry about tighter financial conditions with its revised forecast boosting 2021 and 2022 GDP up by 0.2% each year, to 6.8% and 4.5%respectively, as a result of a far bigger stimulus than its had originally expected ($1.5 trillion vs $1.1 trillion originally), which set the US economy directly on collision course with overheating (and prompted Goldman to pull forward its first rate hike estimate to H1 2022), other banks have started jumping on the overheating bandwagon, and today JPMorgan became the latest bank to nearly double its Covid stimulus forecast, which led the bank to aggressively boost its 2021 and 2022 GDP estimates as well.

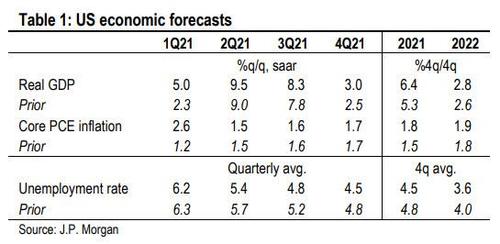

In a note to clients, JPM's chief economist Michael Feroli made the following forecast revisions:

- We now look for a $1.7 trillion fiscal stimulus package (up from $900 billion) to be passed in March

- Even before that kicks in, growth appears to be on firmer footing at the start of the year

- All told we now expect 6.4% (4Q/4Q) GDP growth this year and 2.8% next year

- We see the labor market getting back to full employment, or around 4% unemployment, by 2Q22…

- …and expect core PCE inflation to reach 2.0% by 4Q22, with balanced risks around the outlook

- While the outlooks for growth and inflation are moving up, Fed rhetoric appears to be getting more dovish

Feroli first explains the reason behind his dramatic stimulus forecast revision:

Shortly after the two Georgia Senate run-off elections in early January delivered effective control of that chamber to the Democratic Party we penciled in an assumption of another $900 billion of fiscal stimulus. This sought to balance the risk of a smaller amount reached through a bipartisan deal and a larger amount arrived at by the Democrats using the budget reconciliation process. Since then the odds of a bipartisan deal have diminished to near zero, and Congressional Democrats have pushed forward with a much larger package. Thus, we revise our outlook to incorporate a $1.7 trillion package to take effect in March.

Needless to say, this will not ease overheating concerns, and as Feroli writes, "the larger stimulus package should meet an economy that is getting off to a better-than-expected start to the year. After a soft end to 2020, the economy appears to have shrugged off the latest wave of COVID-19 case counts (which are now rapidly declining). This week’s upside surprise on January retail sales leaves real consumer spending tracking around 5.0% annualized growth this quarter. Spending may stumble in February, partly due to weather conditions across the country, but we expect the stimulus package will support a rebound in consumer spending as early as March."

In sum, between the effect of the $900BN December stimulus and the upcoming $1.7 Trillion Biden stimulus, JPM "now expects real GDP growth at a 5.0% pace this quarter, and 6.4% (4Q/4Q) in 2021."

The soaring GDP will naturally help depress unemployment, and in JPM's new forecast the unemployment rate reaches 4.0% by the middle of next year, which is also the bank's estimate of the natural rate of unemployment.

Hilarious, Feroli then says that in its "forecast the economy doesn’t overheat, in the sense of displaying significant, persistent, above-2% inflation. The experience of the last expansion confirms model findings that it takes a fairly lengthy period of sustained tightness in resource utilization to shift the inflation trend. Even if there are slack resources this year, rapid growth could generate inflation if reallocation frictions cause supply bottlenecks."

That said, even Feroli who clearly has a mandate to not spark further selling ahead of imminent rate hikes meant to cool off the overheating economy, says he thinks "the stimulus will foster heating, in the sense that it will help get the economy back to 2% inflation—a feat that just Fed forbearance on future rate hikes was much less likely to achieve."

Knowing that clients are laughing out loud at this point, Feroli spends some more digital ink trying to justify his naive assessment, and writes that while "It’s easy to tell a story that inflation will pick up significantly in coming quarters, it’s harder to model it."

Actually, no, Mike one trip to the supermarket should help you model everything you need. In any case, this is how he explains away the lack of soaring inflation on the back of trillions of stimulus spending and an overheating economy:

What those models see is that over the last three decades inflation has been very well-anchored around its trend (or local mean). However, those models wouldn’t foresee a regime shift in fiscal or monetary policy. Perhaps that is underway: to account for this possibility we are leaning to the upside on our model output to get inflation to 2% by the end of next year. An upside risk is that a true regime shift would lead to a much larger move in inflation. A downside risk is that we are succumbing to the common forecasting error of base rate neglect. On net, we see balanced risks around our inflation outlook.

Yeah, ok, we'll check back in six months on this. But while Feroli is wrong on his inflation forecast, where he is right is in observing that while his growth and inflation forecasts have been moving up, "Fed rhetoric has been moving in a more dovish direction" and after the latest FOMC minutes he still sees tapering beginning in 1Q22, the same as Goldman. As for the first rate hike...

While we now see inflation getting to 2% by the end of next year, we continue to think the Fed will want to see another year of inflation gradually moving above 2% before the first rate hike in 1H24.

So three years at 0%... with real GDP and inflation likely hitting 5-6%? We make this rhetorical observation just in case there are still any questions why bitcoin will soon hit $100,000.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more