Huge US Jobs Miss, But Don’t Get Too Gloomy

Hiring in August slowed sharply as rising Covid cases and hospitalizations made consumers and businesses more cautious. The more positive spin would be that the underlying fundamentals are in good shape with businesses clearly wanting to hire, but they are struggling to find staff. Either way a September Fed taper looks unlikely.

Jobs miss as Covid rises

We have a huge downside miss for non-farm payrolls in August, coming in at 235k versus 733k consensus. There were 133k of upward revisions, but it is still far weaker than hoped. Coupled with the resurgence of Covid it likely removes any chance of a Fed September taper, but November still looks good.

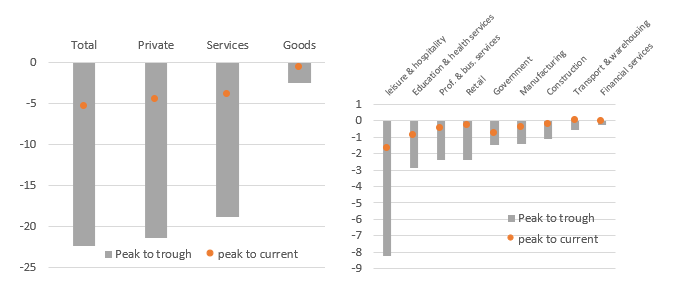

Employment changes by sector through the pandemic

Macrobond, ING

Rising Covid cases have clearly impacted industries such as leisure and hospitality given the numbers we have seen on restaurant bookings and air travel and it is also evident in today’s labour data with a net zero jobs in this sector created last month. Retail fell 29k while construction, government and temporary help supply were down a fraction. There is obviously the risk that September’s report is soft as well given the virus case numbers and rising hospitalisations.

But a lack of workers is also a factor

However, before we get too gloomy we need to acknowledge that the household survey tells a better story with the unemployment rate dropping to 5.2% from 5.4% with household employment rising 509k. Meanwhile wages surged 0.6% month-on-month/4.3% year-on-year. This tallies with the narrative told by the National Federation of Independent Business (NFIB) data that firms want to hire, but there simply aren't the workers available and wages are being bid up as a result. Consequently if we do see the Covid case numbers settle down in the weeks ahead and importantly, labour supply increases, we are likely to see a significant re-acceleration in job creation.

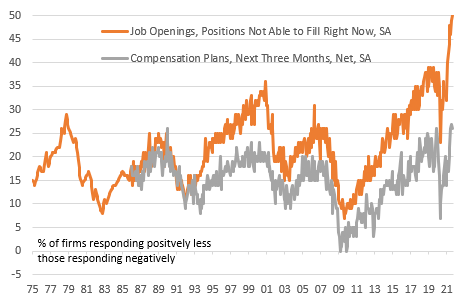

NFIB shows small businesses are struggling hire and are paying up to do so

Macrobond, ING

Lack of suitable candidates holds back the recovery

Moreover, that NFIB survey contains some startling figures. A net 50% of small businesses have vacancies that they can’t fill (a 48-year high) with a net 41% currently raising worker compensation (also a 48-year high) as they desperately try and attract staff. A net 32% plan to hire more staff in coming months (yet another 48-year high), but with 91% of respondents seeing no or few “qualified” candidates, they aren’t optimistic on achieving that. This tells us that the underlying fundamentals of the jobs market are excellent. The risk to my mind is that labour supply won’t return particularly rapidly and wages will continue rising and inflation stays much higher for much longer.

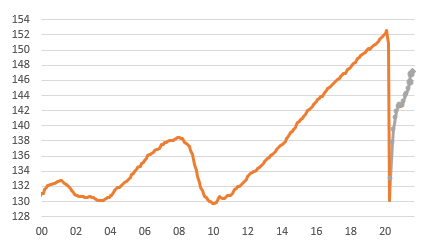

Employment remains 5.33mn below February 2020 level

Macrobond, ING

As for the Fed taper, Fed Chair Powell remains more cautious than many of his colleagues with the resurgence of Covid leading him to warn against implementing an “ill-timed policy move” at last week’s Jackson Hole Symposium. Another of his key quotes was “we have much ground to cover to reach maximum employment” before the Fed can say “substantial further progress” condition has been met. After today’s soft figure employment does indeed remain 5.33mn below the February 2020 peak so this will likely dampen the enthusiasm from several regional Fed Presidents for a September taper. Given our reasons for optimism November looks a decent date for that announcement with a December start point.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more