Gold Suffers Worst Week In 3 Years As Fed Balance Sheet Explodes

Remember, this is 'Not' QE...

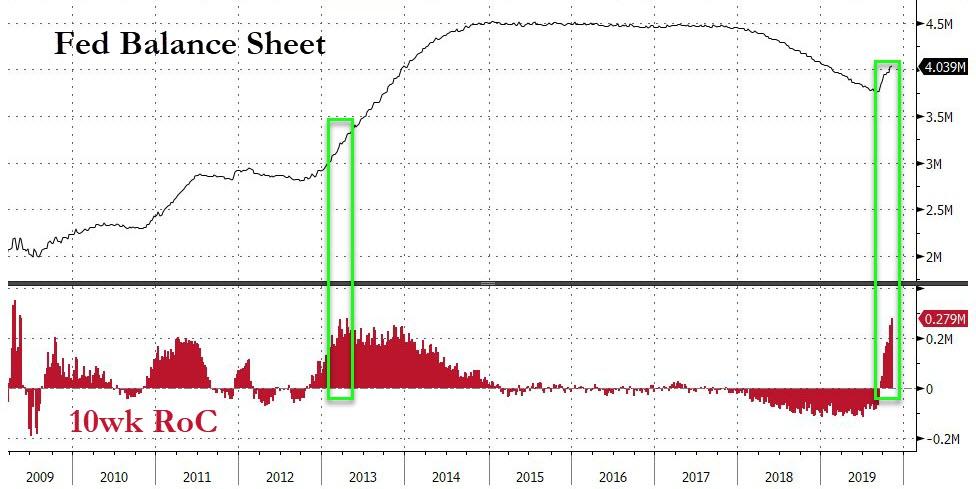

The Fed has expanded its balance sheet for 10 straight weeks (by almost $280 billion) - the biggest such expansion since April 2013, the peak of QE3...

(Click on image to enlarge)

Source: Bloomberg

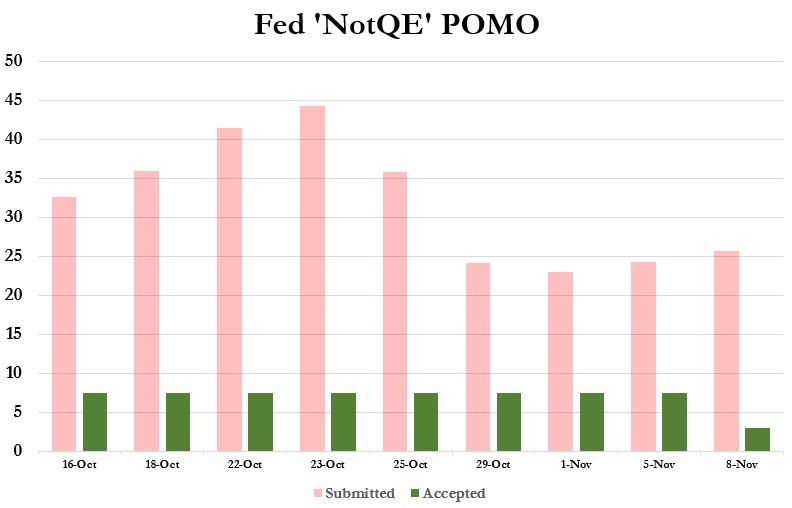

Since The started 'NotQE' POMO...

(Click on image to enlarge)

Stocks haven't had a down week...

(Click on image to enlarge)

