Goldilocks And The 3 Bears Of “Layoffs, Unemployment Claims, And Payrolls”

What to Expect from NFP and the R-Word

Non Farm Payrolls (NFP) are released Friday morning. Markets have had the mighty tailwind of ever decreasing employment rates and strong job gains during this past long cycle post Great Financial Crisis.

Given all of the faltering, in some cases shocking, US and Global economic data signifying slowdown, NFP seems the last indicator of impenetrable strength that Wall Street and die-hard Bulls are hanging their hat on.

Problem is, we have had 9 months in a row of year over year increase in layoffs.

In short, Layoffs have been climbing but not yet “showing up” in NFP and employment rates. Having said that, we’re close. It’s the last great lagging indicator to turn before Recession fears truly appear.

Recessions “cause” unemployment rate to go up, not the other way around (the UR is a lagging indicator)…employment works like this: H/T Liz Sonders

- Layoffs = leading leading indicator

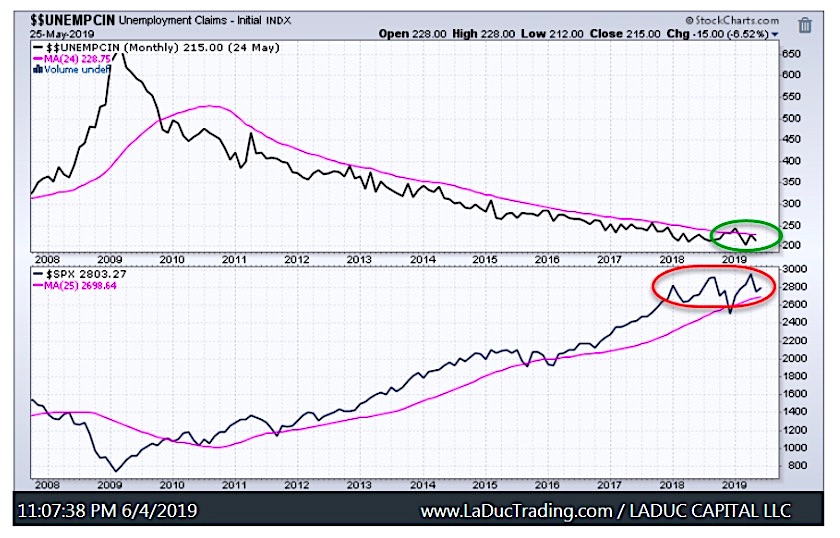

- Unemployment claims = leading indicator

- Payrolls = coincident indicator

- Unemployment rate = lagging indicator

The average span between unemployment rate-troughs and “recession starts” has been 6.4 months. However, the duration of the S&P 500 (SPY) peaking with trough unemployment is evident in my chart below. Not only are we close to turning, in 3 of the 5 last times when US unemployment was at the current level, the S&P 500 peaked within 10 months. Well, the current unemployment rate has been at or <3.9% for 12 months already.

We have a “Goldilocks” market that can quickly turn into the Three Bears of “Layoffs, Unemployment Claims and Payrolls” chasing her out of the house!

What To Expect From Powell/Fed

U.S. INTEREST RATE TRADERS are now pricing in almost two full cuts in the fed funds target before the end of the year. Fed funds futures for Jan 2020 imply an expected rate of just 1.95% compared with current rate of 2.39% (and target of 2.25-2.50%). U.S. TREASURY YIELD CURVE is moving deeper into inverted territory — with 10-yr note rates now more than 19 basis points below 3-month bills. U.S. TREASURY YIELD CURVE inversion is anticipating highest likelihood of recession since 2007 (before 2008 downturn). Recession risk is now well above levels that preceded recessions in 2001 and 1990. So what can the Fed do to ward off economic slowdown AND a rate-cutting policy that might trigger a Recession?

Damned if he does and Damned if he doesn’t:

My Take: Powell is loathe to cut, but he is intonating Fed will cut! No less than 13 Fed Heads are out this week preparing the stage with Powell himself acknowledging “Inflation Shortcomings” at his recent speech Monday night. Rate traders have already front-run this move given the 100 bp drop past six months.

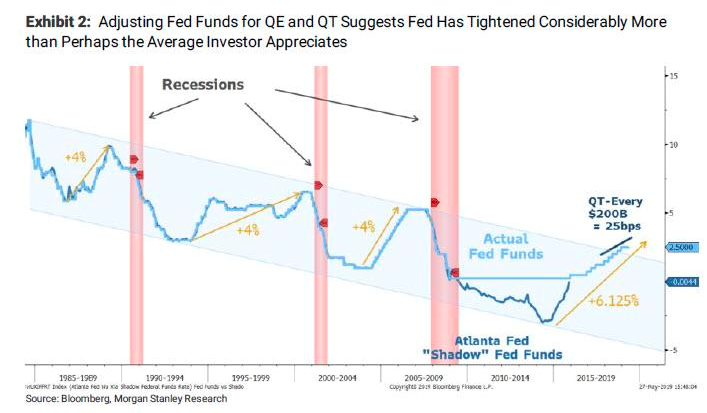

Most don’t expect that if Fed cuts the 10-year yields go UP not down – as market prices in “better economy” – steepening the yield curve. And … Here’s a friendly reminder of what can happen AFTER the Fed cuts: Recession. And judging from the ‘over-tightening’ implied (see chart below) compared to prior cycles, that may be why the bond market is aggressively leading the anticipated rate cut AND why both bond and equity markets are interpreting it as recessionary.

My Take: There’s a good chance market has an initial knee-jerk reaction higher ($2880 SPX for example), before a retreat lower with gusto. A big negative surprise (like the recent ADP print) in NFP may excite the bulls to buy equities on expectations the Fed will cut (reverse psychology works for toddlers and gaming markets I guess), but the diminishing returns of driving up assets on bad data and bad news is as safe as Goldilocks thinking she could make herself at home just before being chased out of the house as the Three Bears return home!