If You’re Not Long, You’re Wrong

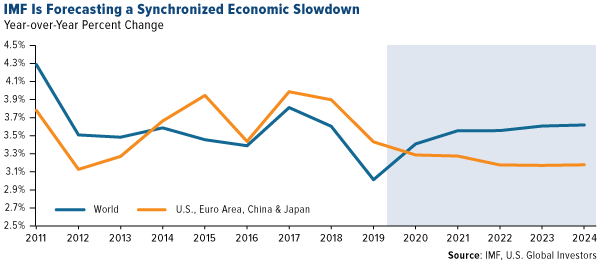

I’m bullish going forward despite signs that the world could be facing its worst economic slowdown since the financial crisis. Just last week, the International Monetary Fund (IMF) downgraded its 2019 growth forecast to 3 percent, a significant drop from the past couple of years.

The reason for my bullishness is simple: Bad news is good news. Policymakers and heads of states see the threat of a slowdown and are more likely to enact stimulus measures to prevent a full-blown recession. This is especially the case in nations with upcoming federal elections—the biggest one being the U.S. presidential election.

President Donald Trump is under pressure from a series of House investigations, not to mention an impeachment inquiry that’s near guaranteed to result in official articles of impeachment. Be that as it may, Trump is the only U.S. president that I’m aware of who sees the market as a barometer of his policies’ success. Every morning, after he wakes up and coifs his hair in the mirror, he wonders what his administration can do to drive stocks higher. We’ve already seen aggressive corporate tax cuts and a wave of deregulation, and we may expect to see more as Trump seeks reelection. So even though you may not like the man’s governing style or his Twitter activity, he always has investors’ interests in mind.

Fiscal-Monetary Imbalance Is a Global Growth Headwind

The same cannot be said of policymakers in the European Union (EU), where much of the slowdown is currently happening. Germany, the world’s fourth largest economy, is facing a recession. The problem is that there’s a massive imbalance between fiscal and monetary policymaking. Instead of doing as the U.S. has done—cutting taxes, rolling back business-killing regulations—EU strategy has been to keep rates at near-zero or lower. Denmark, for instance, now pays borrowers to take out a mortgage.

This is unsustainable, and there are many market watchers, including Bill Gross, who believe we’ve seen the end of what negative rates can achieve. In his most recent investment outlook, the legendary co-founder of PIMCO says that zero-bound easing may have helped asset markets over the past decade, but it will not be enough to keep the bull market running.

This is unsustainable, and there are many market watchers, including Bill Gross, who believe we’ve seen the end of what negative rates can achieve. In his most recent investment outlook, the legendary co-founder of PIMCO says that zero-bound easing may have helped asset markets over the past decade, but it will not be enough to keep the bull market running.

Central bank governors “are becoming wise to the negative effects of rates at zero (or less) that literally rob small savers and larger financial institutions such as banks, insurance companies and pension funds of their ability to earn historically ‘guaranteed’ carry,” Gross writes.

To prepare for “slow economic growth globally,” he has a tried-and-true solution: “High yielding, secure-dividend stocks are what an astute investor should begin to own.”

I agree. If you’re not long, you’re wrong.

A Year Since Canada Legalized Recreational Cannabis

One year ago last week, Canada became the first major country to legalize recreational cannabis for adults. (Uruguay was the very first to do so, in December 2013.) As such, a few other countries—including Luxembourg, Mexico, New Zealand and Russia—are keeping their eyes on Canada to see how things are going.

And with good reason: It’s estimated that the size of Canada’s recreational market will hit $5.2 billion by 2024, up from $569 million in 2018, for an incredible compound annual growth rate (CAGR) of 44.4 percent.

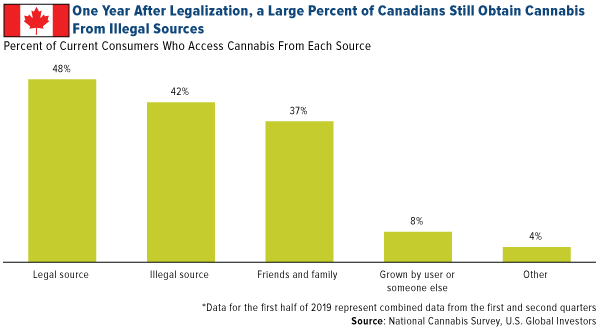

I was in Vancouver last week and the local news spent a lot of time reflecting on this important milestone. I was surprised to learn that, despite legalization, a significant percent of Canadians still get their cannabis from illegal sources. About half of Canadians said they bought supply from a legal source in the first half of 2019, while a whopping 42 percent said they bought it from an illegal source.

The main reason for this is that rollout has been cautiously slow. To date there are only seven official BC Cannabis Store locations in all of British Columbia, none of them in Greater Vancouver.

The same caution is being taken with edibles, which became legal for the first time this past week. (“Edibles” is the catch-all term for THC-infused products such as gummies, cookies, beverages and topical creams.) Even though they’re now legal, they won’t actually be on store shelves for another few weeks as the Canadian government begins accepting applications from companies seeking to produce and sell the products.

It’s a work in progress, but an exciting one nonetheless. For early-stage investors in particular, there’s definitely money to be made.

Disclaimer: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be ...

more