Gold, Silver: The Fed’s Year Of The Hike

The Fed knows it has to taper soon, but won’t tell this blatantly. However, people started to notice. What does this mean for the precious metals?

The Talk of the Town

While I’ve been warning for months that the U.S. Federal Reserve (Fed) will likely taper its asset purchases much sooner than investors expect, the gossip has finally reverberated across the financial markets.

To explain, I wrote on Jun. 21:

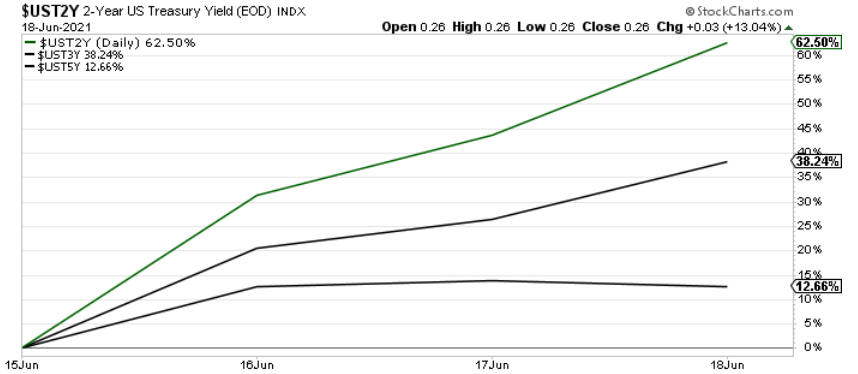

With the Fed’s announcement turning the financial markets upside down, the U.S. 10-Year Treasury yield’s rollercoaster performance didn’t capture the magnitude of the move. For example, with the front-end of the U.S. yield curve becoming increasingly unhinged, the U.S. 2-Year, 3-Year, and 5-Year Treasury yields surged by more than 62%, 38% and 12% respectively following the Fed’s announcement.

Please see below:

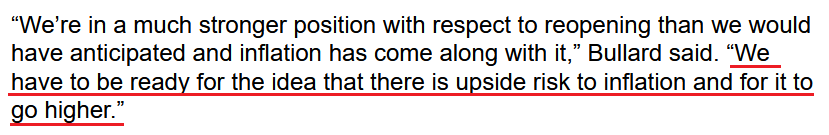

To that point, with the Fed’s critics growing louder by the day, even its own members are sounding the alarm on inflation. Case in point: after St. Louis Fed President James Bullard told CNBC on Jun. 18 that officials saw “more inflation than we were expecting” and added that “I think it’s natural that we’ve tilted a little bit more hawkish,” he reiterated his stance on Jun. 21.

Please see below:

Source: Bloomberg

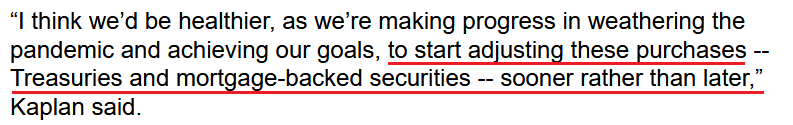

Singing a similar tune, Dallas Fed President Robert Kaplan also said on Jun. 21 that the liquidity splurge has run its course and that “the issue on the table today and in the near term is the timing and adjustment of these purchases.”

Please see below:

Source: Bloomberg

If that wasn’t enough, former U.S. Treasury Secretary Lawrence Summers also voiced his concern that the Fed is already materially behind the inflation curve.

“Much of the consensus of professional forecasters in February was that we would have inflation just above 2% this year,” he said. “We’ve already had more inflation than that in the first five months of the year. This suggests that people should not just modify their forecasts but should think about what their errors of thinking were that led them to be so far off in their forecasts.”

Piling on the poor Fed, former U.S. Treasury Secretary Steven Mnuchin added on Jun. 21 that “there’s no question the Fed needs to go into a period of normalizing rates and normalizing the portfolio … and I do think the markets are underestimating this risk.”

And why does he believe that?

