Infrastructure Investment And Taxes

I talked about infrastructure investment and taxes on WPR today. Will higher corporate tax rates and closing of loopholes in the tax code raise prices of goods produced? Given what happened in the wake of the 2017 reduction in corporate tax rates (i.e., lots of stock buybacks, not much higher investment), I think a resulting price increase is not likely. On the other hand, the infrastructure spending could have an impact on productivity and hence prices.

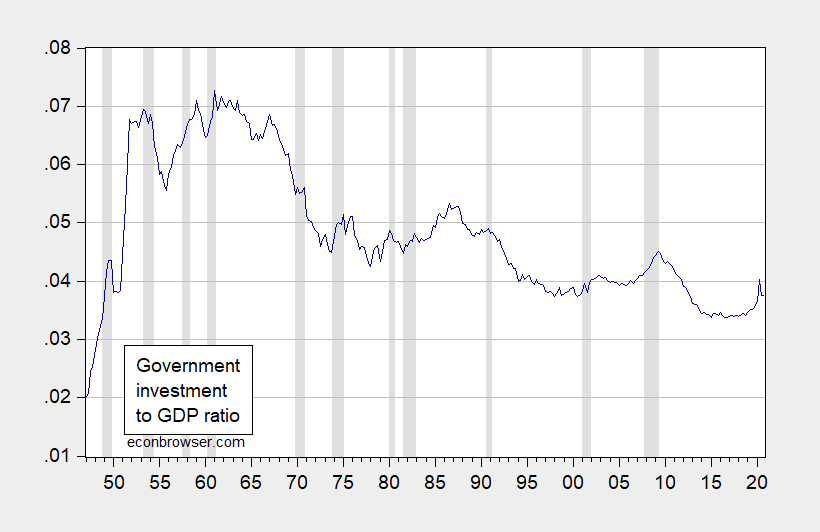

And infrastructure spending has been pretty low…

Figure 1: Government investment as share of GDP (blue). NBER recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

The big question is whether the proposed tax rate increase along with revisions to the measures related to international income taxation will do the trick in terms of raising sufficient revenue.

From Pugliese & Mathews, Wells Fargo (April 1):

President Biden has proposed several changes to corporate taxes to raise revenue for his infrastructure plan. The biggest change from a revenue standpoint would be to raise the corporate income tax rate to 28% from 21% . A general rule of thumb is that a one percentage point increase in the corporate income tax equates to approximately $100 billion of new revenue per year, and most independent estimates are in the ballpark of this rule (Figure 2). Beyond just taking the corporate

rate higher, President Biden has also proposed some other corporate tax policy changes such as introducing a 15% minimum tax on corporations’ “book income”, doubling the rate on global intangible low-taxed income (GILTI) to 21% from 10.5%, assessing the GILTI rate on a country-by-country basis

and eliminating the qualified business asset investment (QBAI) exemption.The AJP also mentions eliminating the tax incentives for foreign derived intangible income (FDII), but it goes on to state that “all of the revenue from repealing the FDII deduction will be used to expand more effective R&D investment incentives,” so we assume that this proposed change does not include any

net new revenue. In addition, the plan also mentions a few other smaller changes, such as more robust tax enforcement and ending “tax preferences for fossil fuels,” but we anticipate that these changes would likely be relatively small from a revenue standpoint.If implemented in full, we project the above tax changes would raise approximately $1.25-$1.50 trillion over the FY 2022-2030 period…

Disclosure: None.