IMF Hikes World Growth Forecast, Small Business Optimism Sinks

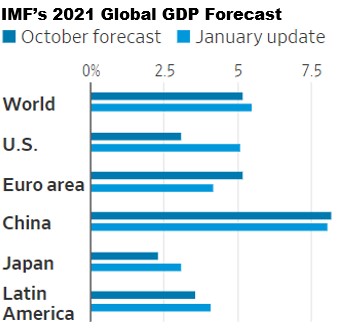

Last week the International Monetary Fund (IMF) raised its forecast for 2021 global economic growth to 5.5%, up from its last estimate of 5.2% in October. Obviously, the IMF expects a strong rebound in 2021 following last year’s global loss of 3.5%. The IMF is the global lender of last resort to countries in distress.

Let me begin by emphasizing that any economic growth estimates you see right now and just ahead should be taken with a grain of salt. With COVID-19 rising again in almost all developed countries, and with new strains of the virus increasing rapidly in many countries, all of the recent economic forecasts are just educated guesses at best.

The IMF admitted its upwardly revised global estimate last week was based on hopes for increasing vaccinations and improved therapies to combat COVID-19, which sparked widespread economic lockdowns last year. But the international lender also warned its latest forecast could be way off the mark if the coronavirus continues to mutate and spread.

IMF Chief Economist Gita Gopinath said in a press briefing last week: “Much depends on the outcome of this race between a mutating virus and vaccines, and the ability of policies to provide effective support until the pandemic ends. There remains tremendous uncertainty, and prospects vary greatly across countries.”

I was also quite surprised to see the IMF raise its 2021 growth forecast for the US from near 3% in October to 5.1% last week. Obviously, the IMF is discounting a double-dip recession in the first half of this, which may be a reasonable position assuming more federal stimulus is coming out of Washington just ahead.

The IMF is also discounting a recession or a slow patch for the US economy in the second half of this year when the effect off the expected stimulus just ahead may have largely worn off. The IMF also increased it forecasts for Japan and Latin America, while trimming the Euro area.

Finally, the IMF noted that rich countries are faring better than poor ones as the global pandemic nears its first anniversary. Low inflation in the US, Europe and Japan has allowed central banks and governments in those regions to keep short-term rates near zero and inject trillions of dollars of fiscal and monetary stimulus.

Their diversified, technologically-advanced and service-oriented economies adapted more smoothly to remote work while suffering relatively less from the shocks to tourism and/or commodity prices. IMF expects this trend to continue in 2021. We’ll see.

US Consumer Confidence Improved in January

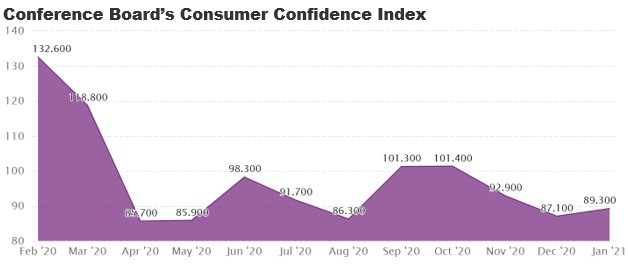

The Conference Board reported last week that its Consumer Confidence Index rose in January to a reading of 89.3, up from 87.1 in December. The Index remains well below it pre-pandemic high of 132.6 in February last year just before the pandemic struck.

The Conference Board’s statement accompanying the latest report noted: “Consumers’ expectations for the economy and jobs advanced further, suggesting that consumers foresee conditions improving in the not-too-distant future. In addition, the percent of consumers who said they intend to purchase a home in the next six months improved, suggesting that the pace of home sales should remain robust in early 2021.”

This is yet another forecast which depends in large part on what the COVID-19 pandemic does just ahead. We know many consumers are sitting on a pile of cash they saved during the economic lockdowns last year. The only question is, when will they be confident to spend it?

Small Business Optimism Index Plunges Again Late 2020

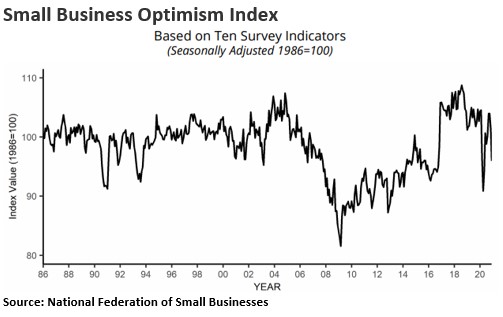

As you can see in the chart below, the Small Business Optimism Index tracked by the National Federation of Small Businesses (NIFB) responded from a record low in 2009 to a new modern-day high in 2018.

Since then, it has trended lower again and experienced a very sharp decline in early 2020 as the pandemic unfolded. Yet as you can also see, it recovered in the middle of last year, only to plunge again in December as the COVID news worsened.

I’ll close with a final thought for you to think about when it comes to small business optimism, or lack thereof. Many small businesses are “S” Corporations, and their owners generally pay tax on business profits at their individual tax rate.

President Biden vows to increase the individual tax rate back to 39.6% just ahead, which means the small business tax on profits will also be at that higher tax level. I can assure you such an increase will not bode well for small business optimism. And let’s not forget that small businesses historically account for 70% of all new jobs.

President Biden and most Dems are hellbent on raising taxes pretty much across the board, especially on high income earners, which includes many small business owners. Bottom line: This is not good for the economy.