Source: Bloomberg

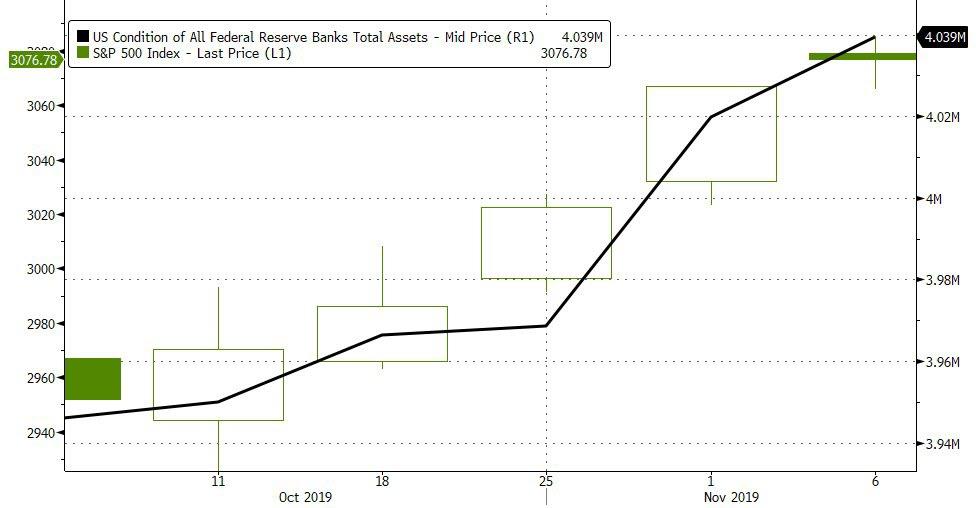

And that explosion in liquidity means fun-durr-mentals collapsing just don't matter...

(Click on image to enlarge)

Source: Bloomberg

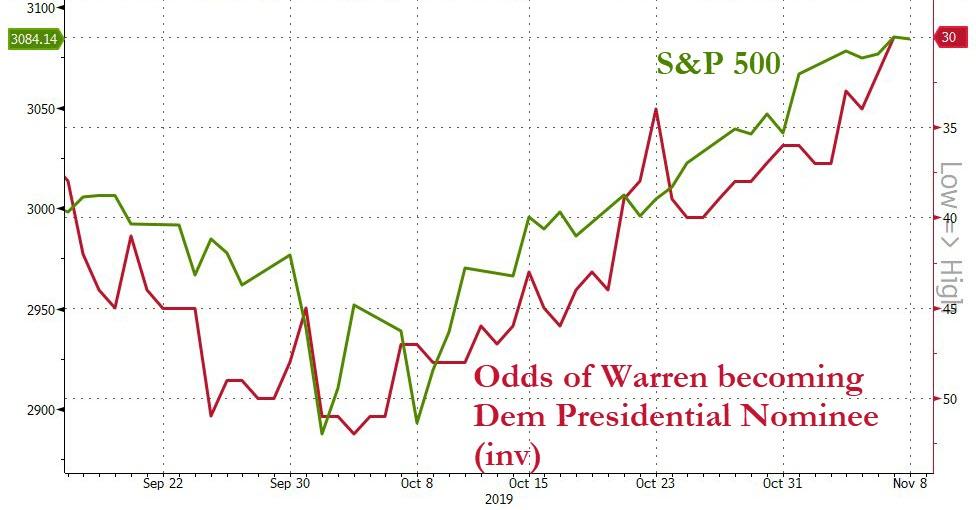

Or maybe there's another reason (stocks have soared non-stop as Warren's odds of getting the nomination have tumbled)...

(Click on image to enlarge)

Source: Bloomberg

All of which made us think... Rep. Alan Grayson: "Has the Federal Reserve Ever Tried to Manipulate the Stock Market?"

Chinese stocks ended the week green but the late Friday session saw notable selling pressure...

(Click on image to enlarge)

Source: Bloomberg

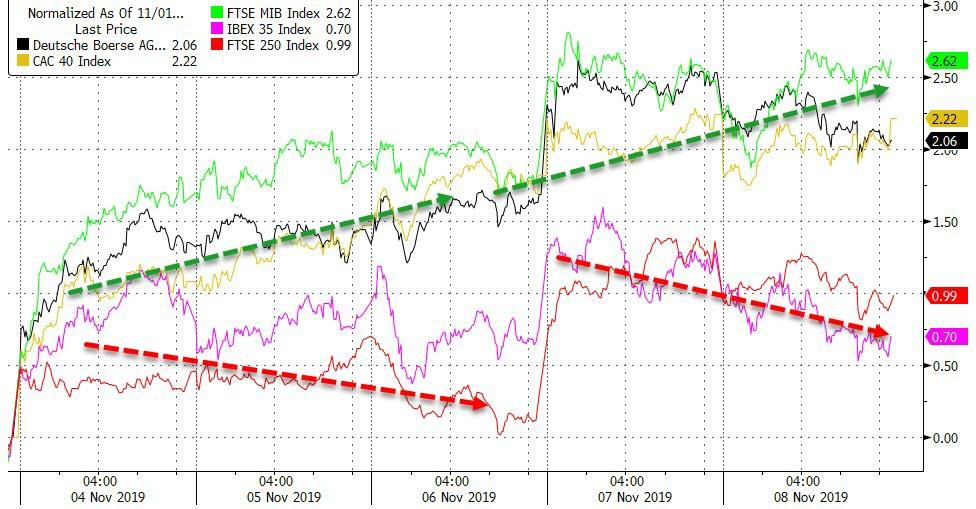

European markets were also higher with a notable divergence between Spain/UK and France/Germany/Italy...

