Global Economic Growth Will Be Very Slow In 2020 And 2021 Even Assuming A Goldilocks Outlook

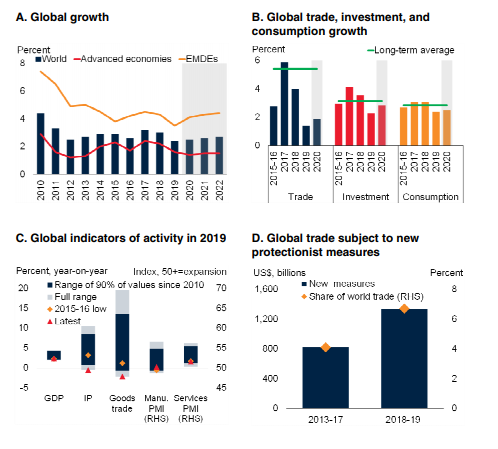

“Global growth is expected to recover to 2.5 percent in 2020—up slightly from the post-crisis low of 2.4 percent registered last year amid weakening trade and investment—and edge up further over the forecast horizon. This projected recovery could be stronger if recent policy actions—particularly those that have mitigated trade tensions—lead to a sustained reduction in policy uncertainty.” (The World Bank, Jan. 2020)

The two main-stream international projections referred to here (The Word Bank, the OECD) are predicated on the assumption that over the next couple of years the advanced economies will continue to grow, albeit very slowly.

These projections also imply that the advanced economies will successfully manage the risks associated with record debt levels, trade protectionism, and uncertain geopolitics.

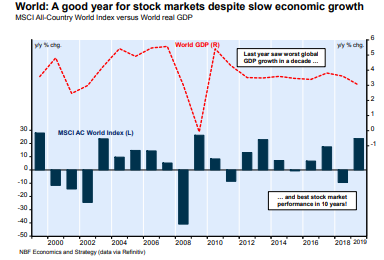

In fact, the advanced countries have already experienced steadily slower growth over the past couple of years. Nonetheless, 2019 was an excellent stock market year despite weaker international economic growth.

The World Bank estimates that global growth came in at only 2.4% in 2019 and projects that the world economy will only expand only slightly faster this year and in 2021.

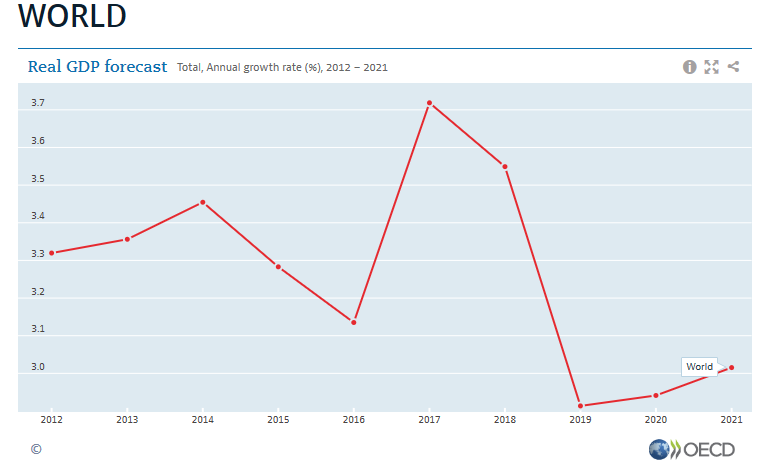

Operating with a slightly different global weighting system, the OECD estimates that global GDP rose by 2.9% in 2019 and projects growth to remain around 3% for 2020 and 2021.

In other words, both forecasting groups are currently describing the weakest world economy since the global financial crisis of 2008-09.

The American led tariff trade war and its widespread dampening of investment and manufacturing activity is one of the principal causes of the sluggish world economy.

Ironically, however, tighter labor markets are also constraining growth in the advanced economies, since in such circumstances their economies cannot expand much faster than the sum of their respective labor force growth rates and productivity gains.

