Four Reasons The Next Recession Will Be Worse Than The Last One

With the stock market at all-time highs and seemingly endless “free liquidity” being provided by the Fed, the last thing most people can envision right now is a major recession—particularly one that will be the worst since the Great Depression of the 1930s!

But the facts we will detail in this article show that this is entirely possible. This is an extraordinary statement, but we are living in extraordinary times!

Here are the four key reasons to believe the next recession could be worse than the Great Recession of 2008–09—which would make it the worst since the 1930s.

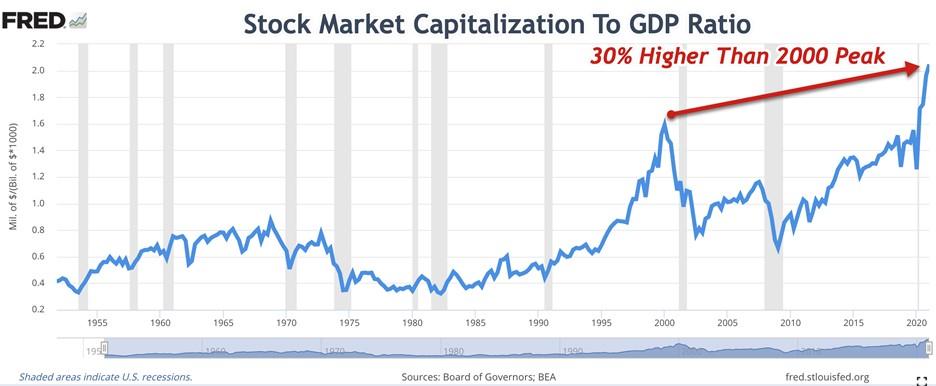

Reason No. 1: Extremely High Asset Valuations

Informed investors know that we are currently in an “everything bubble” driven by massive and persistent central bank money creation.

For example, Warren Buffett’s favorite valuation measure—and the one that best predicts future long-term stock market returns—is the stock market capitalization–to–GDP ratio, which is shown below. Based on this measure, stocks are trading 30 percent higher than the prior all-time high during the tech bubble peak of 2000! Stocks would have to fall over 60 percent for this ratio to return to the levels it reached at the stock market bottom in March 2009.

(Click on image to enlarge)

Source: FRED, with annotations by BullAndBearProfits.com.

Real estate is also expensive. As shown in the chart below of the S&P/Case-Shiller 20-City Home Price Index, home prices are currently 27 percent higher than they were at the housing bubble peak of 2006!

(Click on image to enlarge)

Source: FRED, with annotations by BullAndBearProfits.com.

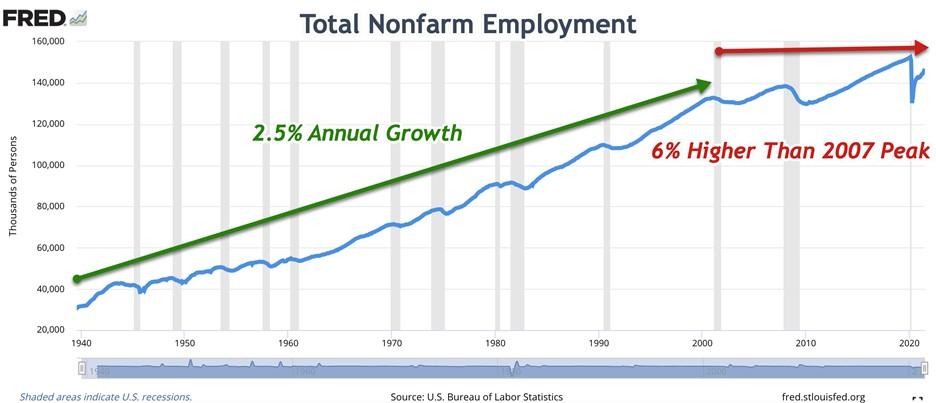

Reason No. 2: Weak Economic Fundamentals

The US economy is not as strong as it used to be. That is certainly true in the wake of the covid pandemic, but it has also been true for the past two decades. All of the taxes, regulations and other government interventions in the economy in recent decades have created a weaker and more fragile economy that will make the next recession even worse.

The chart below of industrial production shows it is only 8 percent higher than at the 2000 peak and 1 percent lower than at the 2007 peak. It has nearly flatlined over the past two decades. That is much weaker than the 3.9 percent annual growth in industrial production from 1920 to 2000.

(Click on image to enlarge)

Source: FRED, with annotations by BullAndBearProfits.com.

Total nonfarm employment, shown below, grew at a 2.5 percent annual rate from 1940 to 2000. Similar to industrial production, nonfarm employment has nearly flatlined over the past two decades. It has increased only 10 percent since the 2000 peak and only 6 percent since the 2007 peak. Sadly, it is still nearly 4 percent below the February 2020 peak.

(Click on image to enlarge)

Source: FRED, with annotations by BullAndBearProfits.com.

Reason No. 3: Excessive Debt Levels

The chart below shows the US total debt–to–GDP ratio is near recent all-time highs at 3.8 (or 380 percent), even higher than the high levels preceding the Great Recession. Global debt to GDP is also at record-high levels of over 300 percent, as is US federal debt to GDP, at 125 percent.

(Click on image to enlarge)

Source: FRED, with annotations by BullAndBearProfits.com.

Excessive debt has been the problem with every financial crisis in history due to prior money creation out of thin air, so the next one promises to be one for the history books, given these unprecedented high debt levels. Debt liquidation and defaults will lead to deflation, as we saw in the Great Recession and even more so in the Great Depression.