(Click on image to enlarge)

Source: Bloomberg

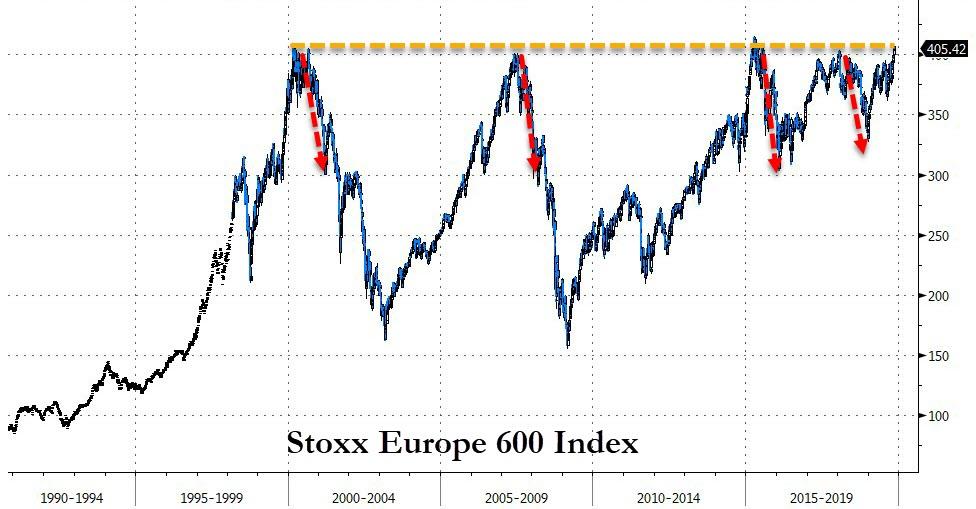

Most notably, European stocks are broadly back near their record highs...

(Click on image to enlarge)

Source: Bloomberg

US equity markets were higher on the week, led by a major move in Trannies all on the back of trade-deal optimism...

(Click on image to enlarge)

It seems, despite Trump's statement that he hasn't agreed to rollback tariffs, the market prefers to believe China/Kudlow over Trump/Navarro...

(Click on image to enlarge)

However, optimism for a US-China trade deal seem to have stalled the last few days...

(Click on image to enlarge)

Source: Bloomberg

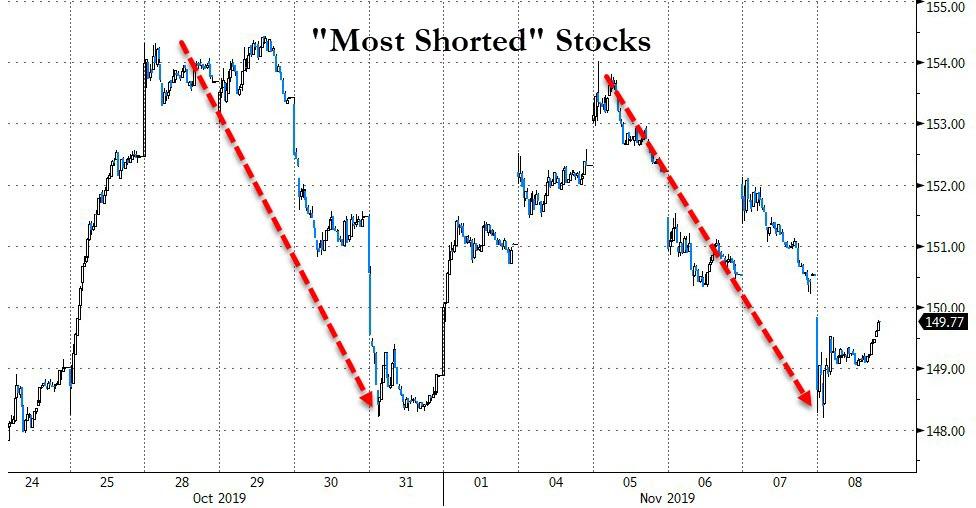

Rather more notably, despite massive intraday squeezes, "most shorted" stocks fell for the second week in a row...

