FOMC Minutes Suggest Fed Will Keep Buying Bonds "For Many Years", Shuns Yield Curve Control

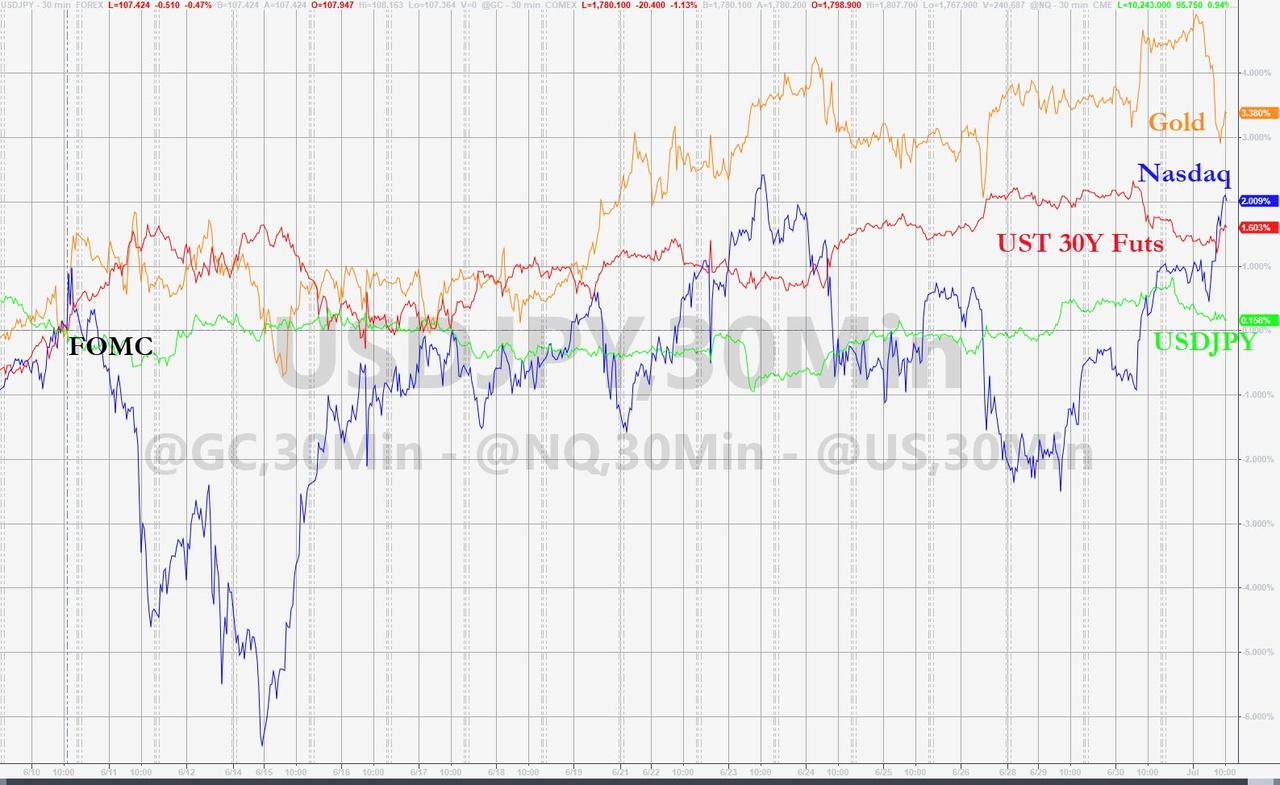

Since The Fed statement on June 10th, gold has outperformed (even beating Nasdaq) as the "lower for... ever" mantra is reinforced...

(Click on image to enlarge)

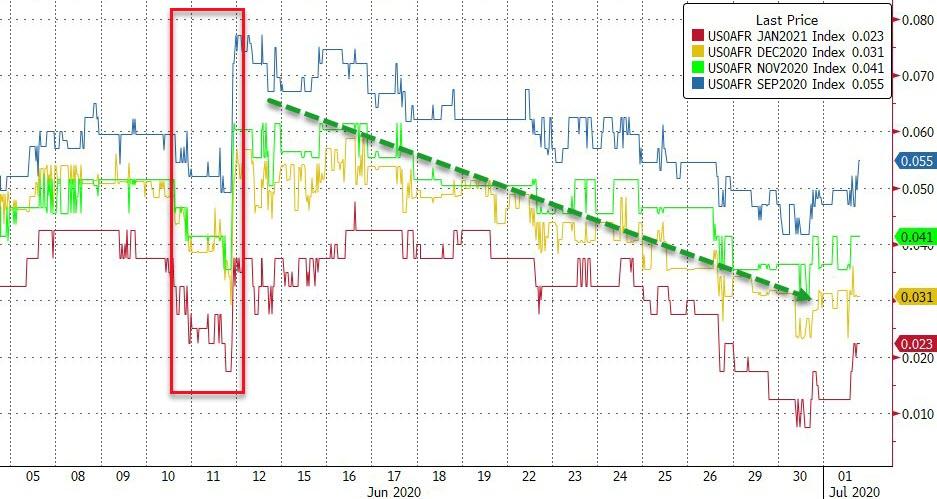

After moving hawkishly higher after the FOMC meeting, the market has drifted notably dovishly in the last two weeks

(Click on image to enlarge)

As a reminder, the FOMC kept rates unchanged at 0-0.25%, at the June 9-10 meeting, as was expected; it did not announce any enhanced forward guidance, nor did it announce any yield curve control policy but did formalize its QE program. Perhaps most notably, Powell adopted a cautious tone during the press conference and has maintained that stance, until yesterday's congressional testimony where he suggested that the economy had “entered an important new phase and has done so sooner than expected”, signaling more optimism.

Today's Minutes are not expected to produce any market-moving comments but Fed-watchers will be listening for discussions of negative rates and yield curve control, and any fears of excess valuations (as noted in The Fed's semi-annual outlook).

***

As expected The Fed's Minutes show that officials reviewed other options to provide more support for the economy but Fed officials did agree there was no more need to analyze yield curve control (mentioned 15 times in the minutes).

A number of participants commented on additional challenges associated with YCT policies focused on the longer portion of the yield curve, including how these policies might interact with large-scale asset purchase programs and the extent of additional accommodation they would provide in the current environment of very low interest rates.

In their discussion of the foreign and historicalexperience with YCT policies and the potential role for such policies in the United States, nearly all participants indicated that they had many questions regarding the costs and benefits of such an approach.

"some participants said [YCT could result] in the central bank inadvertently setting yield caps or targets at inappropriate levels. "

This is important as consensus expected some form of YCT policy adjustment in September.

“That could possibly entail a modest temporary overshooting of the Committee’s longer-run inflation goal but where inflation fluctuations would be centered on 2 percent over time.

“They saw this form of forward guidance as helping reinforce the credibility of the Committee’s symmetric 2 percent inflation objective and potentially preventing a premature withdrawal of monetary policy accommodation.”

On how long they will remain easy...

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more