Fuses Lit For The Next Financial Implosion

Inflation fears and a belief that the U.S. Fed will start tapering its bond purchases in November and hiking policy rates in 2022 have caused bonds to sell off over the past two months (yields rising). It’s likely to be short-lived as even modestly higher rates weigh on a slowing global economy and any tightening resolve will prove transitory once animal spirits slump once more.

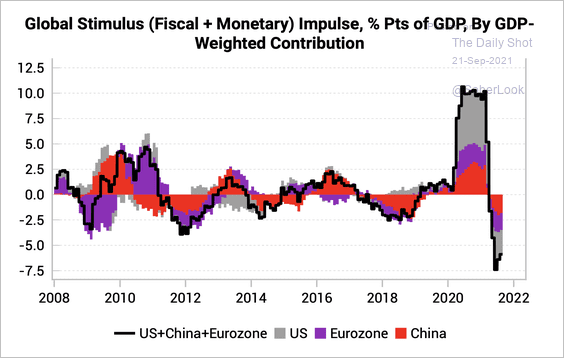

Even if central banks delay action, receding fiscal injections from governments in 2022 will equivalate to several percentage points of tightening. And, as shown below, the negative stimulus impulse is set to detract some 7% of GDP from the world’s largest economies.

A. Gary Shilling reviews the hard place of monetary policy amid present asset bubbles in The Federal Reserve Confronts an almost impossible task:

The Fed risks tightening to the point that it precipitates major financial problems and a recession. Also, a big rate hike could well reveal bankruptcy-inducing excess debt levels in a number of financial sectors, while areas that have seen excessive speculation, such as cryptocurrencies, SPACs and individual investors tied to Robinhood Markets Inc. are vulnerable.

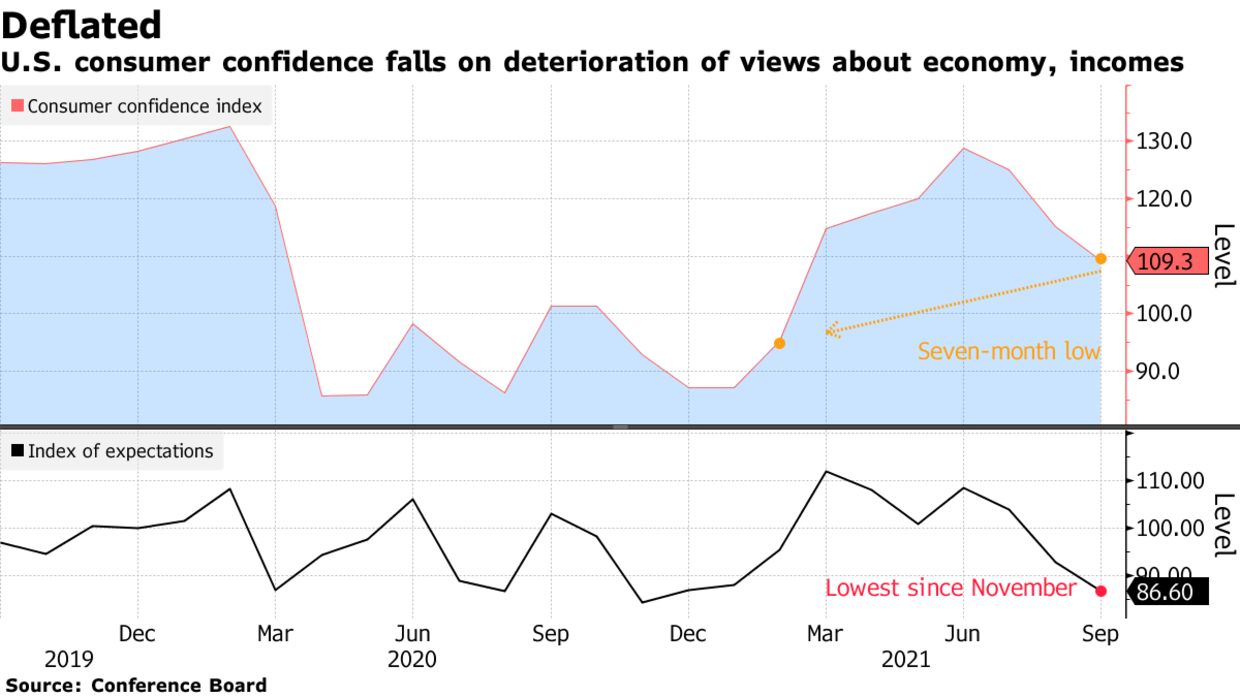

With emergency income benefits and payment deferrals expiring, higher interest rates, energy, and shelter costs have already round-tripped consumer confidence back to the pre-vaccine announcement lows of last November (as shown below). Some note that the deterioration suggests that the U.S. is already back in recession if the history of consumer confidence repeats.