(Click on image to enlarge)

Source: Bloomberg

Momentum had another ugly week (down 5 weeks in a row and this was the worst week since the September momo massacre)...

(Click on image to enlarge)

Source: Bloomberg

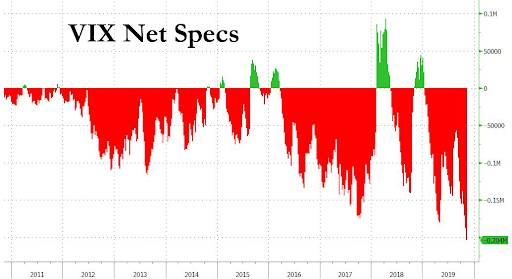

VIX tumbled for the 6th week in a row (longest streak since Feb 2019) barely holding above an 11 handle...

(Click on image to enlarge)

And as VIX tumbled, specs piled into a new record short position...

(Click on image to enlarge)

Source: Bloomberg

Bond yields have tracked Cyclicals/Defensive Stocks almost perfectly...

(Click on image to enlarge)

Source: Bloomberg

Bonds were a bloodbath this week with Treasury yields blowing out around 20bps (short-end outperformed)...

(Click on image to enlarge)

Source: Bloomberg

Pushing the longer-end of the curve to 3-month highs...

(Click on image to enlarge)

Source: Bloomberg

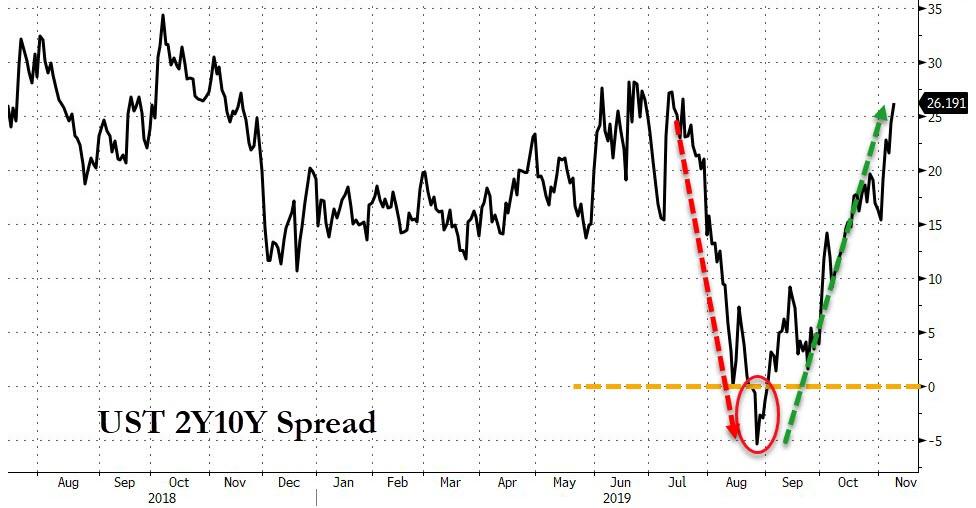

The yield curve exploded this week: 3m10y curve steepened for 5 straight weeks but 2y10y biggest weekly steepening since Feb 2018...

(Click on image to enlarge)

