Here Are All The "Technical Obstacles" Standing In The Way Of Global Corporate Tax Deal

Even after the G-7 struck a tentative deal during its recent meeting, a comprehensive reworking of the OECD's international tax framework - what would constitute the biggest shakeup on the international tax front in a century - will require the consent of dozens of nations, including countries like Ireland, Indonesia and Singapore which have successfully used their low tax rates to drive economic development. Any one of these can sabotage the deal by refusing to lower tax rates.

To try and compensate for this, the Biden Administration is promising foreign governments that they will be entitled to a bigger piece of the profits generated by American multinationals. The G-7 deal would have applied this "carrot" on "profit exceeding a 10% margin for the largest and most profitable multinational enterprises." There have even been talks to specifically exclude Amazon's low-margin e-commerce business, allowing the tax to be based on profits from its more lucrative divisions, like AWS.

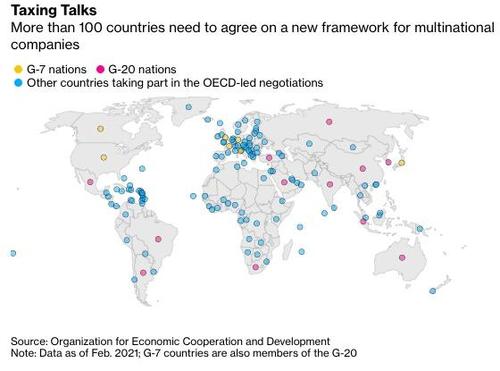

Over the coming weeks, diplomats will hold talks involving more than 100 governments about the new corporate tax framework ahead of a G-20 meeting in July where Washington hopes the outlines of a deal can come together. For the plan to succeed, more than 100 nations would ultimately need to agree on it.

Source: Bloomberg

Given the staggering scope of competing interests involved, as corporations jockey to be excluded from the tax while countries jockey for all sorts of special interest carve-outs, Bloomberg reports that the process could ultimately take years - even as the administration pushes for a significant breakthrough by the end of the summer - and involve a complex web of legislation to compensate for myriad "technical" complications. These include:

- Agreeing which companies will be covered, and deciding how governments can still use tax incentives to encourage virtuous economic activity despite a minimum rate, are among several other challenges that have overshadowed years of talks hosted by the Organization for Economic Cooperation and Development.

- The Intergovernmental Group of 24 developing countries, which includes Brazil, India, and South Africa, wants the scope to gradually broaden to include more than 100 companies, according to a policy note it sent to other governments last month.

- Nations must also decide how much tax revenue to share after the G-7 agreed to reallocate “at least 20%” of profits above a 10% margin. Developing economies want the biggest possible wedge of tax income from multinationals operating in their territories.

- If financial services are excluded from a deal as expected, that poses another challenge since drawing a clear line between them and tech companies is getting harder.

- Ireland remains a "hard sell":

- In addition, some countries including China want exclusions in the rules that allow them to attract high-tech investment with tax incentives. “Minimum tax is devolving part of tax sovereignty and how you maintain incentives over a particular kind of foreign investment,” said David Linke, Global Head of Tax & Legal at KPMG. “That’s a difficult issue.”

- To be sure, Biden has a big carrot to offer: The OECD estimates an extra $150 billion a year could be generated from tougher US rules on foreign income and a 15% global minimum rate.

- A deal could involve dropping a host of levies on mainly American tech firms that countries enacted unilaterally in recent years and which prompted US threats of retaliation. Negotiators must agree on which measures will be rolled back and when, so to restore trust.

- Implementing new rules agreed at G-20 meetings in July or October will require many changes to treaties and domestic laws. This is particularly problematic for the EU, where directives on tax changes throughout the bloc require unanimity, and several countries may object to such legislation enforcing a OECD deal. Aside from Ireland's reservations on a 15% minimum tax, Hungarian Prime Minister Viktor Orban called that plan "absurd".

- The US could see a challenge from Republicans, since a deal may need legislation in Congress, and treaty changes in the Senate that require a two-thirds' majority vote.

While Democrats largely support Yellen's effort, with so many obstacles, it's impossible for Biden to bank on this as he prepares to raise taxes. But since he has already committed to the spending, it's likely that the Administration will proceed anyway, abandoning its promises to offset new spending with taxes, and ultimately allowing the Fed to monetize the bulk of the spending, which could create problems since the central bank might finally be forced to start raising interest rates before then.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more