Well, for one, Bank of America’s latest Global Fund Manager Survey revealed that institutional investors are “bullishly positioned for permanent growth, transitory inflation, and a peaceful Fed taper.” Essentially, they expect a Goldilocks environment. And with that, the narrative is that inflation has already peaked.

Please see below:

The blue line above tracks the net percentage of investors forecasting a higher global Consumer Price Index (CPI). If you analyze the right side of the chart, you can see that the blue line has fallen considerably from its prior high. However, with the Personal Consumption Expenditures (PCE) Index scheduled for release on Jun. 25, another inflationary surprise could be lurking around the corner.

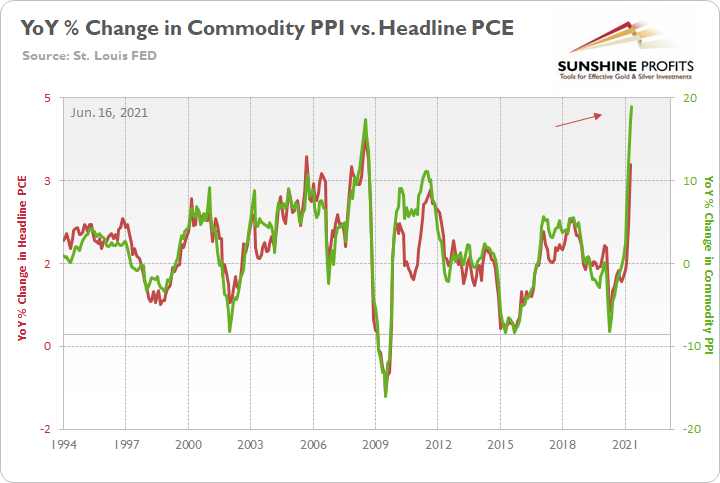

To explain, the Fed increased its year-over-year (YoY) headline PCE Index forecast from a rise of 2.40% YoY to a rise of 3.40% YoY on Jun. 16. However, with the Commodity Producer Price Index (PPI) surging by 18.98% YoY – the highest YoY percentage increase since 1974 – the wind still remains at inflation’s back. Moreover, with all signs pointing to a YoY print of roughly 4% to 4.50% on Jun. 25, the “transitory” narrative could suffer another blow on Friday.

For context, I wrote on Jun. 16:

If we begin with the reported figure [an 18.98% YoY increase], the commodity PPI implies a roughly 4.50% YoY increase in the Personal Consumption Expenditures (PCE) Index.

Please see below:

To explain, the green line above tracks the YoY percentage change in the commodity PPI, while the red line above tracks the YoY percentage change in the headline PCE Index. If you analyze the right side of the chart, you can see that a material gap is clearly visible. What’s more, if we substitute the 18.98% jump with the non-base-effects comparison of 12.60%, it still implies a rise in the headline PCE Index of roughly 3.60%.

Let’s Taper Now… But Don’t Tell Anyone

Furthermore, while investors aren’t paying much attention, the Fed’s tightening cycle has already begun:

- The New York Fed announced on Jun. 3 that it “will begin gradual sales of its holdings of corporate bond exchange-traded funds (ETFs) on June 7.”

- The Fed increased the interest rate on excess reserves (IOER) from 0.10% to 0.15% on Jun. 16.

- The U.S. federal funds rate rose from 0.06% to 0.10% on Jun. 17.

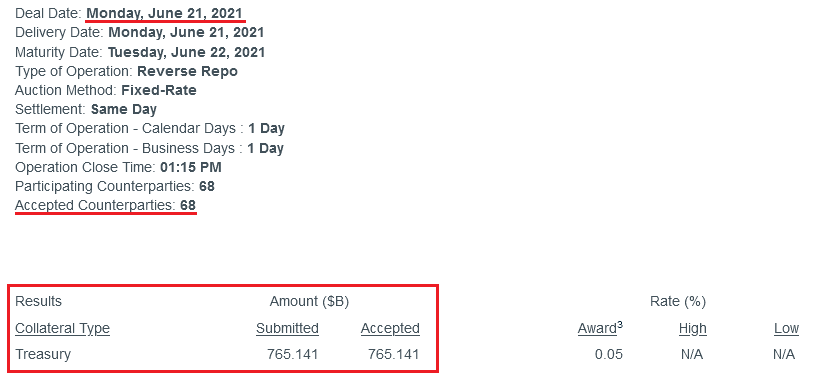

- The Fed sold a record $765 billion worth of reverse repurchase agreements on Jun. 21.