Source: Bloomberg

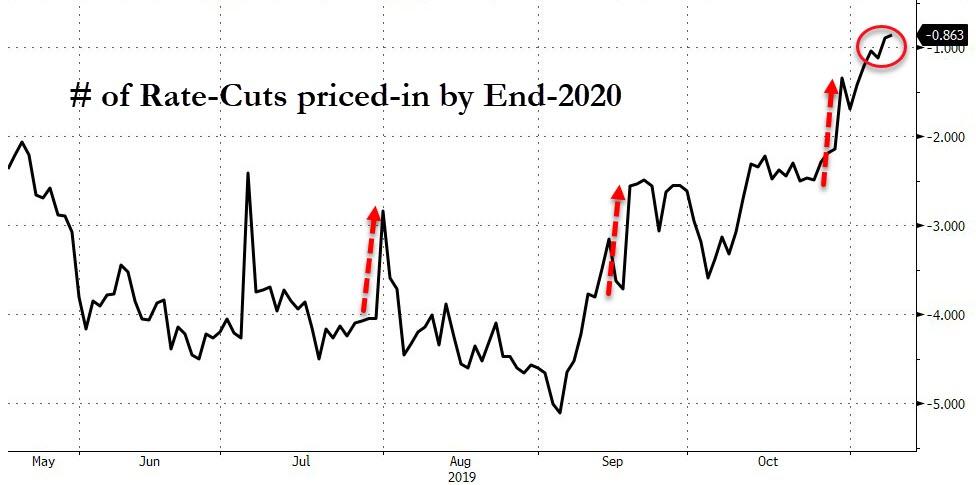

Rates markets are now pricing in less than one rate-cut by the end of 2020...

(Click on image to enlarge)

Source: Bloomberg

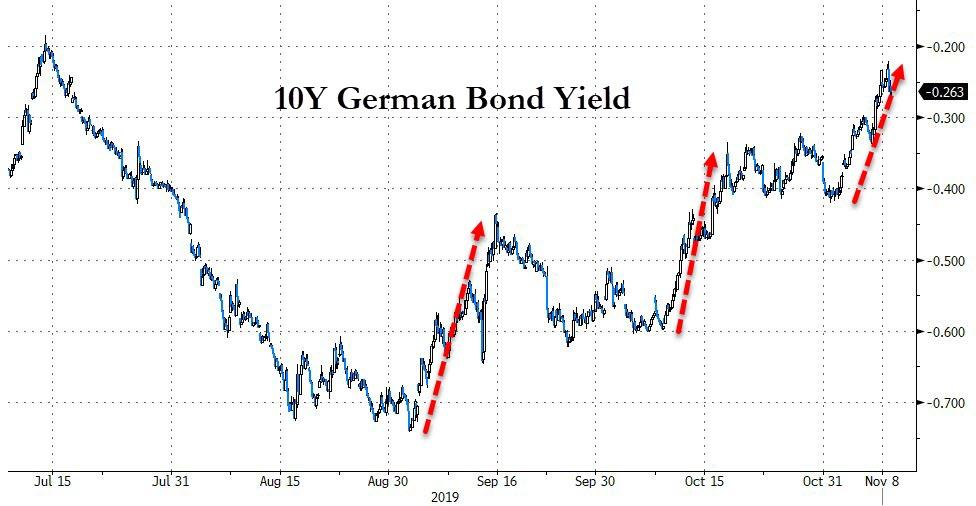

German bond yields have also soared, back near their highest of the year...

(Click on image to enlarge)

Source: Bloomberg

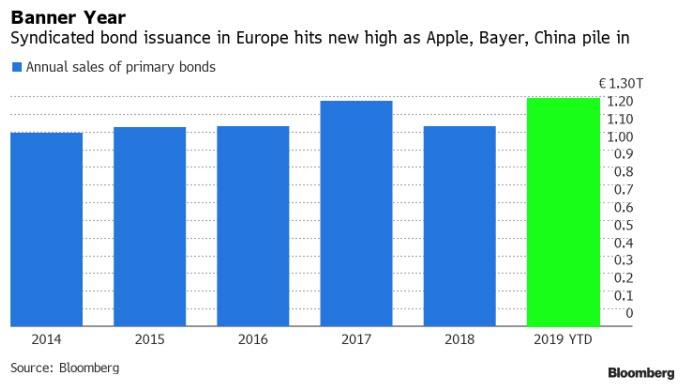

As European issuance has broken the full-year issuance record with more than seven weeks to spare after borrowers including Apple Inc., Bayer AG and the People’s Republic of China piled into the market this week.

