Hauser's Law, Updated For 2019

Back in 2009, we wrote about Hauser's Law, which at the time, we described as "one of the stranger phenomenons in economic data". The law itself was proposed by W. Kurt Hauser in 1993, who observed:

No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP.

In 2009, we found total tax collections the U.S. government averaged 17.8% of GDP in the years from 1946 through 2008, with a standard deviation of 1.2% of GDP. Hauser's Law had held up to scrutiny in principal, although the average was less than what Hauser originally documented in 1993 due to the nation's historic GDP having been revised higher during the intervening years.

We're revisiting the question now because some members of the new Democrat party-led majority in the House of Representatives has proposed increasing the nation's top marginal income tax rate up to 70%, nearly doubling today's 37% top federal income tax rate levied upon individuals. Since their stated purpose of increasing income tax rates to higher levels is to provide additional revenue to the U.S. Treasury to fund their "Green New Deal", if Hauser's Law continues to hold, they can expect to have their dreams of dramatically higher tax revenues to fund their political initiatives crushed on the rocks of reality.

Meanwhile, the U.S. Bureau of Economic Analysis completed a comprehensive revision to historic GDP figures in 2013, which significantly altered (increased) past estimates of the size of the nation's Gross Domestic Product.

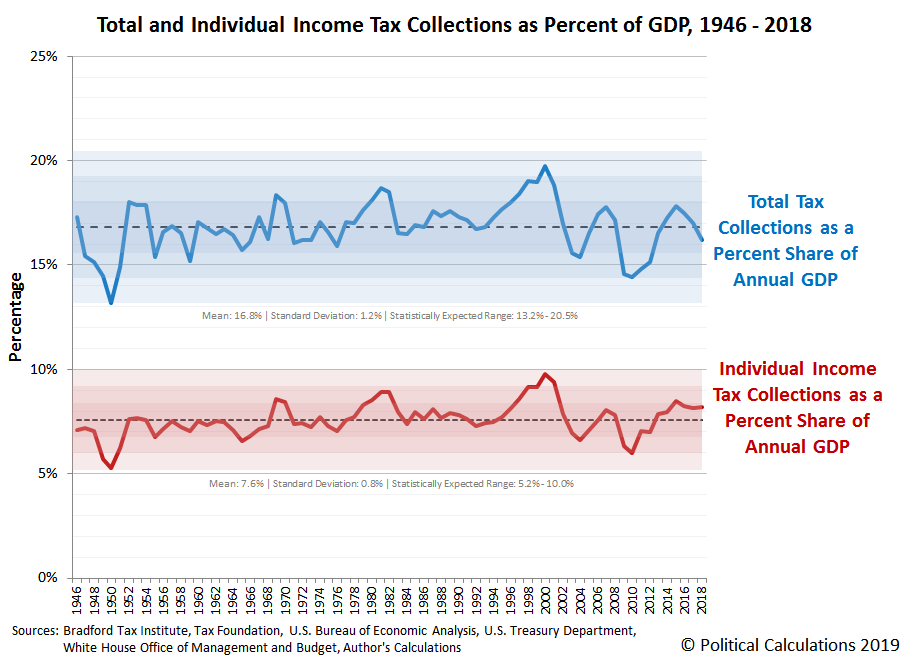

The following chart shows what we found when we updated our analysis of Hauser's Law in action for the years from 1946 through 2018, where we're using preliminary estimates for the just-completed year's tax collections and GDP to make it as current as possible.

(Click on image to enlarge)

From 1946 through 2018, the top marginal income tax rate has ranged from a high of 92% (1952-1953) to a low of 28% (1988-1990), where in 2018, it has recently decreased from 39.6% to 37% because of the passage of the Tax Cuts and Jobs Act of 2017.

Despite all those changes, we find that the U.S. government's total tax collections have averaged 16.8% of GDP, with a standard deviation of 1.2% of GDP. Applying long-established techniques from the field of statistical process control, that gives us an expected range of 13.2% to 20.5% of GDP for where we should expect to see 99.7% of all the observations for tax collections as a percent share of GDP.