Please see below:

Source: NY FED

To explain, a reverse repurchase agreement (repo) occurs when an institution offloads cash to the Fed in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the Fed at an alarming rate.

More importantly, though, after the $400 billion level was breached in December 2015, the Fed’s rate-hike cycle began. On top of that, the liquidity drain is at extreme odds with the Fed’s QE program. For example, the Fed aims to purchase a combined $120 billion worth of Treasuries and mortgage-backed securities per month. However, with daily reverse repurchase agreements averaging $520 billion since May 21, the Fed has essentially negated 4.33 months’ worth of QE in the last month alone.

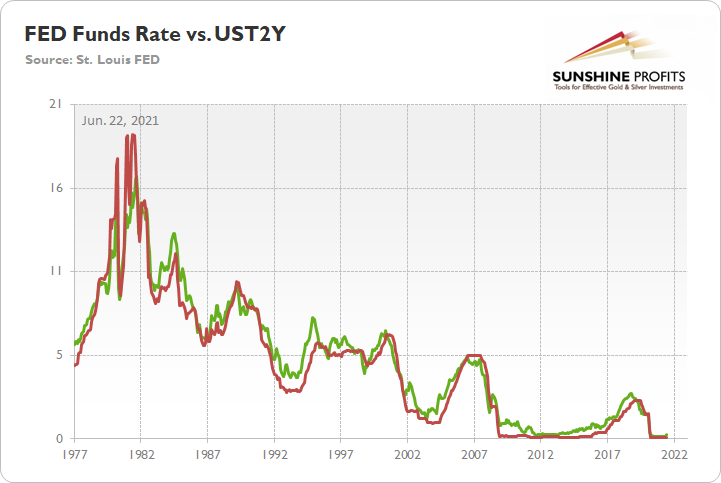

Likewise, I noted at the beginning that the U.S. 2-Year Treasury yield surged by more than 62% following the Fed’s announcement on Jun. 16. And with the short-term benchmark exhibiting a correlation of 0.98 with the U.S. federal funds rate since 1977, further momentum could have the Fed sweating bullets over the summer.

Please see below:

To explain, the green line above tracks the U.S. 2-Year Treasury yield, while the red line above tracks the U.S. federal funds rate. If you analyze the relationship, you can see that the two often follow in each other’s footsteps. Thus, if the former continues its rally, the Fed may find itself behind the interest rate curve.

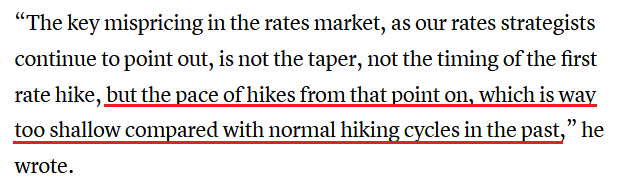

To that point, Hans Mikkelsen, credit strategist at Bank of America, told clients on Jun. 21 that he expects the Fed “to soon begin tapering its [QE] purchases, and to start hiking interest rates earlier than expected – and, most importantly, much faster than currently priced in the markets,”

Please see below:

Source: CNBC

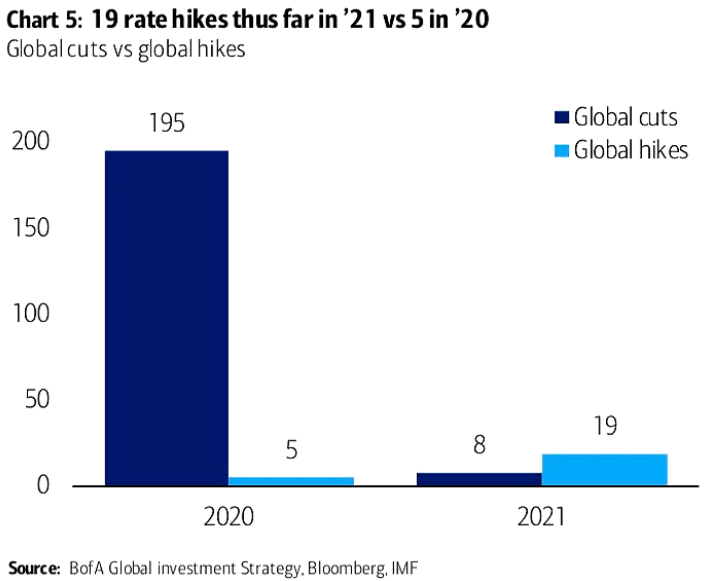

Trends Are Changing

In addition, while 2020 was the year of the cut, 2021 is shaping up to be the year of the hike. To explain, 195 global interest rate cuts were witnessed in 2020 with only five hikes offsetting the dovish nirvana. Conversely, in 2021, we’ve already witnessed 19 global rate hikes and only eight offsetting rate cuts. As a result, not only is liquidity drying up in the U.S., but the global faucet is also starting to creak.

Please see below:

On top of that, with rising interest rates spelling trouble for the PMs over the medium term, the reduction in liquidity could spur volatility across U.S. equities and exacerbate the PMs’ potential selling pressure in the coming months.

Please see below:

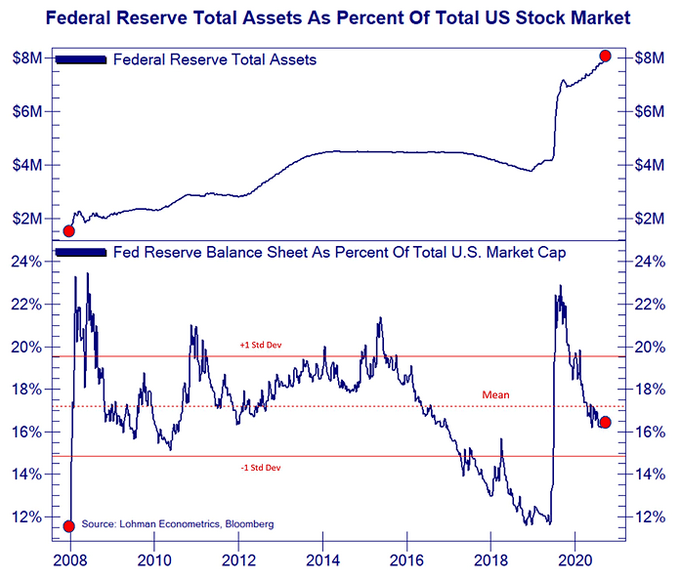

To explain, the blue line at the top half of the chart tracks the Fed’s balance sheet, while the blue line at the bottom half of the chart tracks the Fed’s balance sheet as a percentage of U.S. equities’ total market cap. If you analyze the right side of the chart, you can see that the Fed’s influence peaked in 2020 and has been in free fall ever since. Moreover, with the central bank poised to tighten the liquidity screws in the coming months, a reenactment of late 2018 could weigh heavily on the PMs.

