FOMC Minutes See Rates "Appropriate", Warn Of "Elevated" Asset Levels, Suggest 'NotQE' Tapering Imminent

Since the Fed's statement on January 29th, the severity of the Covid-19 virus has escalated exponentially, economic data has disappointed (even before the virus' impact), companies have issued widespread warnings about their outlooks (due to China-driven consumption slumps and supply-chain disruptions)... and the Nasdaq is up over 6.5%!!!

(Click on image to enlarge)

Clearly the market sees Powell as some omnipotent hero capable of printing anti-virals and making the world right again.

Powell to market: "hold my beer"

The market seems convinced The Fed will re-expand the balance sheet...

(Click on image to enlarge)

Fed Speakers have been very active this week:

- Neel Kashkari, president Minneapolis Fed, non-voter in 2020 - Regarding the coronavirus, “All of the data that we get from China, we look at it with somewhat of a skeptical eye.”

- “As they’ve revised the number of cases, that hasn’t boosted our confidence that there’s full transparency.”

- Raphael Bostic, president Atlanta Fed, non-voter in 2020 - “All in all, I would say the economy is in a pretty good place and it can go on.”

- Loretta Mester, president Cleveland Fed, voter in 2020 - Economy to grow at or a “little above” trend this year. “I think we’re in a good spot.”

- Robert Kaplan, president Dallas Fed, voter in 2020 - Monetary policy is “roughly appropriate.” Expects rates to remain on hold through 2020 despite risks posed by the coronavirus.

- Loretta Mester, president Cleveland Fed, voter in 2020 - Coronavirus risk hasn’t changed her GDP forecast of about 2% in 2020. “There could be spillover to the U.S. economy” in the first quarter.

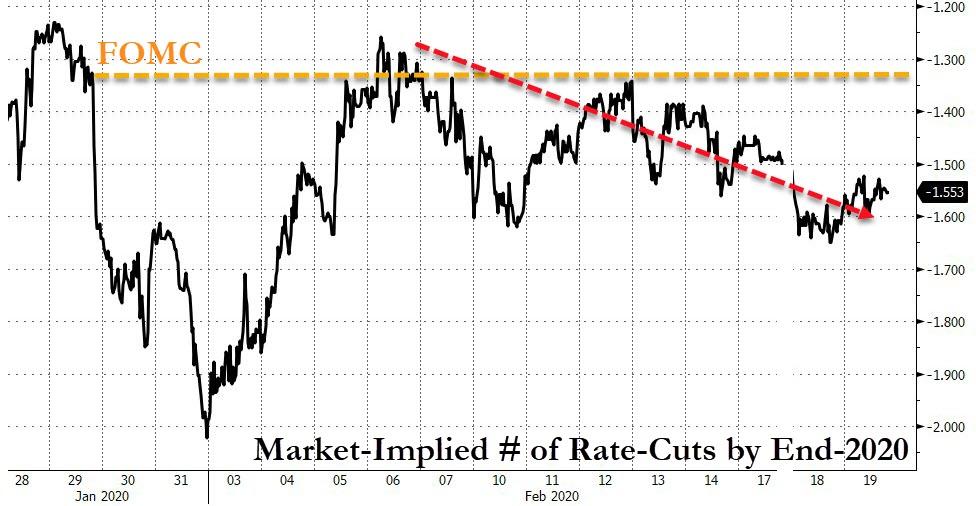

Notably, the market has held on to a more dovish bias since the FOMC statement, as stocks have soared on the back of this Powell-Put...

(Click on image to enlarge)

Source: Bloomberg

Traders are not expecting much from the Minutes beyond what was discussed during the post-statement press conference. All eyes will be on any dovish bias towards coronavirus risks or hawkish bias on the reduction in the repo facility or its balance sheet expansion.

Federal Reserve officials viewed their current monetary policy as appropriate “for a time” while they remained on guard against domestic and global risks that could slow the longest U.S. expansion on record.

“Participants discussed how maintaining the current policy stance for a time could be helpful in supporting U.S. economic activity and employment in the face of global developments that have been weighing on spending decisions,”

BUT...

- *FED MINUTES: CONDITIONS EXPECTED IN 2Q FOR T-BILL TAPERING

- *FED MINUTES: TERM REPOS COULD BE PHASED OUT AFTER APRIL

And more problematically: Staff Saw Asset Valuations Had Increased To 'Elevated Level'

The staff provided an update on its assessments of potential risks to financial stability. On balance, the financial vulnerabilities of the U.S. financial system were characterized as moderate. The staff judged that asset valuation pressures had increased in recent months to an elevated level. Asset valuation pressures were characterized as fairly widespread across a number of markets, similar to the situation in much of 2017 and 2018.

“Many” Fed officials see signs the economy is not at full employment.

Many participants pointed to the strong performance of labor force participation despite the downward pressures associated with an aging population, and several raised the possibility that there was some room for labor force participation to rise further.

There were no less than 8 mentions of the coronavirus:

"uncertainties about the outlook remained, including those posed by the outbreak of the coronavirus."

"early GDP releases showed a pickup in growth in China and some other Asian economies, though news of the coronavirus outbreak raised questions about the sustainability of that pickup."

"Late in the period, concerns about the spread of the coronavirus and uncertainty about its potential economic effect weighed negatively on investor sentiment and led to moderate declines in the prices of risky assets."

" Late in the period, equity prices retraced some of their gains, as concerns about the spread of the coronavirus weighed negatively on risk sentiment."

"some trade uncertainties had diminished recently, and there were some signs of stabilization in global growth. Nonetheless, uncertainties about the outlook remained, including those posed by the outbreak of the coronavirus"

" The threat of the coronavirus, in addition to its human toll, had emerged as a new risk to the global growth outlook, which participants agreed warranted close watching."

And going back to asset prices:

Overall movements in stock prices varied widely across economic sectors, with stocks of firms in the information technology and utilities sectors significantly outperforming aggregate indexes, while stock prices of firms in the energy sector declined markedly

Full FOMC Minutes below:

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more