And that's exactly what we do see. The next chart zooms in on the total tax collections as a percent share of GDP data from the first chart, and adds the data for individual income tax collections as a percent share of GDP below it.

(Click on image to enlarge)

What we find is that the federal government's tax collections from both personal income taxes and all sources of tax revenue are remarkably stable over time as a percentage share of annual GDP, regardless of the level to which marginal personal income tax rates have been set. The biggest deviations we see from the mean trend to be associated with severe recessions, when tax collections have tended to decline somewhat more than the nation's GDP during periods of economic distress.

We also confirm that the variation in total and personal income tax receipts over time is well described by a normal distribution. We calculate that personal income tax collections as a percentage share of GDP from 1946 through 2018 has a mean of 7.6%, with a standard deviation of 0.8%.

For both levels of tax collections, if Hauser's Law holds, we would then expect any given year's tax collections as a percent of GDP to fall within one standard deviation of the mean 68% of the time, within two standard deviations 95% of the time, and within three standard deviations 99.7% of the time. And that is what we observe with the reported data from 1946 through 2018.

As for high tax revenue aspirations, we can find only three periods where tax collections rose more than one standard deviation above the mean level.

- In 1968, the Democratic U.S. Congress and President Lyndon Johnson passed a 10% income surtax that took effect in mid-year, which suddenly raised the top tax rate from 70% to 77% (which increased the amount collected from top income tax earners by 10%.) Coupled with a spike in inflation, for which personal income taxes were not adjusted to compensate, this tax hike led to outsize income tax collections in that year.

- The sustained high inflation of 1978 (7.62%), 1979 (11.22%), 1980 (13.58%) and 1981 (10.35%) led to higher tax collections through bracket creep, as income tax brackets in the U.S. were not adjusted for inflation until 1985 as part of President Ronald Reagan's first term Economic Recovery Tax Act.

- Beginning in April 1997, the Dot Com Stock Market Bubble minted a large number of new millionaires as investors swarmed to participate in Internet and "tech" company initial public offerings or private capital ventures, which in turn, inflated personal income tax collections. Unfortunately, like the vaporware produced by many of the companies that sprang up to exploit the investor buying frenzy, the illusion of prosperity could not be sustained and tax collections crashed with the incomes of the Internet titans in the bursting of the bubble, leading to the recession that followed.

Now, what about those other taxes? Zubin Jelveh looked at the data back in 2008 and found that as corporate income taxes have declined over time, social insurance taxes (the payroll taxes collected to support Social Security and Medicare) have increased to sustain the margin between personal income tax receipts and total tax receipts. This makes sense given the matching taxes paid by employers to these programs, as these taxes have largely offset a good portion of corporate income taxes as a source of tax revenue from U.S. businesses. We also note that federal excise taxes have risen from 1946 through the present, which also has contributed to filling the gap and keeping the overall level of tax receipts as a percentage share of GDP stable over time.

Looking at the preliminary data for 2018, which saw both personal and corporate income tax rates decline with the passage of the Tax Cuts and Jobs Act of 2017, we see that total tax receipts as a percent of GDP dipped below the mean, but still falls within one standard deviation of it, just as in over two-thirds of previous years. Tax receipts from individual income taxes however rose slightly, despite the income tax cuts that took effect in 2018, staying above the mean but still falling within one standard deviation of it.

Hauser's Law appears to have held up surprisingly well over time.

References

Bradford Tax Institute. History of Federal Income Tax Rates: 1913-2019. [Online Text]. Accessed 13 January 2019.

Tax Foundation. Federal Individual Income Tax Rates History. [PDF Document]. 17 October 2013.

U.S. Department of the Treasury. September 2018 Monthly Treasury Statement. [PDF Document]. 17 October 2018.

U.S. Bureau of Economic Analysis. National income and Product Accounts Tables. Table 1.1.5. Gross Domestic Product. [Online Database]. Last Revised: 21 December 2018. Accessed: 14 January 2019.

U.S. White House Office of Management and Budget. Budget of the United States Government. Historical Tables. Table 1.1. Summary of Receipts, Outlays, and Surpluses or Deficits (-): 1789-2023. Table 2.1. Receipts by Source: 1934-2023. [PDF Document]. 12 February 2018.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more