(Click on image to enlarge)

Source: Bloomberg

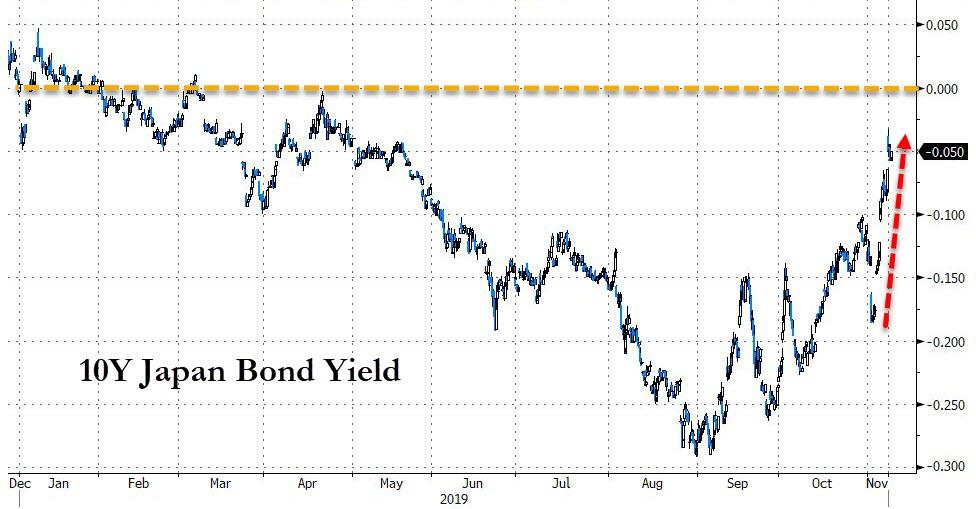

And Japanese bond yields saw the biggest weekly rise since 2013...

(Click on image to enlarge)

Source: Bloomberg

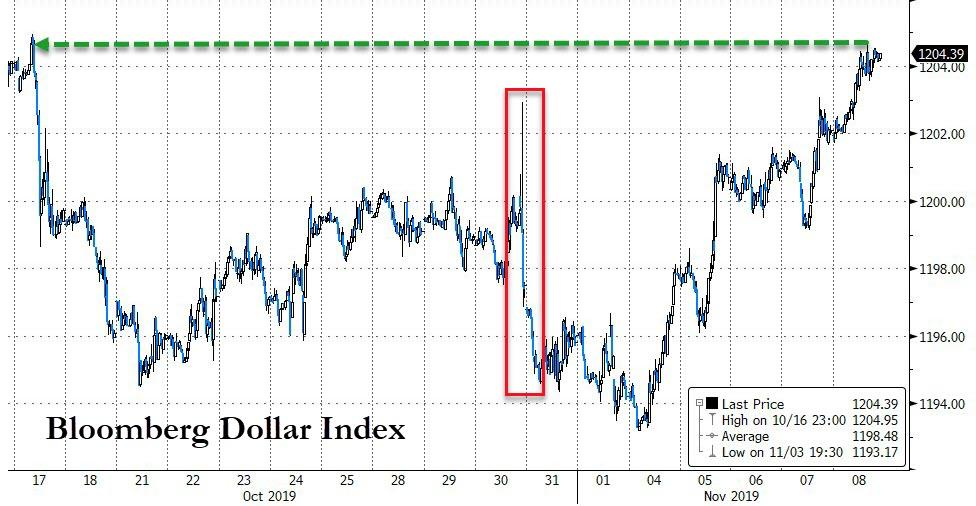

The dollar soared by the most since August 2018 this week...

(Click on image to enlarge)

Source: Bloomberg

Offshore Yuan rallied for the sixth straight week (longest run sine 2018), but trade-deal optimism gains rolled over in the last 24 hours...

(Click on image to enlarge)

Source: Bloomberg

Cryptos had a tough week, tumbling in the last 48 hours...

(Click on image to enlarge)

Source: Bloomberg

Bitcoin broke back below $9,000...

(Click on image to enlarge)

Source: Bloomberg

Commodities were extremely mixed this week with PMs pummeled and crude and copper bid...

(Click on image to enlarge)

Source: Bloomberg

WTI ended back above $57, but could not top $58 at the upper edge of its medium-term range...

(Click on image to enlarge)

Source: Bloomberg

This was Gold's worst week since Nov 2016 (Trump Election)...

(Click on image to enlarge)

...and Silver's worst week since Oct 2016...

(Click on image to enlarge)

Despite gold's tumble on the week, silver was considerably worse, driving the gold/silver ratio to its highest since mid-August...