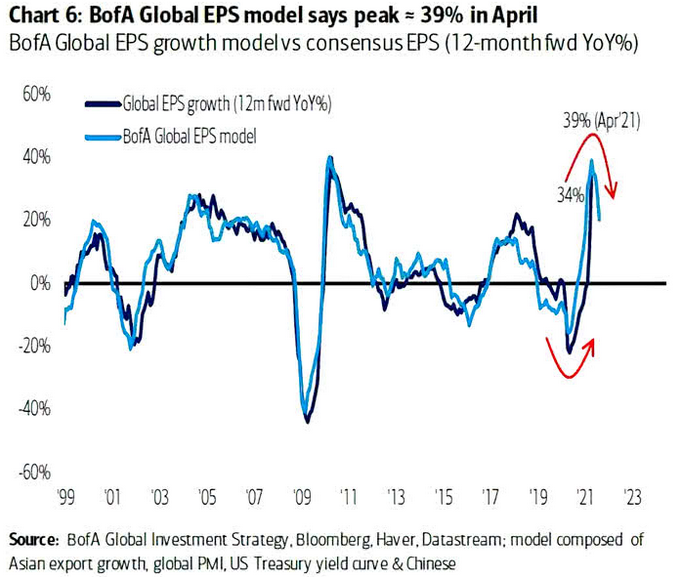

From a valuation perspective, Bank of America’s Global earnings per share (EPS) model signals that growth peaked in April 2021 and that weak quarterly prints could result in high volatility over the next 12 months.

Please see below:

To explain, the dark blue line above tracks the 12-month forward YoY percentage change in global EPS growth, while the light blue line above tracks the future trajectory predicted by BofA’s Global EPS model. If you analyze the right side of the chart, you can see that the light blue line has already moved sharply lower. And if the dark blue line follows suit, global equities could come under severe pressure as investors recalibrate their expectations.

Watch for Out of Tune Singing

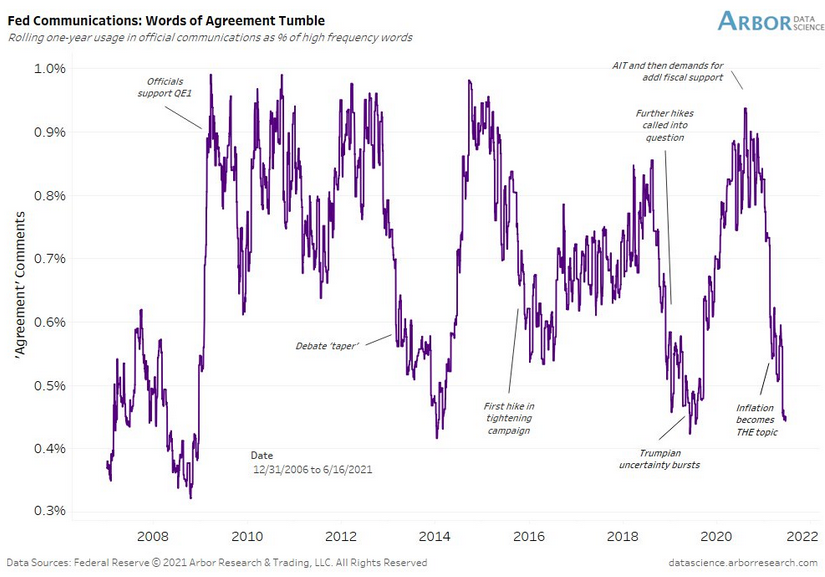

Finally, while I’ve mentioned on several occasions that Fed officials already know that they have to taper (they just don’t want to disclose it publicly and cause a sell-off in the stock and bond markets), their divergent messaging is another sign that a climax is approaching.

Please see below:

To explain, Arbor Data Science tracked Fed officials’ “words of agreement” during various speaking arrangements. When the purple line is rising, it means that Fed officials all support the same narrative. Conversely, when the purple line is falling, it means that Fed officials are sending conflicting signals. If you focus your attention on the right side of the chart, you can see that divergent rhetoric is now at its highest level since the taper tantrum in 2013 and when the Fed reversed course in 2019 following a barrage of interest rate hikes (depicted by the purple lines being extremely low). Moreover, with the last 17 Fed communications showing a further deterioration in “words of agreement,” taper talk should heat up even more over the next few months.

In conclusion, the PMs rallied on Jun. 21 and healed some of their wounds from the past week. And while a short-term bounce remains likely, it’s important to stay mindful of the medium-term catalysts that could pressure the PMs in the coming months. For example, while the front-end of the U.S. yield curve raced to new highs and trampled the PMs, the U.S. 10-Year Treasury yield failed to participate. And with the Treasury benchmark materially undervalued relative to realized inflation and U.S. GDP growth prospects, joining the party could add to the PMs’ troubles over the medium term.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more