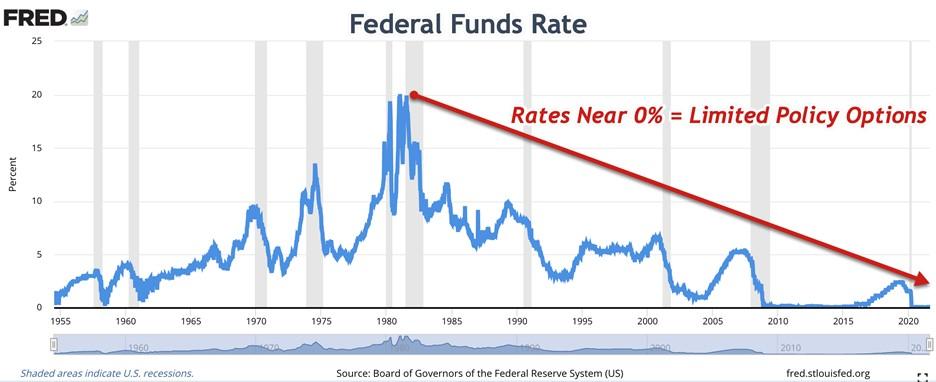

Reason No. 4: Limited Policy Options

The primary case for economic growth over the past twelve years since the Great Recession ended has been “free liquidity” provided in seemingly endless amounts by the Federal Reserve. It is almost as though money really did grow on trees!

But money created out of thin air does not create new goods and services that improve living standards. If it did, a place like Zimbabwe would be the wealthiest country in the world. However, newly created money can flow into financial assets, which helps explain why their valuation levels are so high.

The graph below shows “Austrian” money supply (AMS), the best measure of money supply that is consistent with this Austrian school of economics definition (although it no longer includes traveler’s checks, which have been discontinued in the Fed’s database due to limited use these days). AMS is up 40 percent since February 2020 and is up an astounding 225 percent since the Great Recession ended in June 2009!

(Click on image to enlarge)

Source: Chart courtesy of FRED, with annotations by BullAndBearProfits.com.

This is well above the money supply growth that drove the Roaring Twenties and ultimately led to the Great Depression of the 1930s, as detailed in economist Murray N. Rothbard’s definitive history of that period, America’s Great Depression. In this book, he explained the cause of the boom and bust business cycle:

The “boom-bust” cycle is generated by monetary intervention in the market, specifically bank credit expansion to business … [B]ank credit expansion sets into motion the business cycle in all its phases: the inflationary boom, marked by expansion of the money supply and by malinvestment; the crisis, which arrives when credit expansion ceases and malinvestments become evident; and the depression recovery, the necessary adjustment process by which the economy returns to the most efficient ways of satisfying consumer desires.

All this money creation has enabled the Fed to target the federal funds rate at only 0.1 percent, as shown below. While that is above the negative interest rates prevailing in some countries, it doesn’t leave much room for the Fed to cut rates to try to prevent a recession, particularly with inflation at over 5 percent now. And as the chart shows, the Fed cut rates throughout the prior three recessions and was not able to stop them, since the economy is bigger than the Fed. This leaves the economy very vulnerable to the next downturn, with potentially no “safety nets” to protect it.

(Click on image to enlarge)

Source: Chart courtesy of FRED, with annotations by BullAndBearProfits.com.

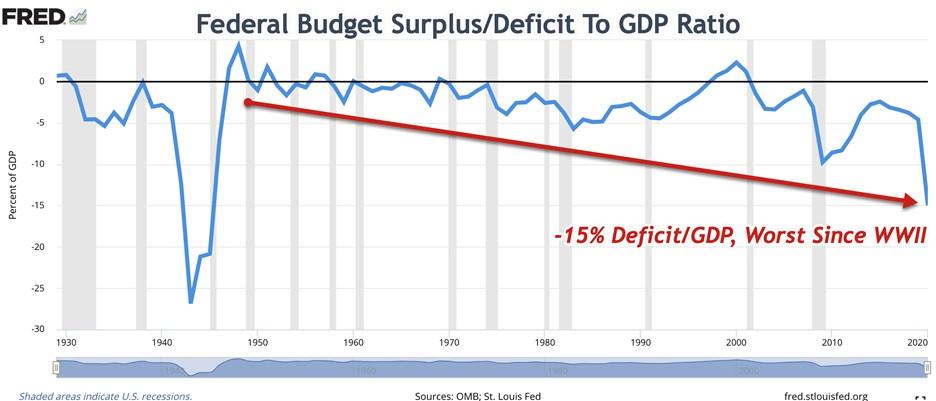

Lastly, for the Keynesian economists who still believe the dogma that federal budget deficits can prevent a recession—despite no evidence or logical theory to support it—the current federal budget surplus/deficit–to–GDP ratio of –15 percent is the worst since World War II, as shown below. Given record-high government debt levels and deficits, how much more deficit spending will bond investors be willing to finance? And what good will it do, since deficits did not prevent the Great Recession?

(Click on image to enlarge)

Source: Chart courtesy of FRED, with annotations by BullAndBearProfits.com.

Conclusion

There is much more that can be said to prove our case, but hopefully, the facts provided in this article are sufficient for people to understand the current risks in the economy. While the exact timing of the next recession is unknown, given the potential magnitude, now is the time for people to start preparing for it.

Mises Institute is a tax-exempt 501(c)(3) nonprofit organization. Contributions are tax-deductible to the full extent the law allows. Tax ID# 52-1263436