(Click on image to enlarge)

Source: Bloomberg

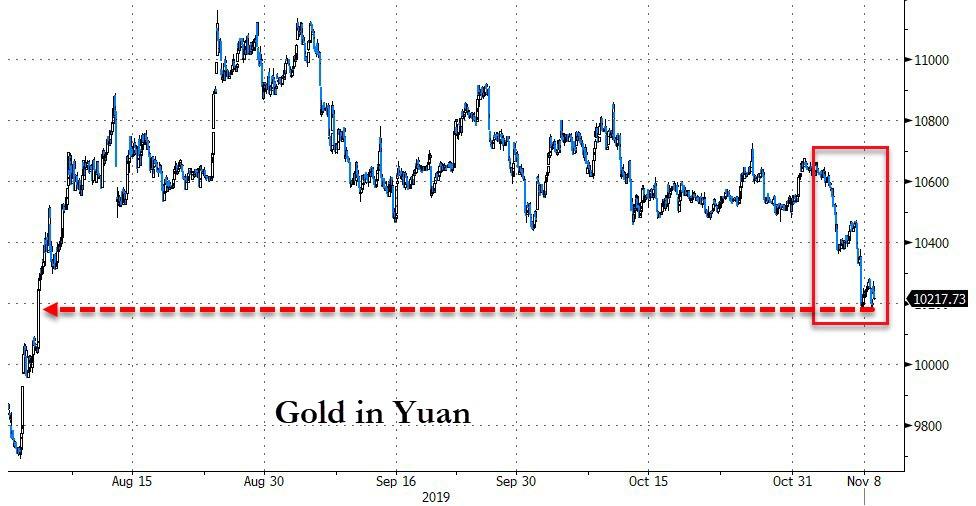

Gold also tumbled against yuan, back to its lowest since early August...

(Click on image to enlarge)

Source: Bloomberg

And as global negative-yielding debt drops below $12 trillion, one wonders if gold has further to fall...

(Click on image to enlarge)

Source: Bloomberg

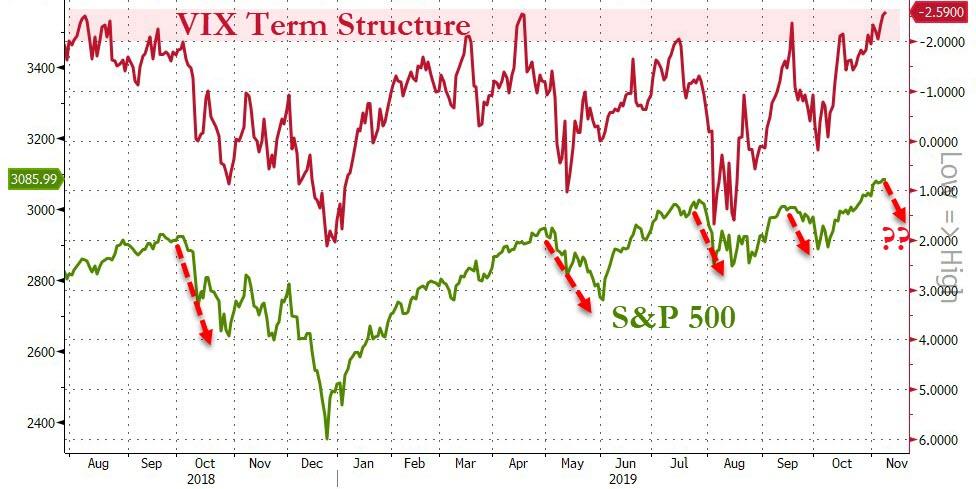

Finally, here a few scary things for melt-up fans to watch...

The surge in yields - we note that despite all the excitement about bond yields rising, signaling to some that growth is back and everything with record-high stocks is awesome again, the last two times that rates accelerate at this pace, things did not end well for stocks...

(Click on image to enlarge)

Source: Bloomberg

Additionally, the steepness of VIX term structure is extreme - a level at which stocks have generally stalled in the past two years...

(Click on image to enlarge)

Source: Bloomberg

And investors are at an "Extreme Greed" level of complacency across multiple asset classes...

(Click on image to enlarge)

And then there's this...

Enough’s enough.

— Otavio (Tavi) Costa (@TaviCosta) November 8, 2019

Fresh 50-year low in the commodities-to-equities ratio.

The next monetary & fiscal experiment will come at a cost.

Major cyclical turn in this ratio likely ahead. pic.twitter.com/gIKtpdp1KB

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more