This latter constraint is clearly surfacing in the slowing US economy, which is operating very close to full employment. We know that in the US there are a huge number of unfilled jobs even though the economy has recently been on a slower growth trajectory. And unless some new stimulation measures are introduced by Congress, for the first time in years America’s fiscal policy will not be supportive for economic growth.

The strong US dollar together with a large trade deficit also implies that trade will subtract from US economic growth in 2020 (for a seventh consecutive year).

In the following projections, the short-term prospects for the advanced economies tend to depend very much on the importance of international trade to their local economies.

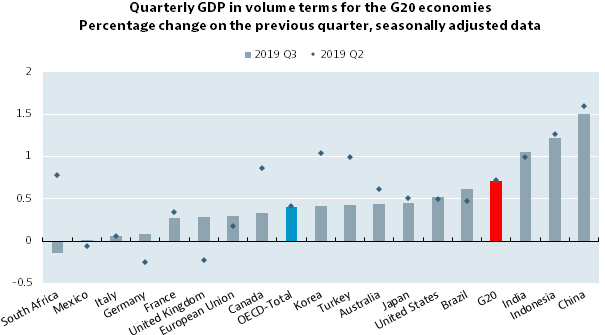

The most recent economic growth data we have refers to the third quarter of 2019.

As one of the following charts illustrates, economic growth in the third quarter for the large G20 economies was roughly similar between the second and third quarters of last year.

In specific terms GDP growth was roughly stable in the United States, Canada, and Germany (at 2.7%, 1.3%, and 0.3%, respectively) in the third quarter of 2019, and picked up marginally in India (to 4.5%), the European Union (to 0.9%), and the United Kingdom (to 1.7%).

Currently, US real GDP growth is expected to slow to 1.8% in 2020 and to 1.7% 2021, while growth in Japan is expected to slow to about 0.6% in 2021. The Euro Area is expected to post around 1.1% growth this year and 1.3% growth in 2021.

China’s “official” growth estimates are always somewhat suspect. Nonetheless, China’s growth rate is projected to edge down from 6.1% in 2019 to 5.8% by 2021. India’s economy is projected to improve from its 5.2% growth rate in 2019 to about 7.4% as of next year.

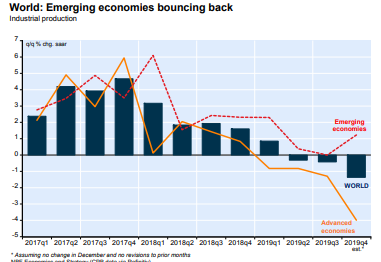

Other emerging market economies are also expected to recover modestly as the trade war wanes a bit and incents them to reinvest.

In sum, even with somewhat optimistic assumptions, global economic growth will likely be below potential over the next couple of years.

Major World Economies At A Glance: 2018-2021

|

1Yr* |

Quarter* |

2019e |

2020f |

2021f |

|

|

U.S. |

2.1 |

2.7 Q3 |

2.3 |

1.8 |

1.7 |

|

Japan |

1.7 |

1.8 Q3 |

1.1 |

0.7 |

0.6 |

|

Canada |

1.7 |

1.3 Q3 |

1.6 |

1.8 |

2.0 |

|

Germany |

0.5 |

0.3 Q3 |

0.6 |

0.4 |

0.9 |

|

India |

4.5 |

4.5 Q3 |

5.2 |

6.1 |

7.3 |

|

China |

6.0 |

6.1 Q3 |

6.1 |

5.9 |

5.8 |

|

U.K. |

1.1 |

1.7 Q3 |

1.3 |

1.0 |

1.5 |

|

Euro 19 |

1.2 |

0.9 Q3 |

1.1 |

1.0 |

1.3 |

|

World |

|

2.9 |

3.0 |

3.1 |

(Real GDP, Annual % Rates of Change) / *12 months % change and annual change.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Recent Global Indicators

(Click on image to enlarge)