(Click on image to enlarge)

It makes sense that the fastest most artificially inseminated recovery in history could be followed by one of the quickest returns to recession. Of course, recession declaration only takes place months after the fact, in retrospect.

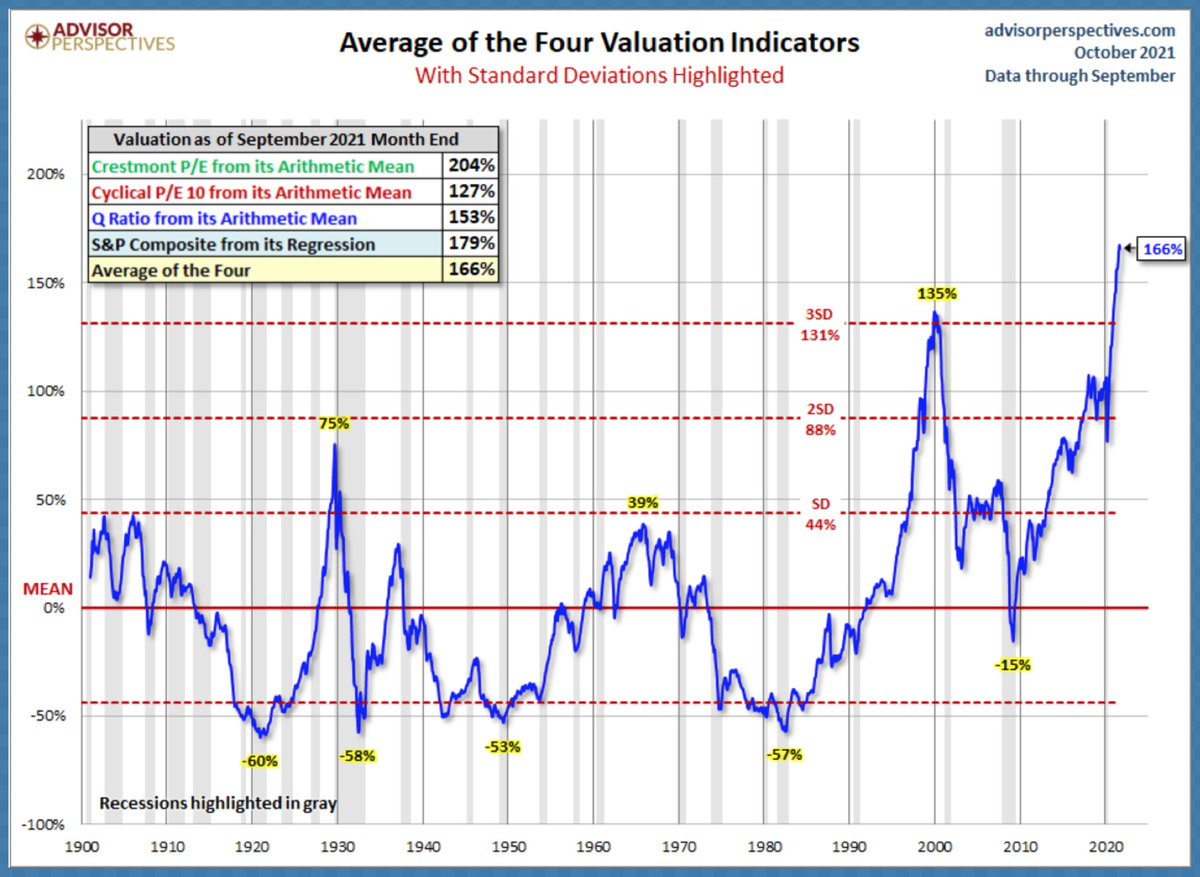

Either way, from the grotesque stock valuations today, a spectacular downcycle looms. As shown below in blue since 1900, the aggregate of four historically informative S&P 500 valuation metrics stands an eye-popping 166% above the long-term mean. Simply breathtaking. Lesser overshoots have been followed by brutal mean-reversion periods lasting years thereafter.

(Click on image to enlarge)

It’s hard not to be both horrified and cautiously excited for what opportunities will be afforded in the next financial implosion. The fuses have already been lit.

Disclosure: None.